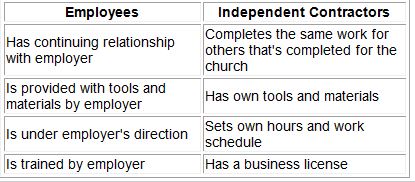

Considered self- employed. If the detailed points above didn’t clear this up for you, here is an easy-to-read chart describing the differences between independent contractors and employees. Independent Contractor vs. Employee For federal employment tax purposes, the usual common law rules are applicable to determine if a worker is an independent contractor or an employee.

Under the common law, you must examine the relationship between the worker and the business.

Am I an independent contractor or an employee ? There is no “black and white” definition of who is an independent contractor. Instea there are a number of factors (set forth in the chart below) that courts and agencies use to decide if you are an independent contractor or employee. Note: Want to know how hiring contractors or employees affects your.

For the employee , the company withholds income tax, Social Security, and Medicare from wages paid. For the independent contractor , the company does not withhold taxes. See full list on acf.

What makes you an employee vs.

Is it better to hire an independent contractor or an employee? Should you hire employees or use independent contractors? Unreimbursed expenses, independent contractors are more likely to incur unreimbursed expenses than employees.

Opportunity for profit or loss is often an indicator of an independent contractor. Services available to the market. The law is pretty clear about the rules and perks of being an employee vs.

If you have additional questions about the law in your area, speak with an employment attorney today. If you’re paid hourly as a contractor, you may need to convert that hourly pay into a salary so you can compare to a full-time salary. Here’s how I do that:Take your hourly rate and multiply it by 08 which is the number of hours in a year if you work hours a week for weeks.

Or if you need to convert a salary into an hourly wage, you can divide the salary by 080. That way, you can compare the salary for each role to each other role. When you’re a W-employee, you work for someone else. Why does this matter?

The employer is responsible for a lot of the cost of employing someone. If you’re a W-worker, then you work for someone else, and they are pr. So how do you compare two positions when one is a contractor position and one is full-time.

Get both opportunities into the same units for wages—you can choose either hourly or salaried.

If it’s a W-contract position, then you can basically compare the full-time and contractor positions directly because the employer is paying the sam. In the example above, Joe needed to compare a contractor role paying $80k to a full-time role paying something like $55k. He’s already using common “salary” units, so we can skip that first step. If we add to $55k—the W-wage he thinks they might offer.

INDEPENDENT CONTRACTORS vs. EMPLOYEE When determining if someone should be considered an employee or independent contractor , there are two tests that can be done. However, regardless of which test is use employee worker status is essentially based on who controls the worker’s activities. If you’re ever trying to determine whether someone should be considered an independent contractor vs. Classifying a worker as an employee or an independent contractor has a significant effect on the cost of employing that individual.

For this reason, the IRS and Department of Labor pay close attention to worker classification issues to ensure that employers are making the right determinations. Unfortunately, because independent contractors often cost less than employees , some employers classify their workers as contractors even though they are really employees. In fact, the Labor Department estimates that up to of companies misclassify employees.

In addition to reading this guide, please also review the. Factor Test page and the Worker Classification Standard Operating Procedure.