What is a letter of indemnity? When to use letters of indemnity? Can a lender present a letter of indemnity? Who signs a letter of indemnity?

Usually there letter starts with standard words like ‘we agreed that…’ which means that it is recommended that you start. Words like ‘for goodness. This letter should include the name, date of sending the and address of the organization to whom you are sending the. Now, move towards the body section of the letter after writing a salutation. You have to mention all the necessary.

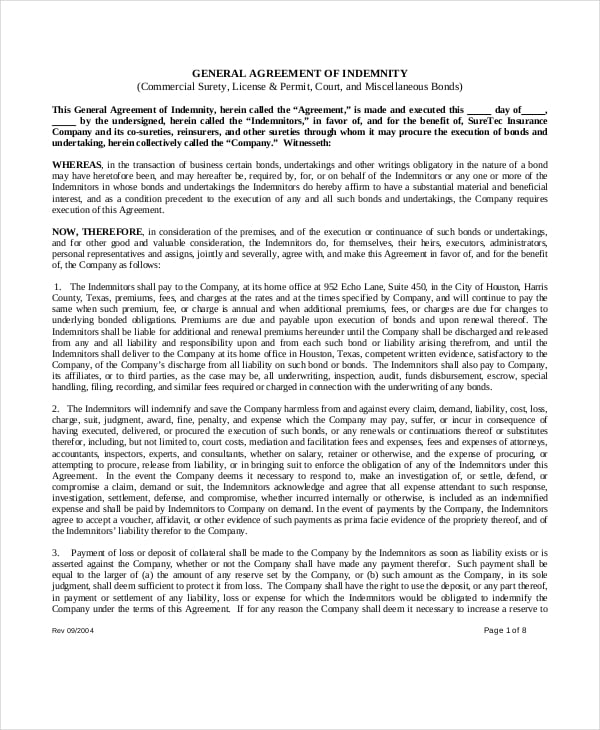

At last, you have to thank the reader and sign off the letter. A written undertaking by a third party (such as a bank or insurance company), on behalf of one of the parties (the first party) to a transaction or contract, to cover the other party (the second party) against specific loss or damage arising out the action (or a failure to act) of the first party. Also called indemnity bon bond of indemnity. A letter of indemnity is a letter used in the world of business to protect a party against financial losses in the event that an obligation is not upheld.

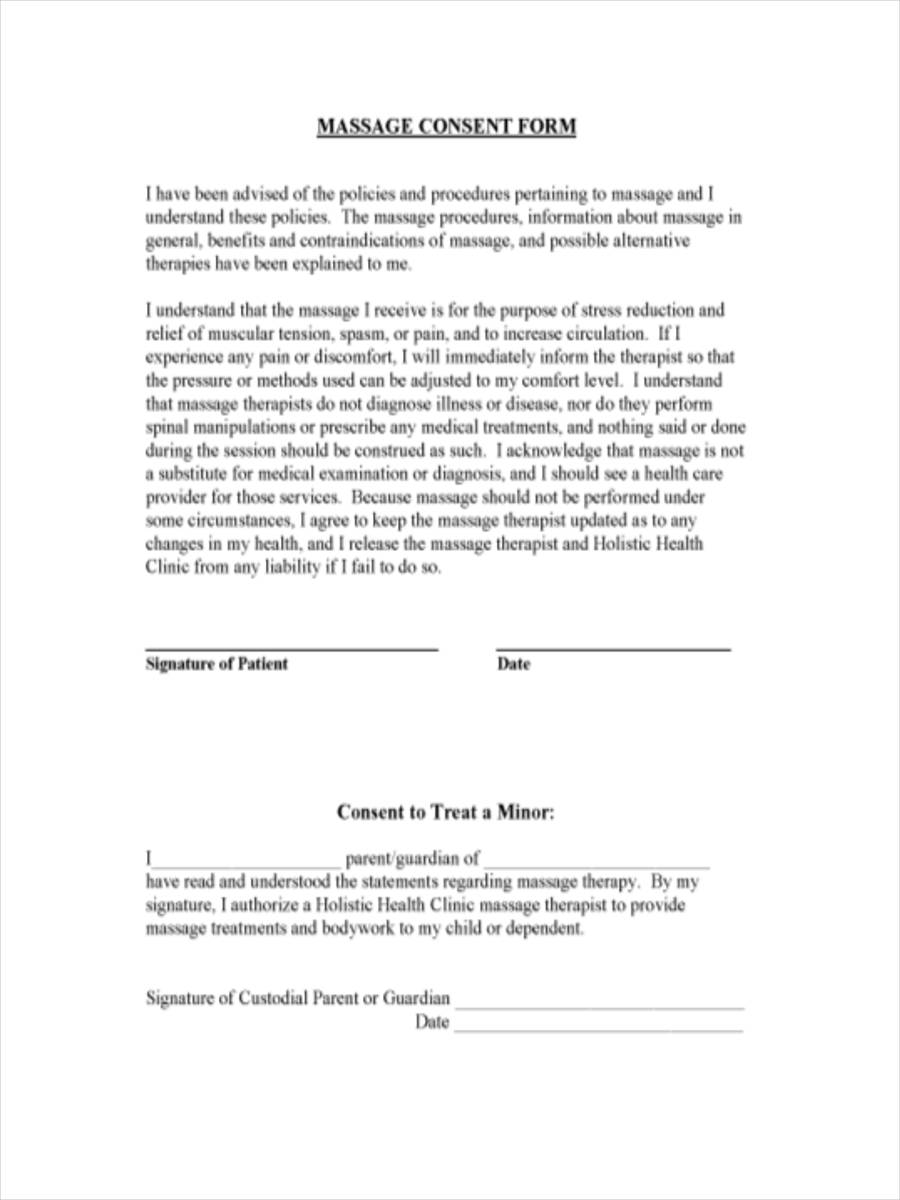

Variety of letter of indemnification template that will completely match your demands. These themes offer superb instances of ways to structure such a letter, and also include sample material to serve as an overview of design. The advanced tools of the editor will guide you through the editable PDF template. Enter your official identification and contact details. We here by certify that FEDEX is not responsible if The material is damaged in transit.

It is a written document where the third party assumes the responsibility to cover for losses incurred if. A letter of indemnity (LOI) is a document which the shipper indemnifies the shipping company against the implications of claims that may arise from the issue of a clean Bill of Lading when the goods were not loaded in accordance with the description in the Bill of Lading. Dhl indemnity letter.

The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. CORPORATE LETTER OF INDEMNITY Date: To : CMA CGM S. An Indemnity agreement is an excellent tool for risk allocations and it helps in protecting the business effectively. They are widely used by many types of industries to protect their businesses. One can go through various templates that are available on the internet and select the suitable format for their business requirements.

Expenses means all costs incurred in the defense of any claim or action brought against the Indemnitee including. Activity means the followi. Notice of Claim means a notice that has been provided by the. If you cannot provide a letter of indemnity , however, then your parcel cannot be delivered. It will be returned to the sender at their own cost.

To ensure this does not happen, be prepared to provide a letter of indemnity when shipping to areas of unrest. Indemnity Agreement to Be Given To Landlord by Someone Who Is Indemnifying the Landlord against Non-Payment by Tenant. In each case this offer will usually be made in return for the owner taking on some non-contractual risk. Letters of Indemnity. The Indemnifier hereby agrees with the Landlord: (a) to make the due and punctual payment of all rent, additional.

This protection is complete and unconditional, and the compulsions of the Indemnifier shall not be free discharge. Draft letter of indemnity. While not intended to be exhaustive, some of these include: – PI club cover. There are cover implications whenever a master, or member, issues a bill of lading. It is completely separate from your insurance coverage.

An indemnity agreement can be developed with or without insurance. The party that has agreed to assume liability must do so regardless of whether they have insurance to cover the incident. A title insurance company usually obtains a gap indemnity when there is a sit down closing because there is a gap of time between closing the real estate transaction and recording the instruments.