Incorporate in Easy Steps. Free Registered Agent for Mos. Name is Available in Your State. Business Type is Right For You. Now Offering Even Lower Prices – Start Here!

How do I incorporate a new business? What does it mean to incorporate your business? Should you incorporate your small business?

LLCs are popular with small business owners because they combine the simplicity of a corporation with the tax advantages and flexibility of a partnership. The process of incorporation involves writing up a document known as the articles of. Plus, our registered agents are available for the long haul, ready to help however they can.

See full list on how.

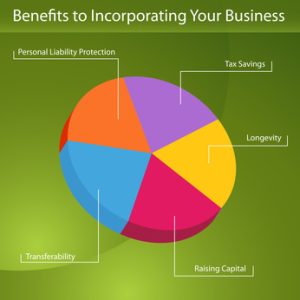

Ask for instructions, forms and fee schedules on business incorporation. It is possible to file for incorporation without the help of an attorney by using books and software to guide you along. An incorporated business (also called a corporation) is a type of business that offers many benefits over being a sole proprietor or partnership, including liability protection and additional tax deductions.

Form an LLC, incorporate a business , make a will, register a trademark, get legal advice, and more online. A Tax Agent Will Answer in Minutes! Filing Fee Secretary of State: $100. Questions Answered Every Seconds.

Comparing Company Types. Each incorporated entity type is different, but they share certain important traits across the board. Corporations are the most complex business legal structures to form and typically require some degree of professional legal assistance. A lawyer can help verify that you have chosen the right business structure for your purposes and ensure that it is properly established.

The articles of incorporation (also called a charter, certificate of incorporation or letters patent) are filed with the appropriate state office, listing the purpose of the corporation, its principal place of business and the number and type of shares of stock. The term incorporation refers to the act of forming a new corporation. When you go from being a sole proprietor or partnership to a business structure such as an LLC, there are numerous deductions at your disposal that are not available to individuals.

Nevada, Delaware, and Wyoming are all typically referred to as corporate havens and are all popular jurisdictions to incorporate your business.

Wherever you choose to incorporate , be aware of the significant differences between each state. Decide on a Corporate Structure. When a company incorporates, it becomes its own legal business structure set apart from the individuals who founded the business. Each of these types has its own advantages and disadvantages, so you should explore the explanations of each corporation type and consult a tax accountant for advice. The decision to incorporate you or your business is the first step in providing effective protection from personal liability, excessive taxation, and provides the entrepreneur or the savvy investor with an effective and powerful tool to aid in managing and growing their business ventures.

First you will need to decide which type of company (also known as an entity) will best suit your business needs. How to use incorporate in a sentence. Professional corporations, Medical corporations, Close corporations or business corporations with a specific purpose cannot be filed online. The incorporator must be a natural person age or older.

Since you and your business are two separate entities, incorporating your business will require you to do two sets of taxes. As an incorporation , you’re generally required to document everything, including things like meeting minutes and a share register. Yes, even if it just for liability protection.

Forming a business entity provides liability and tax advantages. Many states allow entrepreneurs to register their business online to make the process faster. The SBD is calculated at the rate of on the first $500of taxable income, which may reduce your net corporate business tax to a much lower tax rate than you would receive on your personal income. Before you incorporate yourself on the internet, I would recommend that you consult both a tax preparer and an attorney about the various forms of business structures you have available to you Each possibility has different advantages and disadvantages. A sole proprietorshipis a business that is owned and operated by an individual.

It is the simplest and most common structure chosen to start a business. There is no distinction between the business and you, the owner. You are entitled to all profits and are responsible for all your business ’s debts, losses and liabilities.