How to get an Income verification letter for independent. How do you write an income verification letter? How do I report income as an independent contractor? What are the rules for an independent contractor? Does your employer claim you are an independent contractor?

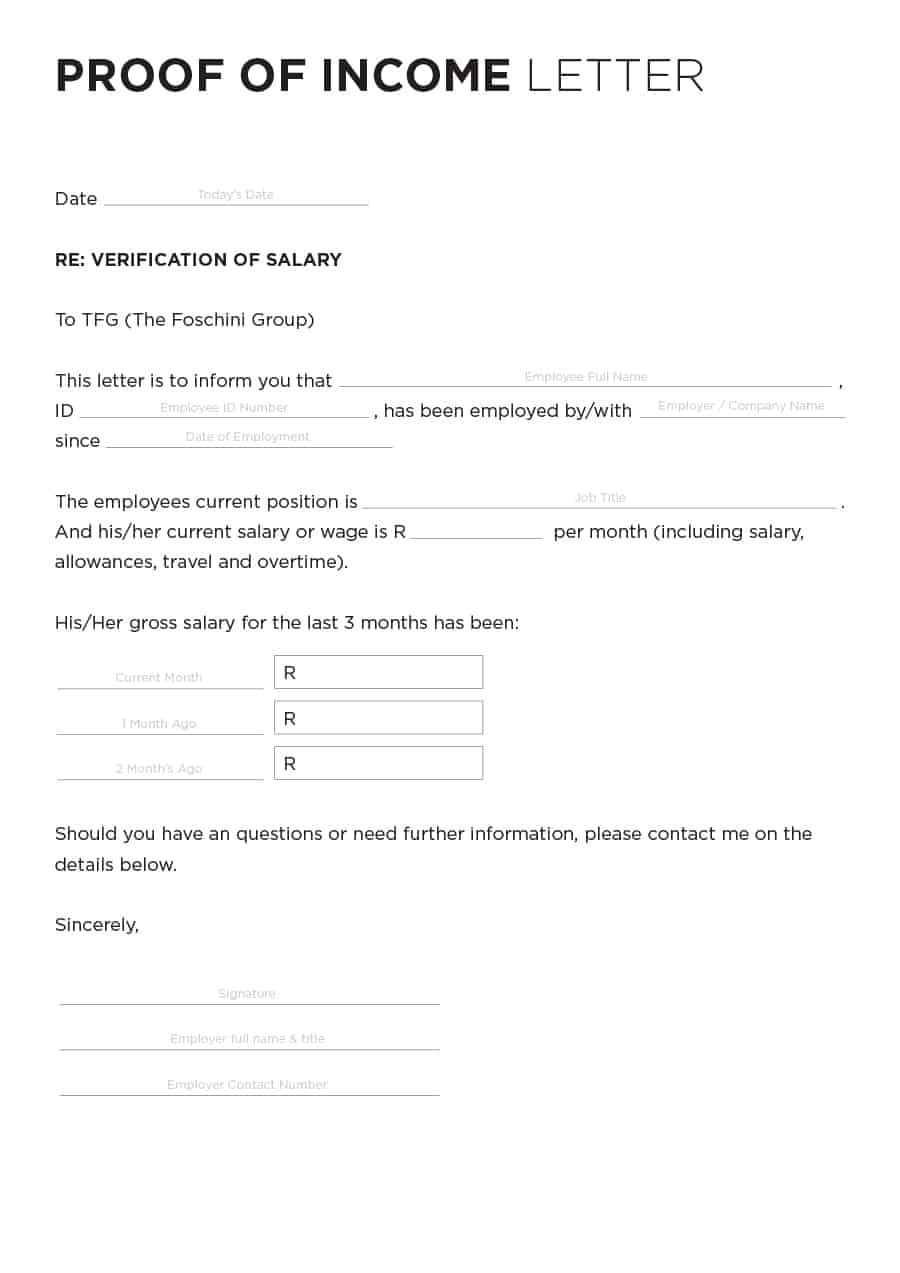

Four ways to verify your income as an independent contractor Income-verification letter. The most reliable method for proving earnings for independent contractors is a letter from a. Contracts and agreements. An independent contractor will typically coordinate a contract or agreement with a new. These guidelines will be valuable as you write the proof of income letter. At that top of the letter , include your contact details and address.

For the self-employed individuals, the business name should feature in this section. After your address include the current date. The recipient’s address should follow the date. The verification of income for a small business owner, an independent contractor or an independent professional need not be more than it is for someone who receives a normal salary or salary. Generally, the business owner must withhold income taxes , withhold and pay Social Security and Medicare taxes, and pay unemployment tax on wages paid to an employee.

Small Business Self-Employment Income If you own and run a small. How can I receive proof that I work as an independent contractor with DoorDash? To receive confirmation that you work as an independent contractor on the DoorDash platform, please file a support case using the link below. Luckily, showing proof of income as a self-employed individual is a lot easier than most realize.

The most important thing to keep in mind when proving your income is to keep constant documentation. Keeping your tax returns, profit and loss statements, and bank statements all in the same place will make proving your income easier down the road. An income verification letter is a formal letter. It’s given by an employer when an employee requests for it.

Such a document is very important. You need it to verify if information about the employee’s salary is accurate. It is critical that business owners correctly determine whether an individual providing services is an employee or independent contractor. Employers generally do not have to withhold or pay any taxes on payments to independent contractors. Writing an income verification is very usual to be asked to verify your income when inquiring about a loan, rental agreement, etc.

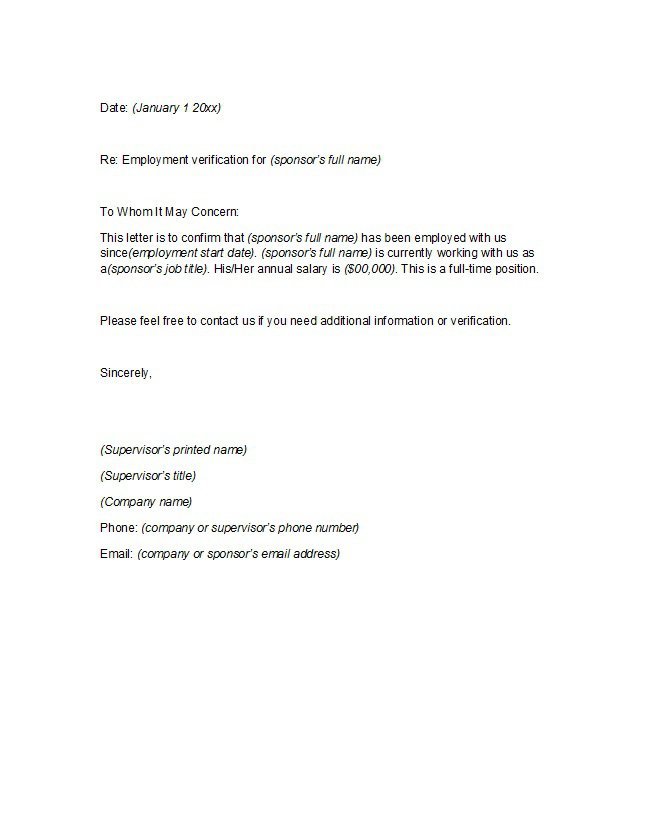

Independent contractor status must be verified. A narrated conversation with the employer. Proof of income letter can be written by an individual and as a matter of fact, the letter is usually written by the employer or the firm who is employing the staff. The government or bank may require proof of income letter for many things and one of those is verification of the salary received by the person.

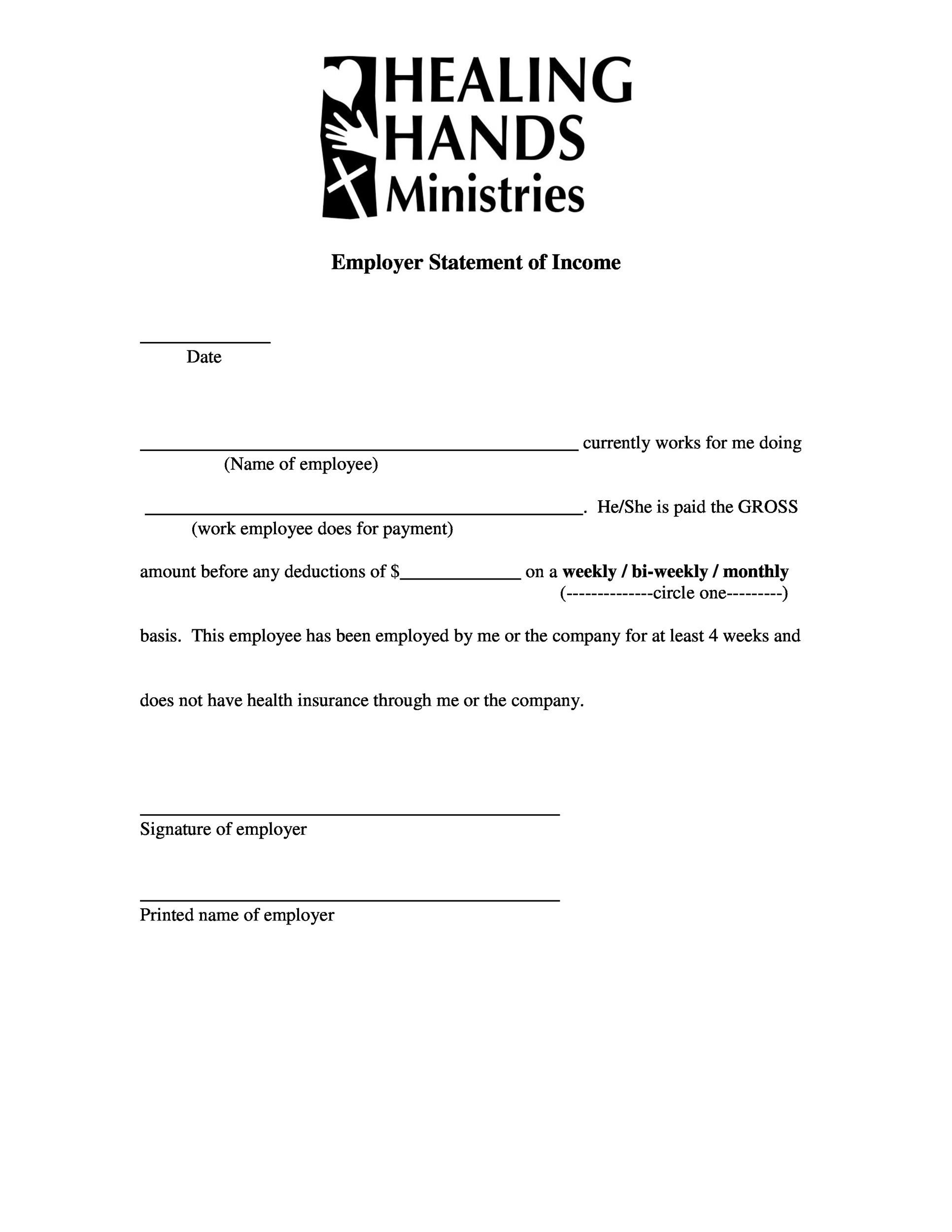

This type of verification letter is commonly used when someone seeks housing or is applying for a mortgage. This verification will usually come in the form of a letter , written by you, an employer, an accountant, or a social security caseworker. As the income verification letter will be used as an official documentation of your income , it is important that it contain specific information. Your income is a factor that can determine a number of things from your health insurance plan to the amount you receive for a personal loan. Employment verification letter for independent contractor – xxxiividi form.

Complete this form and sign the declaration below. Be sure to attach the additional documentation specified below. The requestor of the employment information will use the form to confirm that an individual has a secure job and an income stream capable of affording the monthly payment.

An employment verification letter, also known as a ‘proof of employment letter’, is a form that verifies the income or salary earned by an employed individual. This document is normally printed on an institution’s official stationery or letterhead. A contractor can use the form to register himself in the government roster, to send a proposal to the client or to receive a feedback after the work is completed. If all you need is a letter verifying how much you’ve earne you can do that yourself by visiting the Accountpage in the Handy Pro app, scrolling to the Management Toolssection, and selecting Email Income Verification. Was this article helpful?

In accordance with the Internal Revenue Service (IRS), an independent contractor is not an employee an therefore, the client will not be responsible for tax withholdings.