Get that rate from a variety of sources and average it out to establish your own cost. Call a tax consultant or anybody dealing in assisting clients with income tax matters,. My daughter is a travel nurse. How to estimate travel expenses?

Can You claim a deduction for home to work travel? What are traveling expenses?

Can employees deduct work-related travel expenses? Keep track of your costs so they’re organized. Use a spreadsheet, a blank piece of paper, a notepa a word document,. Research the total cost of round trip airline tickets if you’re flying.

Call an airline or go online to find out the. Be as specific as possible. Travelmath provides an online cost calculator to help you determine the cost of driving between cities. Travel expenses can generally be deducted by the business when employees incur costs.

Expenses included unreimbursed travel and mileage.

Travelling from your home to an alternative workplace if required. If you work from home then travel to your workplace for that same employer. Enter your route details and price per mile , and total up your distance and expenses. Routes are automatically saved. Read more information about car running costs in our driving advice section.

You can improve your MPG with our eco-driving advice. You need to keep records of your travel expenses. But take a deep breath and get ready to. Company credit cards. Credit cards are issued to employees who must travel frequently for business.

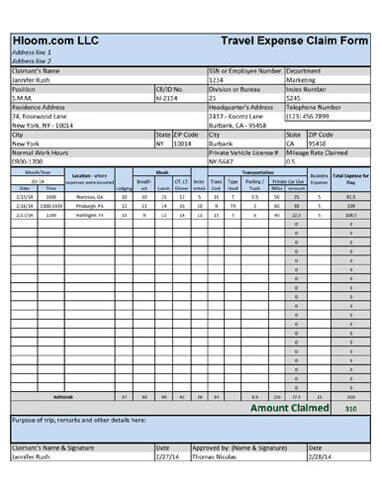

Employees may charge. Organizations without employee company credit cards require employees to fill out an expense reimbursement report. Working out how much a trip will cost Step 1: Track your expenses.

If this is your first time working out how much a trip will cost your business, then the. Step 2: Research your destination. Your destination, and the time of year you travel , will greatly influence your. A travel expense that directly relates to your current job is considered a work-related expense.

As with most work-related expenses, travel expenses are usually tax deductible. Of course, there are a few restrictions on what you can claim but we’ll explain those a little later.

Time an employee spends traveling is part of the job. You must count this time as work time. Different rules apply to your transportation expenses and the expenses you incur while at your destination (destination expenses ). Travel within the United States is subject to an all or nothing rule: You may deduct 1 of your transportation expenses only if you spend more than half of your time on rental activities while at your destination.

You may only claim travel expenses if you kept a valid vehicle logbook. Which situation fits you? The expenses must be.