Pricing a business correctly is important if you really want to sell it. As a consultant I talk to many business owners, brokers, and agents on a daily basis about valuing businesses. It always amazes me on how some of these individuals. There are so many formulas for this it is mind blowing.

However a business is only worth as much as a buyer is willing to pay. So much depends on the type of business, how established it is etc.

How can I calculate the value of a business? How do I determine the value of my business? Market approach – sales based.

Step – Pick your multiple – If your company is growing, potential buyers or investors will pay more than $per $of your. Calculate Seller’s Discretionary Earnings (SDE) Most experts agree that the starting point for valuing a small business is to normalize or. Find Out Your SDE Multiplier. Taking the same example of a law firm, suppose the profits were $4000. See full list on how.

Traditional valuation methodology can be simplified down into three types of methods.

They are: Earnings multiple – A buyer applies a multiple, usually in the range of 1-(depending on the size of the business) and multiplies it by the annual profits. To actually calculate the business value , you can select a number of business valuation methods. Business valuation formulas are the computational building blocks that power each valuation method. If the business sells $100per year, you can think. For example, if you have $100in assets and $30in liabilities, the value of your business is $70($100– $30= $7000).

With the asset-based metho you can find the book value of your business. These are the assets recorded in the company’s accounts. Then, you should think about the economic reality surrounding the assets.

Essentially, this means adjusting the figures according to what the assets are actually worth. This method determines a business’ value by adding up the sum of its parts. Tally the value of assets. Add up the value of everything the business owns, including all equipment and inventory. Subtract any debts or liabilities.

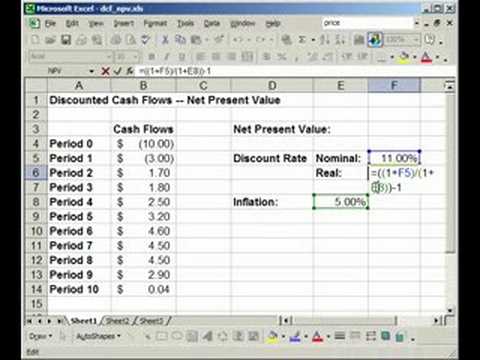

The worth of tangible. You’ll need to calculate the cost of employing people, delivering training, developing products and services, building assets and a client base. You calculate today’s value of each future cash flow using a discount rate, which accounts for the risk and time value of the money. Use price multiples to estimate the value of the business.

Another valuation rule of thumb is using price multiples, which base the value of the business on a multiple of its potential earnings.

Price multiples provide buyers with a tool to estimate their return on investment. They are a quick way to arrive at a general estimate of the business’s sale price. No need to spend time or money on a business valuation firm. Just enter in the information on our valuation spreadsheet and our software will calculate the value of your small business. History has shown that this methodology, while not bulletproof, is the most effective way to establish the valuation basis of a small business.

Bob Adams’s Simple Valuation Guidelines. Goodwill equals $8000 or $million minus $1. This means company X paid $800premium above the company’s net identifiable assets to acquire its unidentifiable assets, which add to its earning power. Leaving aside tax factors, the formula we use for evaluating stocks and businesses is identical.

Indee the formula for valuing all assets that are purchased for financial gain has been unchanged since it was first laid out by a very smart man in about 6B.