How do you calculate the valuation of a business? How can I calculate the value of a business? How to determine your business values?

Two of the most common business valuation formulas begin with either annual sales or annual profits (also known as seller discretionary earnings), multiplied by an industry multiple. Both methods are great starting points to accurately value your business. See business valuation tool instructions for an explanation of the factors involved in the calculation.

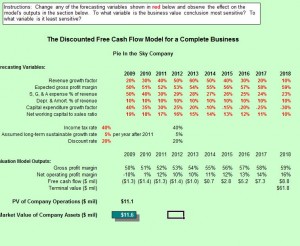

Similar to bond or real estate valuations, the value of a business can be expressed as the present value of expected future earnings. Use this calculator to determine the value of your business today based on discounted future cash flows with consideration to excess compensation paid to owners, level of risk, and possible adjustments for. Each type of business calculator is different, so it is difficult to answer your question.

NPV function in Excel. The spreadsheet is the greatest thing since sliced bread. You walk into a diner and order a slice of apple pie.

If the diner sells the entire slices, how much will it collect? Add the total value of your net liquid assets to the figure you calculated in step 2.

If you have net liquid assets of $700 the total value of your business is $22000. If you are in any doubt about the most realistic value for your business , you are strongly advised to seek professional assistance from your accountant or a business appraiser. Be sure to use actual financial data and considered forecasts that can be defended with rational arguments.

As a result, businesses can end up on shaky ground. The value of your business is as good as the inputs that you provide. Remember to provide accurate information about your business. Value that you get represents 1 of Equity in the Company (1 of shares).

Net debt is a positive number if you have more debt than cash in the business. It will be a negative number. Industries usually come up with their own rules and formulas to value a business. S, Accredited in Business Valuation is an official designation awarded to Certified Public Accountants.

If the business sells $100per year, you can think. Free Small Business Valuation Calculator : This business valuation calculator is designed as a research tool only to provide small business owners with a free and confidential (no personal info required) instant business valuation result that can be used to help determine an approximate asking or sales price when valuing a small business for sale. And then produce a written report.

The way you calculate a company’s net worth is to take the either the value of the goodwill of the company, or the value or assets minus liabilities. For a simple business asset valuation, add up the assets of a business and subtract the liabilities. You might want to use a business value calculator to do this.

So, if a business has $500in machinery and equipment, and owes $50in outstanding invoices, the asset value of the business is $45000. The Value my business calculator takes the information you input and performs a series of calculations in the backgroun to give you a likely range of values within which you might expect to successfully sell the business. A thorough inventory of hard assets is required for an accurate liquidation value. The business interruption formula can be summarized as follow: BI = T × Q × V. Where, BI = business interruption.

T = the number of time units (hours, days) operations are shut down. Q = the quantity of goods normally produce or sol per unit of time used in T. Go beyond financial formulas. Don’t just base your assessment of the business ’s value on number crunching.

Consider the value of your business based on its geographical location. In addition, consider its potential strategic value to a would-be acquirer if there are business synergies. Estimate story points to complete Epic 4. With the asset-based metho you can find the book value of your business. Your book value is the owner’s equity on the balance sheet.

To calculate goodwill, the fair value of the assets and liabilities of the acquired business is added to the fair value of business ’ assets and liabilities. The excess of price over the fair value of net identifiable assets is called goodwill. The future value calculator can be used to determine future value , or FV, in financing.

FV is simply what money is expected to be worth in the future. Typically, cash in a savings account or a hold in a bond purchase earns compound interest and so has a different value in the future. ANSWER: Yes, Rhonda, there are really two formulas most often used in small business for valuing a small business.

The minimum that your business is worth is called book value , and that is if you just closed the business and sold off your inventory, collected any bills that were due to you—any receivables—paid the payables and any bills you. In many cases, the value of the intangible assets exceeds the value of the tangible assets, which can result in a major amount of arguing between the buyer and seller over the true value of these assets. There is no perfect valuation formula.