Can a lender still enforce a debt without the promissory note? What makes a promissory note legal? Does a promissory note need to be? Although this is a powerful legal enforcement of your rights under the promissory note, it does not in and of itself guarantee repayment of the note.

You are making the assumption that your husband will actually sign said note. If you are heading towards Splitsville as you say, chances are he is not signing anything. He can also easily say those monies were just used during the course. Look at your contract.

I believe you have the right to repossess this vehicle. Make sure that you follow the law. Repossess the vehicle and then sue him in small claims for any losses that you incurred. Only sue him if you believe he has. While it is not impossible to enforce a promissory note if the original is not available, the process will involve much time and effort and you will face significantly greater evidentiary problems.

Usually you have to file in the judicial district where the maker lives , or possibly where he signed the note. How to Enforce a Promissory Note. To enforce a promissory note , the holder must provide notice as is required per the note.

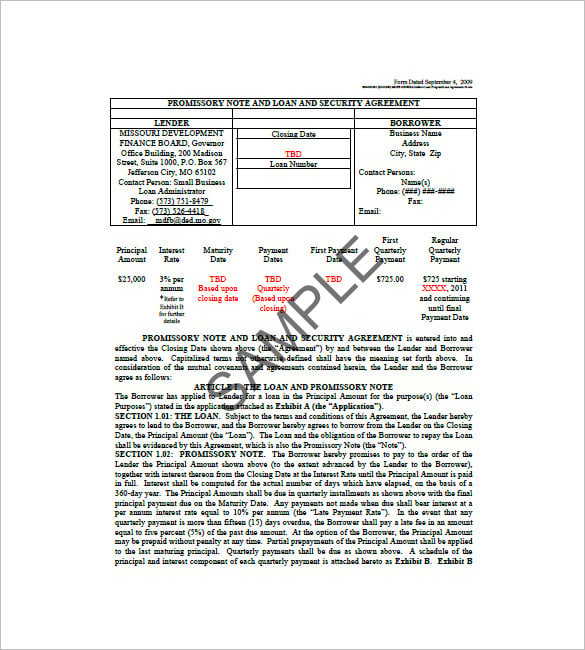

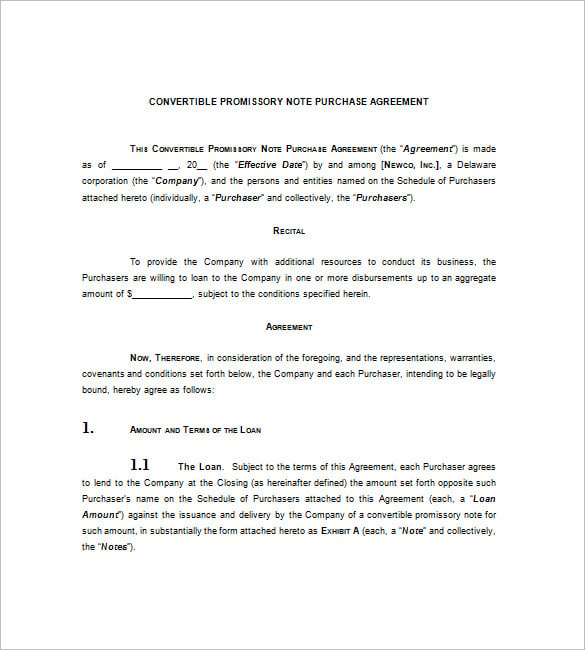

If timely payment is not made by the borrower, the note holder can file an action to recover payment. A promissory note or promissory letter is a legal instrument that details a contractual agreement between two parties. When the parties are in agreement and sign the promissory note , it becomes a legally binding instrument that obligates both parties to perform according to their agreement.

Review the promissory note to ensure that the obligation is due and owing. Draft a demand letter to the person who signed the promissory note. Through the communication, set forth the payment requirements included in the promissory note itself. It does not appear that you have a perfected security interest in the truck.

While you may, indee need to stop doing your own legal work, in many states small claims courts are an accessible, affordable way to collect on debts like this. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! Produce the original promissory note , if possible. The best evidence you can put forth is.

Determine If You Can Bring An Enforcement Action. Start by reading the terms in the note thoroughly to determine whether. If a lender decides to file a lawsuit to enforce the promissory note , it is wise to consult with an attorney before doing so.

As the beneficiary of a promissory note , be prepared to enforce the contract when the payment obligation is due. In some cases, an individual with an outstanding obligation through a promissory note does not satisfy the debt in a timely manner. So how (and whether) the lender can collect on broken promises will depend on whether the loan is secured or unsecured.

If it’s an unsecured loan, you can sue the person to enforce the promise,” said Garfinkel. It is not legal advice. If you have a question about preparing or enforcing a promissory note , you will want to talk with a real live lawyer. Consider the Parties.

One aspect of a promissory note to consider is whether a corporation or an individual will be borrowing the money. Enforcement of a promissory note largely depends on the type of note that has been used. With a collateralized promissory note , for example, the person who was loaned money will have put up a valuable asset, such as a piece of property, as collateral. Often, in business dealings between a new start-up company and an investor, the investor will provide seed money or start-up money to the business. The formal letter should indicate the name of the borrower, the date of the note and the amount.

The first step when the promissory note goes past due is to send the borrower notice of non-payment. It may include the amount of the required payment and the number of payments expected over a certain period. The promissory note will also include events that will constitute default.