How Do I Declare Personal Bankruptcy? How do you file a personal bankruptcy? How you can file personal bankruptcy?

When you declare bankruptcy , your co-signer still may be legally obligated to pay all or part of your loan. When determining what kind of bankruptcy to file, debtors must consider their ability to pay their debts, and whether they have assets they would like to preserve.

A Chapter bankruptcy generally discharges all debts, but also requires most assets to be liquidated in order to pay off at least some debt. The debtor must also pass a means test, which is conducted in order to exclude individuals with high income or a lot of assets from filing for Chapter 7. It generally takes three to six months. See full list on moneycrashers. Married couples with financial problems may choose to file separately or file one bankruptcy case together. Many choose to file together simply because they do not have to pay two separate filing fees and also because spouses frequently co-sign on one another’s loans.

For example, Tim and Mary are marrie and both of their names are on their home loan, credit cards, and car loan. Tim lost his job last year, but Mary did not.

Tim decides to file Chapter bankruptcy alone. But since he’s proce. The advantages and repercussions to filing for bankruptcy can be many and complex, and the process can seem overwhelming. In this way, you can understand how the process will affect you now and for years to come.

Have you been through the process of filing for bankruptcy ? Other options include an IRS payment plan or an offer in compromise. If you are a person that has filed bankruptcy , a debtor’s attorney or a U. Trustee with questions about an open bankruptcy you may contact the IRS’ Centralized Insolvency Operations Unit, Monday through Friday, 7:a. In general, depending on exactly how everything was set up, you would not be able to declare your personal credit cards in the BK for the LLC. If it was a loan, you would be listed as a creditor on the BK. During the Bankruptcy proceedings.

Most banks require years after the discharge and at least active trades lines on the credit report. Personal bankruptcy is commenced by an individual filing Chapter 1 or 13. The most common is Chapter 7. The debtor is allowed to exempt certain property from liquidation by the trustee.

The underlying policy of bankruptcy law is.

It’s much more difficult to liquidate your assets and get a fresh start to your credit history. The Department of Justice’s U. Trustee Program approves organizations to provide the credit counseling and debtor education required for anyone filing for personal bankrutpcy. Only the counselors and educators that appear on the U. Trustee Program’s lists can advertise that they are approved to provide the required counseling and debtor education. Pre-bankruptcy credit counseling and pre-discharge debtor education may not be provided at the same time.

You must file a certificate of credit counseling completion when you file for bankruptcy, and evidence of completion of debtor education after you file for bankruptcy — but before your debts are discharged. Only credit counseling organizations and debtor education course provi. If you’re looking for credit counseling to fulfill the bankruptcy law requirements, make sure you receive services only from approved providers for your judicial district. Check the list of approved credit counseling providers online or at the bankruptcy clerk’s office for the district where you will file. Once you have the list of approved organizations, call several to gather information before you pick one.

Some key questions to ask are: 1. Trustee Program promotes integrity and efficiency in the nation’s bankruptcy system by enforcing bankruptcy laws and oversees private trustees. The Program has regions and field offices, and oversees the administration of bankruptcy in all states except Alabama and North Carolina. What services do you offer? For more information, visit the U. If you have concerns about approved credit counseling agencies or debtor education course providers, contact the U. Under Chapter 1 you repay all or part of your debt through a three-to-five-year repayment plan.

When you make the personal bankruptcy filing, you will also submit a repayment plan to the court. After submitting the plan, you should begin making payments to the trustee (who then pays your creditors). You can go bankrupt in one of two main ways.

The second way is for creditors to ask the court to order a person bankrupt. Personal Bankruptcy is, first and foremost, a consumer right – defined and protected under both Canadian and Quebec law – which protects you from your creditors. Ultimately, it is a recourse that allows you, when no other options are available, to prevent your financial situation from getting worse, to regain control of your life and to get. If you’re considering filing for bankruptcy , these are the steps you must take.

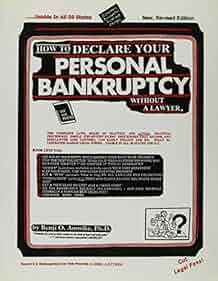

Step 1: Find an Attorney. You’ll find additional information about exempting property in the Chapter exemption overview article , as well as to specific exemption questions in the Chapter bankruptcy exemption FAQ. Will I Lose My House If I Declare Personal Bankruptcy ? Bankruptcy can be an unsettling experience for those who find themselves deep in debt.

The process is designed to help people keep as much. Because chapter bankruptcy completely eliminates the debts you include when you file, it can stay on your credit report for. You keep your personal property, such as clothes, electronics, household furnishings and other exempt assets.

Depending on your state laws, the type of bankruptcy you file, and your finances, you can sometimes retain larger assets, such as cars and the family home. It ranks up there with divorce, loss of a loved one and business failure. Beyond the emotional impact, here are other effects of declaring bankruptcy : Your bankruptcy becomes public domain.

This means your name and other personal information will appear in court records for the public to access.