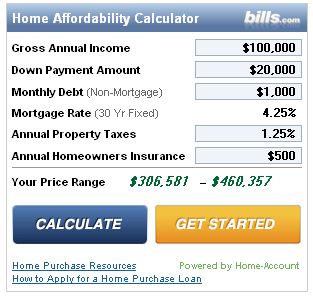

An affordability calculator is a great first step to estimate how much home you can afford. But here are some other things to consider when figuring out your home shopping budget. To determine how much house you can affor most financial advisers agree that people should spend no more than percent of their gross monthly income on housing expenses and no more than 36. Simply enter your monthly income , expenses and expected interest rate to get your estimate.

Adjust the loan terms to see your estimated home price, loan amount , down payment and monthly payment change as well. The home affordability calculator from realtor.

Quickly find the maximum home price within your price range. This formula can help you crunch the numbers to see how much house you can afford. Rule of thumb is that you can qualify for a mortgage at times your gross annual salary. Assuming you can get.

Credit bureau scores and free credit scores are completely worthless! Mortgage lenders look at your FICO Scores. You will need a minimum FICO of 620.

To arrive at an affordable home price, we followed the guidelines of most lenders.

How to calculate the true cost of a mortgage? How do you determine how much mortgage you can afford? Which mortgage calculator is the best? One influential factor in determining the amount of money you can borrow on a home loan is your debt-to-income (DTI ) ratio. It is recommended that your DTI should be less than to ensure that you have some padding on your monthly spend.

A good DTI greatly impacts your ability to get pre-qualified for a mortgage. Front-end debt ratio is also known as the mortgage -to-income ratio, and is computed by dividing total monthly housing costs by monthly gross income. For our calculator , only conventional and FHA loans utilize the front-end debt ratio. See full list on calculator. Back-end debt ratio includes everything in the front-end ratio dealing with housing costs, along with any accrued recurring monthly debt like car loans, student loans, and credit cards.

This ratio is known as the debt-to-income ratio, and is used for all the calculations. Conventional loans may be either conforming or non-conforming. Conforming loans are bought by housing agencies such as Freddie Mac and Fannie Mae and follow their terms and conditions. Non-conforming loans are any loans not bought by these housing age. Please visit our FHA Loan Calculator to get more in-depth information regarding FHA loans, or to calculate estimated monthly payments on FHA loans.

An FHA loan is a mortgage insured by the Federal Housing Administration. Borrowers must pay for mortgage insurance in order to protect lenders from losses in instances of defaults on loans. The insurance allows lenders to offer FHA loans at lower interest rates than usual with more flexible requirements, such as lower down payment as a percentage o.

A VA loan is a mortgage loan granted to veterans, service members on active duty, members of the national guar reservists, or surviving spouses, and is guaranteed by the U. Department of Veterans Affairs (VA). To be approved for a VA loan, the back-end ratio of the applicant needs to be better than. In other words, the sum of monthly ho. The calculator also allows the user to select from debt-to-income ratios between to in increments of.

If coupled with down payments less than , 0. PMI insurance will automatically be added to monthly housing costs because they are assumed to be calculations for conventional loans. There are no options above because that is the point at which DTI exceeds risk thresholds for nearly all mortgage lenders. If you cannot immediately afford the house you want, below are some steps that can be taken to increase house affordability, albeit with time and due diligence.

In general, home-buyers should use lower percentages for more conserva. Reduce debt in other areas—This may include anything from choosing a less expensive car to paying off student loans. In essence, lowering standard of living in other areas can make it more possible to afford a particularly sought-after house.

Increase credit score—A better credit score can help buyers find a loan with a better i. Depending on your credit score, you may be qualified at a higher ratio, but generally, housing expenses shouldn’t exceed of your monthly income. For example, if your monthly mortgage payment,. Input your net (after tax) income and the calculator will display rentals up to of your estimated gross income. Property managers typically use gross income to qualify applicants, so the tool assumes your net income is taxed at. More Veterans Than Ever are Buying with $Down.

The calculator shows two sets of : Most lenders require borrowers to keep housing costs to or less of their pretax income. Estimate Your Monthly Payment Today. Your total debt payments (including housing costs) can’t.

This ensures you have enough money for other expenses. Also, your total monthly debt obligations (debt-to-income ratio) should be or lower. A down payment is standar if you can afford it.

Though some mortgage loans may only require as little as 3. Find your true home buying power. Use your own stats – including your full credit profile – to see how much home you can afford. This calculator will give you a better idea of how much you can afford to pay for a house and what the monthly payment will be. This mortgage calculator will show how much you can afford.

Fill in the entry fields and click on the View Report button to see a complete amortization schedule of the mortgage payments. If you earn $0a month, that means your monthly house payment should be no more than $250. The calculator below will show you a ballpark figure for how much house you can afford based on your down payment amount and maximum house payment. Use our mortgage calculator to determine your budget. To determine your DTI ratio, simply take your total debt figure and divide it by your income.

For instance, if your debt costs $0per month and your monthly income equals $00 your DTI is $0÷ $00 or percent.