The portal allows insolvency practitioners to access itemised accounts of incapacitated entities. Watch our video for a demonstration. Business Portal information.

P-ATO materials and your customer system ATO materials together. Your System Security Plan should document that your system inherits some controls (partially or fully) from the cloud.

P-ATO , as well as documenting the controls handled by your system. Your agency issues an ATO for your system running on cloud. Your registered tax or BAS agent can enrol, identify and declare for JobKeeper on your behalf using Online service for agents. You can find out how to set this up at ato. Example – A business that does not pay employees.

Angela runs a small convenience store in Darwin using a trust as her business vehicle. She is the only person who works in the business.

She provides for her own remuneration by making trust distributions during the year and does not pay any wages. I asked: The ATO website says our registered address is xxx xx xxx xxx. How do we get it updated? It provides easy and convenient access to information and allows you to conduct transactions with the ATO in a secure, online environment.

Set up your myGovID and establish your authorisations using Relationship Authorisation Manager (RAM). If you require further assistance contact the ATO. Before commencing the process, businesses are being told to go through a five-step process, which first and foremost includes registering their interest and subscribing for JobKeeper payment updates. However, we recommend that it be installed and tested way before the cutover date. Use it to lodge activity statements, request refunds and more.

High call volumes may result in long wait times. Ask questions, share your knowledge and discuss your experiences with us and our Community. Answered: Hi all, Whenever I try to the business portal to try and register my business name, the webpage lags, ausgovcustomers.

ATO or the Commonwealth endorses you or. Get help with a range of tax issues from the ATO at a time that suits you. For a more personalised and secure experience, use the call-back service.

Operating our business through a trust with no employees. Surprisingly it only took mins to get through. Use the PAYG instalments calculator if you want to work out the instalment amount or rate to: use when you enter PAYG instalments voluntarily. Calculate PAYG instalments. Online services for agents is a secure system to provide registered tax and BAS agents and their authorised staff access to a range of services and information for their clients.

When using myGovID to , you will have an ABN selection screen that will appear if you have more than one ABN linked in Relationship Authorisation Manager. Make sure your payroll system is correct and that each pay period in your system is right. The ATO will only work off the latest year to date information.

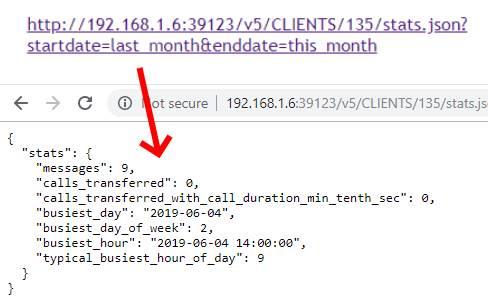

The week to week doesnt matter as such. The ATO Busienss Portal will provide the employer with a list of files the ATO has received. The ATO is the Government’s principal revenue collection agency. Our role is to manage and shape the tax, excise and superannuation systems that fund services for Australians.

The Australian Government is serious about your safety and privacy online. When using government online services, your personal information won’t be shared without your permission – putting you in control. It astounds me that not a week goes past where there are not multiple comments on the ATO ’s Portal and website. Makes me wonder if one of the Big banks ran their IT the same way, how long would they stay in business (and look at how many people access their systems on a daily basis). The ATO has responsibility for administering the Australian federal taxation system, superannuation legislation, and other associated matters.

All I had to do was to link my Individual MyGov account to the ABN of my company and after some verification checks was able to get to the portal that.