Expertly Designed Forms – Try Free! How many copies of GST tax invoice to be issued? Can we pay the GST against a pro forma invoice? Is it necessary to invoice numbers for the GST?

Do I need to pay GST on reselling the GST paid item?

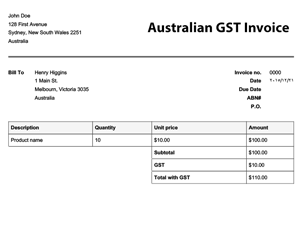

Hence, you must know the format and particulars that go into creating tax invoices so that you can create invoices correctly and undertake business transactions effortlessly. You can read our GST invoice guide and article on invoices in GST to know GST invoice components and types. This is the standard invoice format for Australian tax invoices.

Change the invoice format via the button below. Add or edit the Taxes or Discounts -if applicable- from the Taxes and Discounts buttons. The commercial invoice tax invoice template is a simple template that finds out the total price of the product purchased including the GST.

It contains the GST number, the date of invoice , the invoice number and the description of the product.

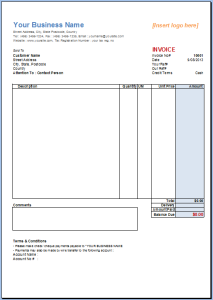

TAX INVOICE Business name Date. When you make a taxable sale of more than $82. GST ), your GST -registered customers need a tax invoice to claim a credit for the GST in the purchase price. If a customer asks you for a tax invoice you must provide one within days of their request. Tax invoices must include at least seven pieces of information.

You must get a tax invoice to claim GST on goods or services costing over $which you buy as part of your taxable activity. How tax invoices for GST work When GST -registered customers need get and issue tax invoices and what the invoices need to show. You may issue a simplified tax invoice instead of a tax invoice if the total amount payable for your supply (including GST ) does not exceed $000.

Receipt In Minutes – Start Now. Print Instantly- 1 Free! Bill number and date 2. Customer and taxpayer’s GSTIN number 5. Note that the PST is referred to as the Retail Sales Tax (RST) in Manitoba or the Quebec Sales Tax (QST) in Quebec. If your invoice involves charging HST (the Harmonized Sales Tax ), see an invoice sample with HST.

If your business is not enrolled for GST (Goods and Services Tax ), then your invoice will not exclude an assessable segment. For example, your invoices and receipts may show sales invoice tax , GST (goods and services tax ), VAT (value-added tax ), local tax , etc.

To comply with your local taxation laws, there is a multitude of blank tax invoice templates that you can copy and use for your business invoice. However, if you want to ensure the. Drafted By Professionals – Finish In Just Minutes – Create Documents Effortlessly! Download GST Invoice Format in Excel, Wor PDF. Before we get down to the rules that govern GST invoices , we have to understand what is GST invoice.

A GST invoice is a document which is supposed to contain all the relevant details of a business transaction and both the parties involved. This free Canadian invoice template charges both GST (Goods and Services Tax ) and PST (Provincial Sales Tax ). This billing format is suitable for business who sells products or provides service in Canada. Disclaimer: I created this GST invoice for educational purposes only but provided this could be used for small shop keepers and businesses and this invoice format is valid in India.

The invoice template provided with Biz Invoice can be customised with your logo, features all the required fields, and has the option to include your ABN and GST amounts. Biz Invoice is also available with most Westpac foreign currency accounts, though the invoice template associated with these accounts will not be a tax invoice for the specific country you’re trading with. A tax invoice is the invoice created by a GST registered business owner when he sells taxable goods and services. What is a bill of supply? A bill of supply is an invoice generated by a GST registered business owner when he sells GST exempt goods or services, or when he is registered.

The importance of tax invoice under GST has increased due to the invoice matching facility under such a tax regime. This is because to claim credit under GST , the return for outward supplies of the supplier must match with the return for inward supplies of the recipient. With service-specific templates for invoices , you can enter quantities and unit costs for labor and sales and even adjust the invoice template to double as a receipt.

You’ll also find invoicing templates and billing statements that deduct deposits or provide tax calculations.