What is rounding in GST? How to compute GST amount? In this type of rounding, if the value in Paise is Paise or more, it is rounded upward to. Paise is more than Paise, it should be rounded upward to the nearest Rupee and if the value in Paise is less than Paise, it should be rounded downward to the nearest Rupee.

As the recipient, you must: issue the original or a copy of your RCTI to the supplier within days of one of the following dates the date of the. RCTI comply with your obligations under the tax. Mathematical if GST = 6. However if you rounding by the accounting process it is different and is an average process in that GST 6. The other query was that when an item is $18. MYOB is calculating this as $1.

Date of issue of the receipt. Your business name and GST registration number. The total amount payable (including the total amount of GST chargeable ) The words Price payable includes GST. When the number is 5- you round the number up to the next highest number. If the amount is equal to or more than half a cent, round up.

Rounding off fractional amounts. Specific accounting rules that apply to exempt, zero-rated and special supplies. It applies to each invoice as tax is payable on each invoice. Should the amount of tax be retained with…. Voice and data rates (in per-minute and per-Mb terms) have been on a steady decline for several years, and along the way, this has thrown up some pricing and billing challenges.

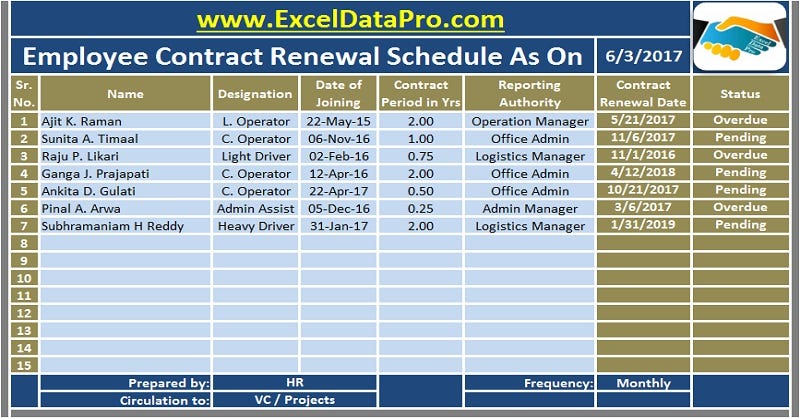

GST rounding is a well-known accounting issue that arises when you work backwards from a GST inclusive price. All usage charges are calculated to decimal places in our billing system but only show decimal places on the bill. Auto-suggest helps you quickly narrow down your search by suggesting possible matches as you type. Is GST accepting decimals figure for Gross Amount?

This is the way to have the most accurate result as possible. The method to be used for rounding off in GST invoice is normal rounding , i. Now, from a GST compliance perspective, there is an obligation on providers to calculate this correctly. Local regulations or local custom may require the invoice to be rounded in a specific way, for example, to an amount divisible by 0. Set up rules for rounding invoices in local currency and in foreign currency. This means that when we adjust the figure from its decimal place total down to decimal places an element of rounding needs to occur. If we define GST rounding precision on general ledger setup then it will applicable for all invoice.

In my case i have defined GST rounding on General Ledger Setup and its working perfectly fine but for some of invoice i dont want rounding. Hope my question is clear now. GST annual exclusion), and keep reading if you want to learn more about the disconnect between the annual exclusion for gifts and the GST annual exclusion when making transfers to trusts. CGST Rules updated as on 15.

There is great deal of confusion about rounding of tax amount and invoice value under GST. This confusion stems from the fact that under Excise both tax values and invoice values were rounded to nearest rupee. Tax (not rounded): 1. Normal Inc Value: 16.

Moneysmart Inc Value: 16. There are plenty of other examples (e.g 1 3etc). Can someone explain the logic or rule that triggers the rounding so we can replicate it in our systems? Total invoice rule – under this rule, the unrounded amounts of GST for each taxable sale should be totalled and then rounded to the nearest cent (again rounding up from cents).

So, you ll be doing rounded off in invoice at final figure. This should include any tax, duty, fee, levy or other additional charges (for example, GST or airport tax). Exceptions: this rule does not usually apply in business-to-business transactions. This means you do not need to include GST if a price statement is made exclusively to businesses.

The harmonized sales tax replaces the provincial sales tax and the GST in some provinces.