The procedure is very simple just following the following steps. Goods and Service Tax ( GST ) is an indirect tax which is for India on the supply of products and administration. You only need to register for GST once, even if you operate more than one business.

How do I register for GST? Is it necessary to do GST registration? Can I get register for GST at my home address? BTS100a_Instructions for Filling Out BTS Registration Form 100. BTS101_ Registration Form _Individuals.

BTS103_ Registration Details for Persons BTS104_Application to Change Status Details or Cancel Registration. Vendor Form for Businesses. All applications for GST registration are to be submitted online via myTax Portal. Lodge your Grievance using self-service Help Desk Portal. Proper officer will give decisions in FORM GST REG within days from date of receipt of clarification from the applicant.

Where registration is cancelled due to reason for non filing of returns. File such returns first along with all payment of all dues of tax, interest and penalty, if any. Get your business new GST registration online from the GST official registration website. Check GST return, pay good and service tax, GST filing and takes the help of GST registration Consultant. Get GST Certificate in just 3-working days.

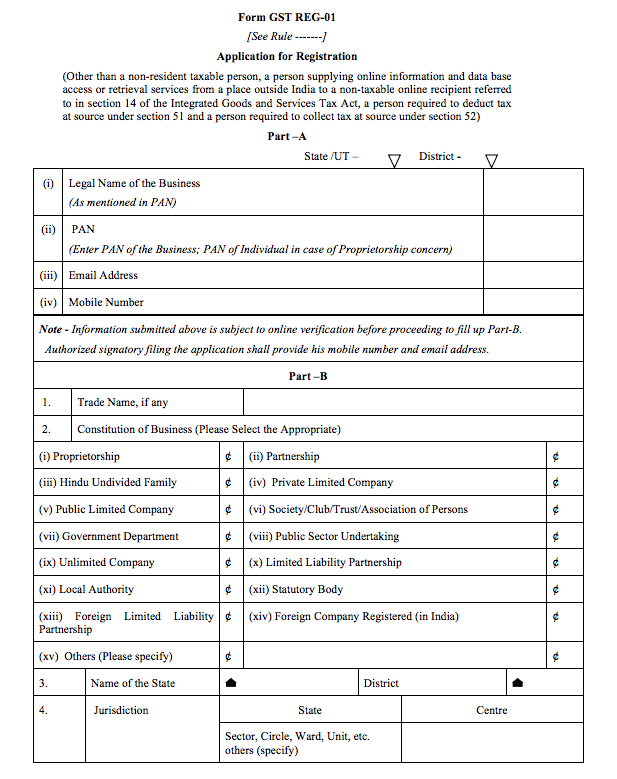

Various forms issued for registration , filing returns or refunds etc. So far Government has issued 1types of Form under GST. GST Registration online application. Document Checklist (PDF, 9KB) Registering for GST (Video Guide) -. If you have any mistakes or errors in GST registration , you can rectify it in the application for registration either at the time of registration or even afterwards. The GST officer will verify and approve within days in FORM GST REG-15.

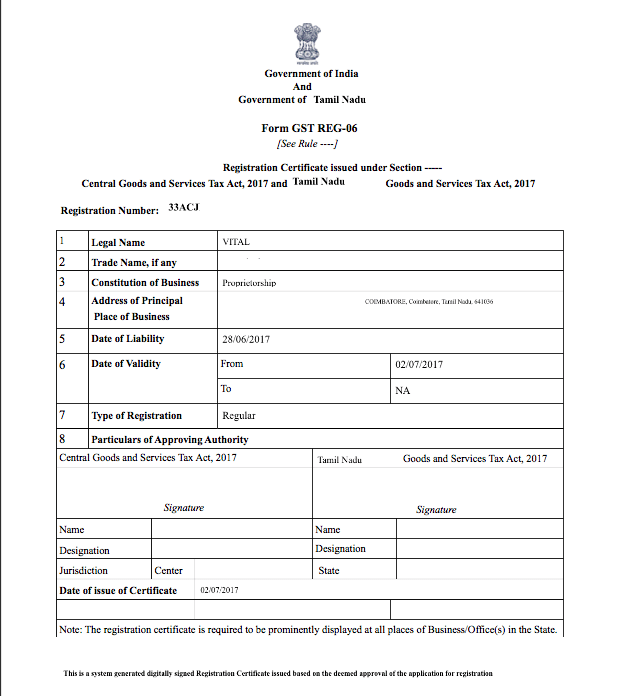

You must submit FORM GST REG-along with documents. When you register for GST you choose how often you file your GST returns (your filing frequency) and how you record your GST (your accounting basis). What you need to do once registered. Form GST REG for Certificate of provisional registration under GST.

Taxpayer is required to verify his details on common portal. After successful verification, a certificate is issued on provisional basis. This registration number is also called GSTIN. Full form of GSTIN is goods and services tax identification number. This is used as a proof at various places.

As per the GST law, the suppliers of goods with an aggregate annual turnover of more than Rs Lakhs must mandatorily register under GST. The PAN is verified on the GST Portal. Verify and Submit the Online GST Application Registration Form.

There are three ways that lets you verify and submit your GST application registration form. Select Gender Male Female Other. Once submitte we will ensure all details are correct, process the order and confirm you have been properly registered with the ATO. Best of all, you do not have to deal with anyone else. Not-for-profit organisations must register for GST if their GST turnover is $150or more and they may choose to register if their GST annual turnover is lower.

If your organisation is registered for GST , your organisation must include GST on most, or all, of its sales. In most circumstances, your organisation can also claim a credit for the GST included in the price of goods and.