How do I register for GST? Is it necessary to do GST registration? Visit the GST portal at gst. Login to the portal using your login credentials.

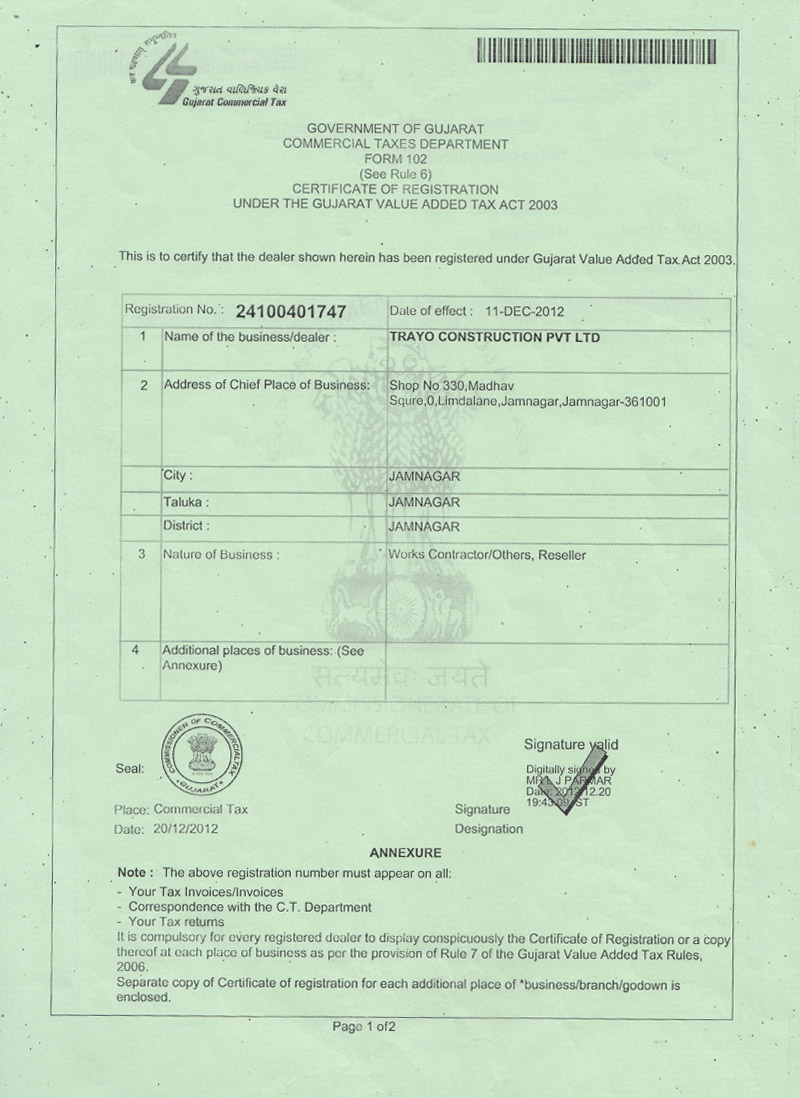

The certificate contains all the details of the business. On the first page, basic details like name, address,. Enter the username and password to login to your account. Certificate Details Hence, you can view the.

GST once registered its need filling work. Composition scheme is for small businesses whose aggregate turnover less than 1. GST abolished or subsumed multiple taxes into a single taxation system. Lodge your Grievance using self-service Help Desk Portal.

Name, A form of business, Address, Date of registration and Validity period of the business. The second page contains details of any additional. GST registration is essential for all vendors whose aggregate turnover in a financial year exceeds Rs lakh. Rs lakhs for NE and hill states) is required to register as a normal taxable person. This process of registration is called GST registration.

For certain businesses, registration under GST is mandatory. This period of validity can be further extended by the proper authority as specified under section (1). However, some applicants may require to provide additional documents to the GST department for further clarifications. Business Formation :- Are different.

When an individual decided to perform business as sole trader or as Proprietor then the business name has to be registered with one of many options available such as GST , IE code, MSME etc. What is ProprietorshipRegister. You do not need to submit hard copies. The following are the main documents are required for GST registration.

Local Authority – Any proof substantiating Constitution. Grant of Registration:. Where after due verification as per section (12) of the Act, the application for grant of.

If application for registration has been made within days from the day the person becomes liable. Application Type Choose appropriate type of application. Sales Tax Registration basics. Those are as follows:-PAN card. In this article, we look at the process of downloading the GST certificate from the GST Portal.

Downloading GST certificate is a pretty easy process. The government does not issue any physical certificate , we. Backdating your GST registration. You can apply to backdate your GST registration. GST Registration Documents.

Enter details then click login2. If you are not accustomed to GST provisions, then you might get. Click User services4. Take a look at how to register for GST online in few easy steps. Go to the GST portal.

Select GST Cancellation for cancelling existing GST Number. These persons are not eligible for small supplier status in respect of their taxi business.