Do I need to pay GST on reselling the GST paid item? Does signature compulsory on GST invoices? How to create GST invoice in Excel?

Bill of supply: Use this invoice when shipping GST-exempt products. You need to create a business login account with Amazon. Fil all details of your business Establishment like Name, address and GST number. Then place the order in name if your business.

In such case you will get an invoice showing GST of your busi. GST applies to each low value item in an order , regardless of the total value of all items in an order. The order details display a tax breakdown for LVG items where GST is calculate collecte and remitted by Amazon.

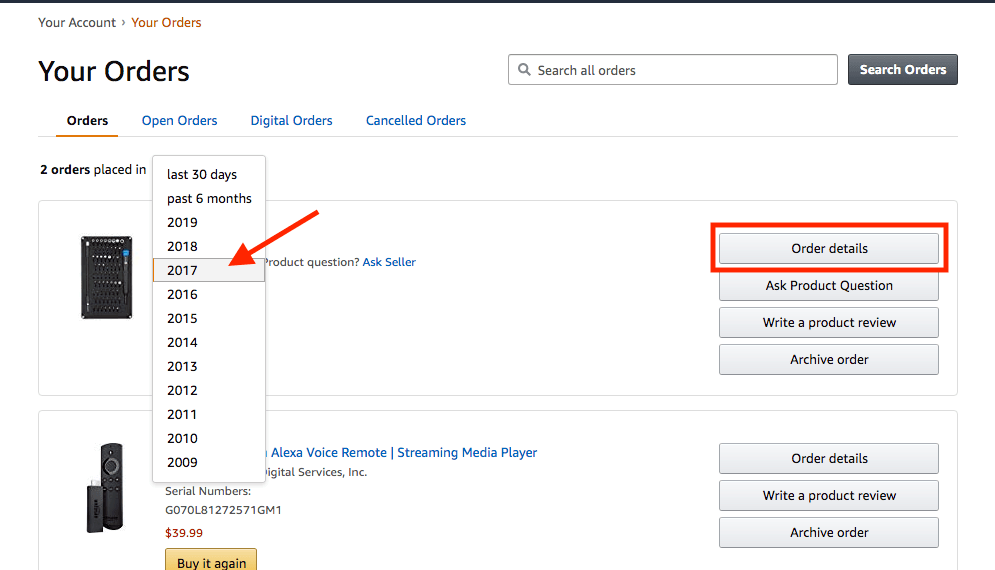

An invoice with relevant order and tax details is available in Your Orders. To view, or print an invoice, go to Print an Invoice. To print an invoice : Go to Your Orders.

Select Invoiceunderneath the order number. GST Invoice for Input Tax Credit. No, tax filing for your B2B orders is different from that of B2C. Platform may also issue credit notes for the commission or other charges.

Seller Fulfilled Orders. In looking, I found one US seller who charged my province’s PST on something that is not PST taxable. But rule says u got to have invoice with Gst no. An invoice or a bill provides a list of goods sold along with the amount due for payment.

The ‘Statutory Compliance Checklist’ is a good reference source to update yourself on the GST rules and regulations. Any entity or business that is registered under the GST must be able to provide GST compliant invoices. AWS”) is established in the United States, it is registered for Australian GST purposes as a normal taxpayer. As such, AWS accounts for GST at on certain sales of AWS services to customers located in Australia.

AWS’s online pricing does not include applicable taxes. You can print an invoice for your order in Your Account as soon as your order is shipped. Therefore, GST may still be collected on invoices issued prior to the time you updated your address or registration number.

About Tax on Digital Products and Services sold on Amazon. To sell in India, you need a GST number. Each account in an organization can download AWS, Inc. Note: You can access AWS Marketplace invoices only if you sign in as the root user of the linked account. Such a document indicates the names of the parties involved as well as the details of goods or services supplied under a given transaction.

I don’t see the problem issuing an invoice with a different name and address on it, in fact, I’ve seen it done on loads of occasions. Just fill in an invoice with the billing address as the buyer’s company and the delivery address as the one you send it to, or vice-versa. What is the time limit to issue invoices in the GST system?

It basically means that whatever tax you are charged on your business purchases, you can claim them and set them off against the GST charged on your business sales. There are two invoice types you need: Taxable invoice : It charges tax to your buyer and. Every invoice has Amazon ’s GST number whether the seller is collecting GST or not.

At present as per the GST invoice generated by amazon the Tax rate on shipping charges are same as the tax on product, this keeps on varying , which is confusing. You can find here the details of the GST Return forms, the process of return filing, due dates, applicability, etc. The … Continue reading Complete GST Return Filing Process for E. The PDF invoice shows the information associated with your payment method (name, address, and so on), and not the information associated with your AWS account.