Now go to the GST section on the front of the BAS and follow the instructions on the form. You will need to transfer amounts from this calculation sheet to the BAS. Do not send us this worksheet when you file Form GST190. Keep the worksheet in case we ask to see it. Don’t lodge the worksheet with your BAS.

We recommend you file it with a copy of the BAS it relates to. For businesses using the Accounts metho enter the actual amount for Label Gdirectly onto the activity statement. The calculation worksheet should not be sent to the Tax Office. It should be kept with periodic reports and other working papers to be reviewed in the event of a Tax Office query.

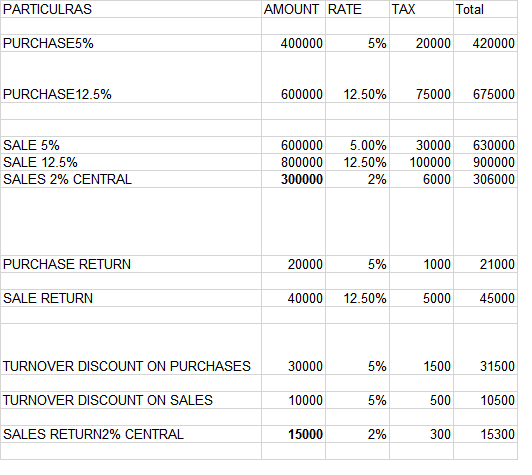

Enter the total of all GST and HST amounts that you collected or that became collectible by you in the reporting period. It’s the time to take new responsibilities in the dynamic environment of GST Law, especially in the first year of GST Audit once the forms be notified by the Government. On the other han Revenue argued that in respect of all the matters covered under IGST Act the provision of CGST Act applies mutatis mutandis. Goods and services tax ( GST ). Claiming depreciation calculator.

Property tax decision tool. To download a fillable BAS worksheet in PDF format, click following link: Download BAS worksheet. See Tax Office information here.

Show amounts at these labels. GST calculation worksheet How to vary the amount you pay. For further information, refer to the ATO website. It has the G- GGST codes that may assist you when preparing your BAS along with calculations that are built in. GST amounts you owe the Tax Office from.

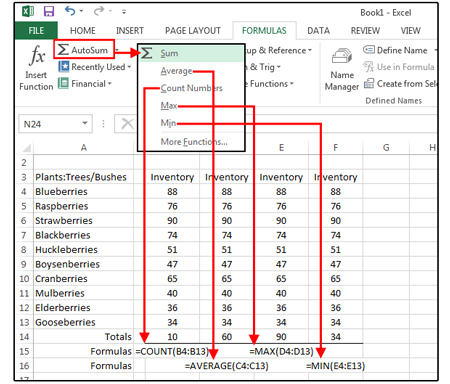

After it’s filled out, it can then be saved or printed just like any other PDF file. Because the calculation system in PDF files is based around Javascript, you can do a lot of advanced things with it. So let’s now have a look at calculating the total including GST. This time we multiply the total by 1 or by 1. In the example below cell B1 which is the figure without GST (exclusive figure) is being multiplied by 1. For business GST – the tax is paid to the Inland Revenue Department (of New Zealand) usually on a or monthly filing period.

It generates an on-screen output that displays a list of values that you need to provide while calculating and filing your company’s GST returns, as part of your Business Activity Statements (BAS). Separate GST -Exempt and Non-Exempt Trusts: The usual practice “when property will be placed in trust and the generation skipping transfer will occur at a later time, (is) to allocate GST exemption to one trust (or group of trusts) so that it (or they) will be entirely exempt from the tax and for the other trust (or trusts) to not be exempt at. Prepare a purchases budget. Below is an explanation of how each of the figures on a BAS is derived.

At time of writing, the BAS worksheet is calculated on an Accrual Basis only. Calculate other cash income and expenditure. Summary and Detailed GST reports are available on a Cash or Accrual basis.

DETAILS Figure 1: BAS Worksheet – showing all GST Fields Figure 2: BAS Worksheet – showing all PAYG. Alternatively, the values could be drawn from separate budget worksheets (e.g., the expected sales figure could be linked to the sales budget worksheet , which would include a sales forecast for each product line). It might also include some other preliminary calculations. GST on export would be zero rated.

Both CGST and SGST will be levied on import of goods and services into India. The incidence of tax will follow the destination principle i. SGST goes to the state where it is consumed. Complete set-off will be available on the GST paid on import on goods and services.