This worksheet allows you to work out GST amounts for your business activity statement (BAS). Don’t lodge the worksheet with your BAS. We recommend you file it with a copy of the BAS it relates to. GST calculation worksheet for BAS (If you want to use the calculation sheet method to work out GST amounts) GST amounts you owe the Tax Office from sales Do not lodge the calculation sheet with your BAS.

Some of the worksheets for this concept are Gst calculation work for bas, Gst rate change adjustment gst 1calculation , Everyday math skills workbooks series, Gst adjustments ir 3calculation , Gs completing your activity statement, Mq maths a yr 1 Achievement objectives description of mathematics, Work. GST previously claimed or paid. The calculation worksheet should not be sent to the Tax Office. It should be kept with periodic reports and other working papers to be reviewed in the event of a Tax Office query.

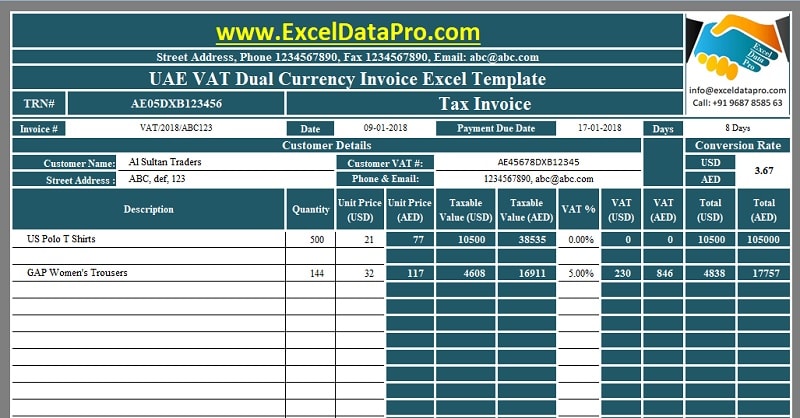

For best , download and open this form in Adobe. Enter the total of all GST and HST amounts that you collected or that became collectible by you in the reporting period. For business GST – the tax is paid to the Inland Revenue Department (of New Zealand) usually on a or monthly filing period. Answer interactive questions.

Used by million students worldwide. Keep the worksheet in case we ask to see it. Go to the Settings tab and click Import button in top-right corner. Select country Australia then click Next button.

It’s the time to take new responsibilities in the dynamic environment of GST Law, especially in the first year of GST Audit once the forms be notified by the Government. On the other han Revenue argued that in respect of all the matters covered under IGST Act the provision of CGST Act applies mutatis mutandis. Claiming depreciation calculator. Goods and services tax ( GST ). Property tax decision tool. Calculation worksheet method.

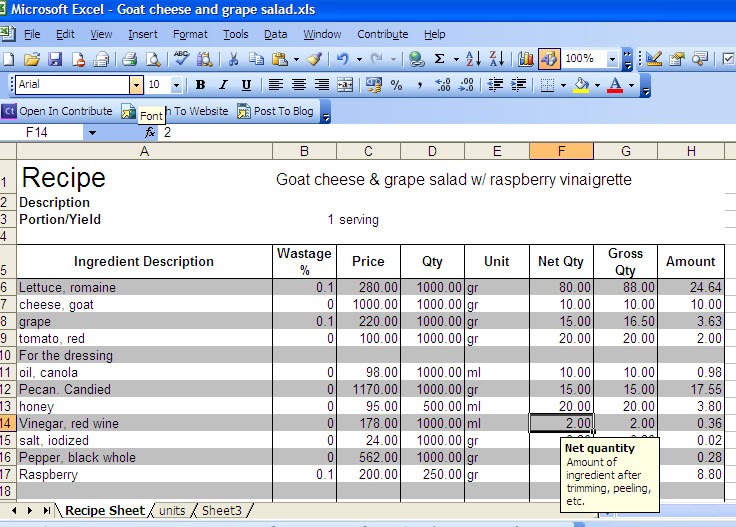

Section 49A deals with Utilization of Input Tax Credit. Users can use it on monthly basis as well. To do this you simply multiply the value, excluding GST by or by 0. To find the total including GST simply add the two values together.

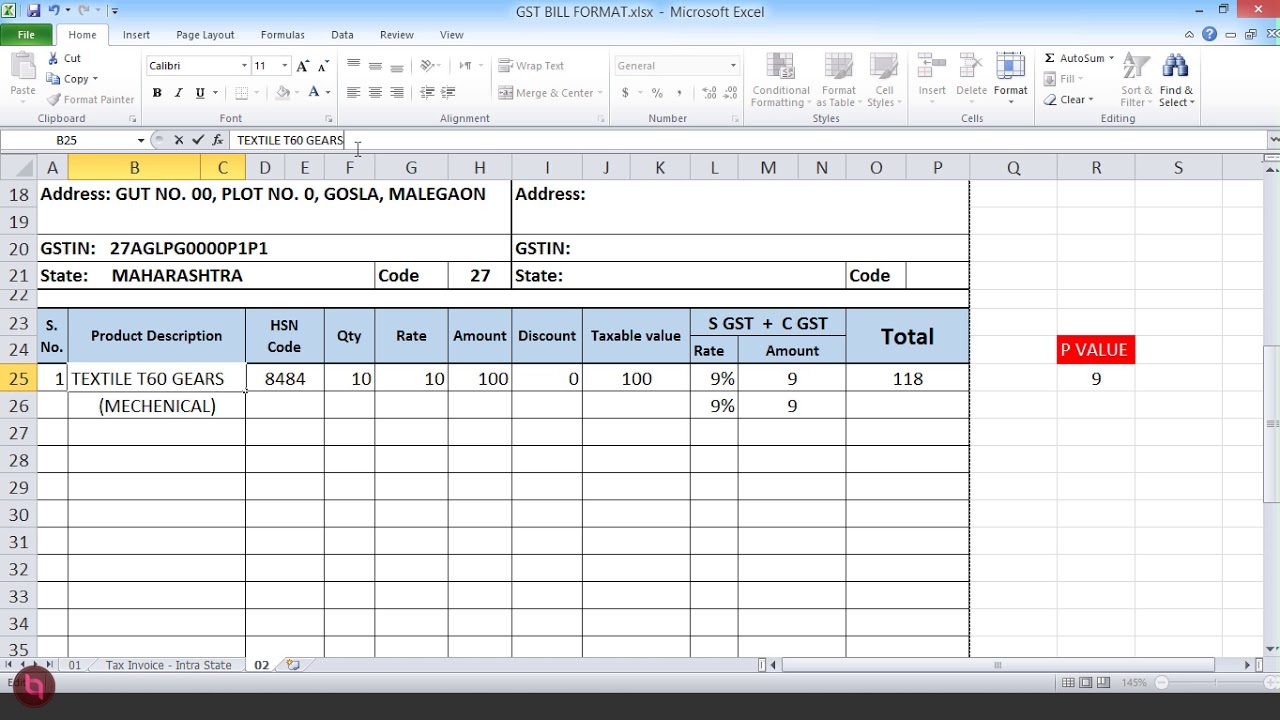

In the example below Bhas been multiplied by 0. There are slabs in GST such as Nil, , , and respectively. GST is levied on the final goods of the manufacturers. This can be explained with a simple mathematical formula mentioned below.

In case a product is sold for Rs. For further information, refer to the ATO website. It has the G- GGST codes that may assist you when preparing your BAS along with calculations that are built in. Worksheets are Gst calculation work for bas, Gst rate change adjustment gst 1calculation , Everyday math skills workbooks series, Gst adjustments ir 3calculation , Gs completing your activity statement, Mq maths a yr 1 Achievement objectives description of mathematics, Work out the vat information.

Click on pop-out icon or print icon to worksheet to print or download. This spreadsheet calculator adds to determine a GST -inclusive amount, or allows you to calculate in reverse by entering the GST -inclusive price to determine the amount of GST within. To download the spreadsheet click on the image and save the file to your desktop.

All sums are set to calculate automatically for your convenience. Here are some tips for answering the questions: Allow approximately 5-minutes to complete. It calculates PST and HST as well.