When could Delaware be the right choice? One of the top factors that could actually make Delaware the appropriate choice , is investors. If your company intends to bring in future private equity investment, Delaware could be the right choice. What are the advantages of Delaware LLC? Does Delaware require LLCs?

How to form a Delaware LLC? Why to form a Delaware LLC? It’s the same bank account, same EIN, same everything. It’s really one LLC (a Delaware LLC ) that is allowed to transact business in both Delaware and Florida. You could also convert (known as “domestication” in Florida ) your Delaware LLC into a Florida LLC.

And after that’s processe dissolve the Delaware LLC. We’ll tag our contenders “Delaware West” and “Delaware South”, both of which are striving to become the “New Delaware”. In case you don’t already know, “Delaware West” is Nevada and “Delaware South” is Florida, two states where officials and state legislatures seem dead serious about becoming the place to incorporate or form LLC’s or other business entities.

Your Delaware LLC will have to register as a foreign LLC in Florida. In addition to the Delaware formation costs, you will need to pay a nominal fee to register in Florida. Florida also requires what it calls a “Certificate of Existence, so you also need to pay a small fee to Delaware to obtain a Certificate of Good Standing.

To be completely honest with you, it’s mostly B. The disadvantages of forming an LLC outside of your home state far outweigh the perceived “advantages”. Let us explain: Domestic LLC vs. The information required is basically the name of the LLC and the name and address of a registered agent, who will receive any legal notifications on behalf of the LLC.

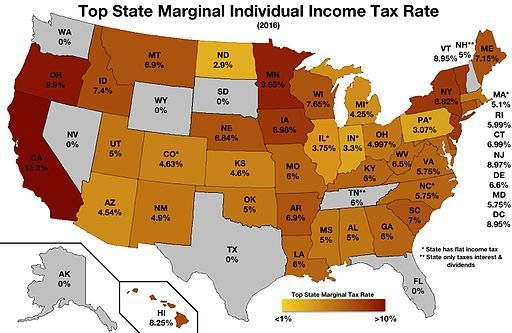

There are no requirements for a written operating agreement, annual member meetings, or annual reports. An LLC not doing business in Delaware does not need to register with the state Division of Revenue or obtain a business license. See full list on info. There is no Delaware tax on intangible property. LLC members who are not Delaware residents are not taxed on their share of profits.

For the most current information on formation and taxation, visit the website for the Delaware Division of Corporations. Unlike in many states, a Delaware LLC is not required to disclose any information about the owners. Anyone seeking to sue you or to find out information about your financial situation will not be able to check the Delaware LLC records and learn about your ownership interest. Unlike other states, Delaware has a special court for business disputes.

For more than 2years, the Court of Chancery has developed corporate law. Disputes in the Court of Chancery are resolved by judges with expertise in business matters, not by juries. The structure of an LLC is governed by the LLC operating agreement, which includes setting forth the rights and responsibilities of members, as well as how member disputes are resolved. Some states have rules controlling the structure of an LLC , but Delaware law affords an LLC great freedom in how it sets up the operating agreement. Delaware offers the ability to set up a series LLC , which allows a single LLC to have numerous divisions, known as series, with each series operating as a separate entity, with its own assets, members, and limitation of liability.

A series LLC , with various degrees of limitation, is currently available in just over a dozen states. A Delaware LLC will still have to register as a foreign LLC in its home state. Also, in order to register in your home state, you probably need to obtain a Certificate of Good Standing from Delaware , which comes with a nominal cost. All states require an LLC doing business in the state to have a registered agent.

Fees for such service typically start at about $1per year. While the Delaware franchise tax and registered agent fee may be relatively low, you will still need to pay whatever taxes are assessed by your home state. A written operating agreement will supersede any oral agreements, provided the written agreement includes a provision that the written agreement is the sole agreement and that any modifications must be in writing. Form a Delaware LLC Now. Florida LLC compared to Delaware LLC Annual Entity Tax $138.

Annual Report Filing Fee $2LLC Tax required to be entered into Public Record. Delaware LLCs used in Florida are favored for asset protection. With a Delaware LLC, the charging order is the exclusive remedy of a creditor. This is the reason why the.

FTC, the Supreme Court of Florida ruled that the judgment creditor of the single-member Florida LLC could seize on the debtor’s entire right, title and interest. In the case of Olmstead v. Keep in mind that Delaware ’s conversion statute makes clear not only that all of the LLC ’s property, as well as debts, are automatically transferred to the new corporation, but also that all rights of creditors against the LLC continue against the new corporation, all LLC debts and liabilities continue in force against the new LLC , and all. An LLC is not a corporation, but it shares certain characteristics, including limited liability for its owners. The Delaware LLC is the most popular choice because of its simplicity. Startups, small businesses, real estate investors, and many other businesses choose an LLC because it has few required dance-steps to follow to run it properly.

Incorporation in Delaware : For many decades, Delaware was the single most popular state to incorporate in and it is still favored by many attorneys and especially by publicly traded corporations. There are a number of advantages to Delaware , however probably the biggest and most substantive advantage of Delaware to consider is The Chancery Court. Delaware Law allows for the conversion of one entity type to another entity type.

With minimal startup requirements, simple maintenance and the ability for members to establish their own company structures and rules, the advantages to forming a Delaware LLC are clear. Here are a list of forms that are available. Limited Liability Company Act Subchapter I.