What should I review in due diligence? What do I need to know about due diligence? How to manage due diligence? What are the best due diligence questions? Legal due diligence is the examination and review of legal documents and contracts.

Financial due diligence. Commercial due diligence. Get deal-ready with our financial due diligence checklist Take a long term , prepared approach to due diligence and achieve a state of always-on readiness for MA deals and more.

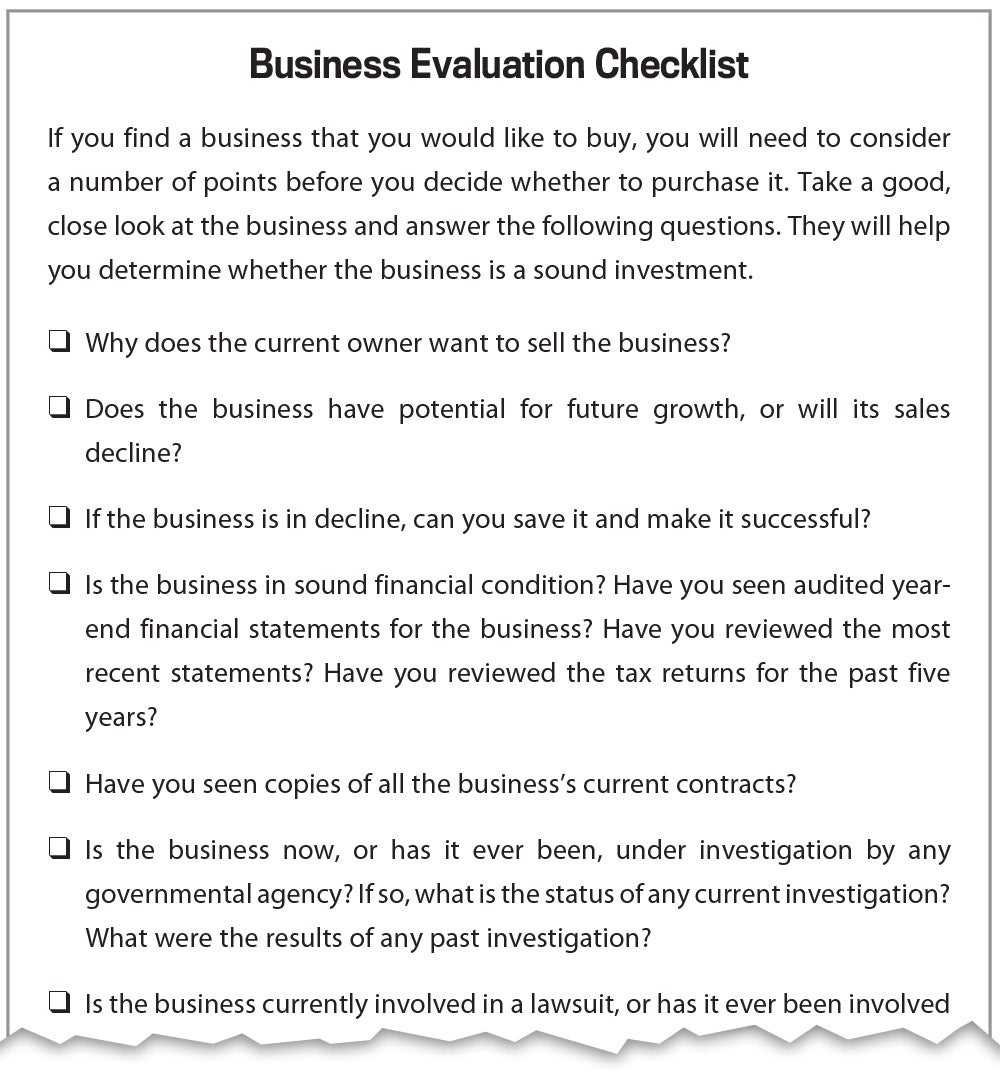

This financial due diligence checklist will ensure your vital business information is structured correctly, saving you time, cost and risk. The financial due diligence process may need to be modified to meet the specific needs of certain industries and businesses. The primary objective of financial due diligence is to help businesses and organizations understand their financial situation. The due diligence checklist includes over items that range from financial to legal to operations items that should be verified before completing the transactions. Agreements relating to any compensation arrangements.

Copies of all consulting agreements. Collective bargaining agreements, non-competition, nondisclosure. Annual and quarterly financial information for the past three years 1. Income statements, balance sheets, cash flows, and footnotes 2. Planned versus actual 3. Sample Due Diligence Checklist I. Management financial reports 4. Breakdown of sales and gross profits by: a. Historical Period – Current Year Unaudited (April to Date) and last years audited. Detailed description of the Company and its Business Model b. Revenue Streams (current as well as future revenue streams, include description of all revenue streams to be captured ) c. Usually, when you show any interest in buying a particular property, the owner will insist that. Basic Property Information.

Goes without saying, you should go through every piece of information regarding the physical. However, the basic objective and framework remain the same. The first step to a due diligence checklist is getting an overall understanding of the target company.

Operational due diligence. Key Considerations to Put on Your Due Diligence Checklist 1. Corporate attorneys carefully review the corporate structure, capitalization,. Tax due diligence explores any historical income tax liabilities and provides an analysis of any tax.

Before any analysis of value should be done, you want to make sure the area you’re looking to invest in. The most recent unaudited statements, with. Due diligence in project finance involves thoroughly reviewing all proposals involved in a deal. This Checklist for Investors is the product of collaboration between CGAP, The Smart Campaign, and many investors. It draws on investor practice and experience.

This checklist is not designed as a standalone due diligence tool. Instea it is designed to lower transaction costs by presenting questions to add to common due diligence topics. Organization and Good Standing. The buyer will be concerned with all of the seller’s historical financial statements and related. Startup Investment Due Diligence Checklist.

If you decide your startup requires investor support, be prepared for an intensive due diligence process and have any and all expected documentation ready and well organized. A startups lack of knowledge of what is expected of the due diligence process or being ill prepared can turn off potential investors. An assessment of the promoters’ history is conducted to ensure the. Evaluation of the Company and Project Business Model.

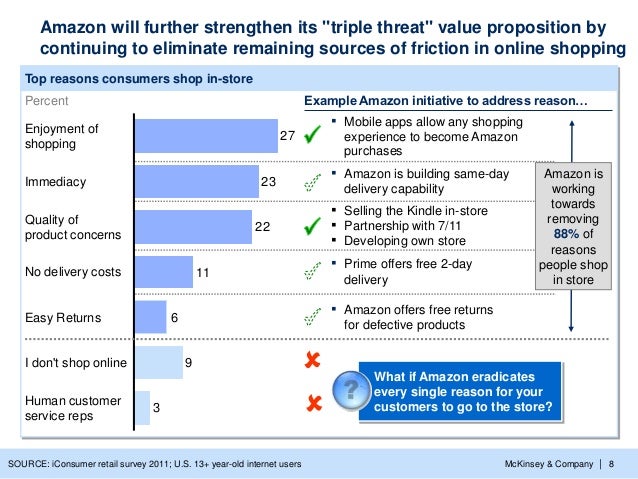

An extensive evaluation of the business model assists the lenders. The components of the service are revenue and market due diligence , synergy validation, maintainable earnings, future cash flows and all operational issues, as well as deal structuring. Quarterly income statements for the last two years and the current year (to date).