What are the steps of estate planning? What information is needed for estate planning? What is the will and estate planning process? Most estate planning advisors will recommend an individual start with their medical requests.

This will involve completing the following forms: 1. Living Will – Allows a person to make their end of life decisions such as the option to no longer receive food or fluids if they should become incapacitated.

The form is specific to each State. Medical Power of Attorney – Allows a person to choose a health care agent who will have the authority to make medical decisions on their behalf. See full list on eforms.

Although, it’s highly advised the financial agent be someone that can be trusted. The financial agent will have the following powers (if selected): 1. Operating Business Entit. In order to begin managing the assets of the individual, a list of assets will need to be made to have an idea of its value. This list should also include any life insurance policies the person may have.

Current Assets List – For personal use to better organize and list all personal property and real estate.

The beneficiaries are the individuals that will be given the estate assets after the person dies. This is most commonly the spouse (if married) and the children (if any). The person can choose to give their assets to whomever they choose and is not only limited to individuals but also companies or organizations, such as non-profit institution. To transfer the estate to the beneficiaries, one (1) of the following forms will need to be completed: 1. Last Will and Testament – Referred to simply as a ‘Will’, states who will get what after a person’s death. Living Trust – Avoids the probate process and allows the creator of the living trust to be the trustee and to remain collecting money being generated from the living trust’s ass.

It’s not so easy to sign these forms. They must be done in accordance with their State’s execution laws which usually involve two (2) witnesses and a notary public. It is important that the witnesses are not mentioned in the estate documents, meaning that they cannot be the financial agent or a beneficiary. Places to Notarize Documents 1. Charges $and the process is completed online. Financial Institution – Such as Bank of America, TD Bank, and Chase Bank will notarize doc.

After the documents are complete it’s important to have in a safe and secure place that family members are aware of for reference. The ideal location is with the individual’s attorney along with providing copies to trusted family members and friends. If you’ve been dragging your feet when it comes to estate planning , you aren’t alone. American adults lack even basic estate – planning documents.

Estate planning may not be as exciting as booking a plane ticket or checking out restaurant reviews, but it does offer many benefits to make sure you don’t end up losing everything you worked hard for. To start your estate plan : List the value of your home and other real estate along with cars, jewelry, artwork, and other physical assets.

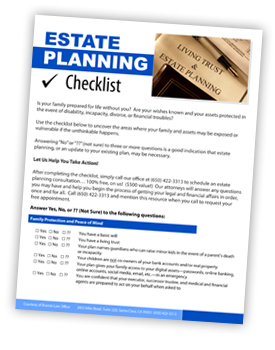

Gather recent statements from your bank, brokerage, and retirement accounts. Include the location and contents of any safety deposit boxes or safes. Your IRA or 4(k) plans. Each of these categories has questions you need to answer, to make sure your estate planning documents are complete and up to date. You should print it out and take it with you when meeting with an estate planning lawyer.

How to Create an Estate Plan in California. Step – Define Medical Requests. It is imperative that the principal defines the medical treatment they wish to receive upon the occurrence of.

Create estate planning documents online with LegalZoom. Make a last will, living trust, living will (advance directive) or power of attorney easily and affordably. THE PROPERTY INFORMATION CHECKLIST General Headings This Asset Information checklist is designed to help you list all the assets you own and what they are worth. If you do not own assets under a particular heading, just leave that section blank.

Under certain headings you may own more assets than can be listed on this checklist. Congrats on the recent nuptials! Checklist -For-Newlyweds.

Now that you, or someone you care about, said the vows and enjoyed a relaxing honeymoon, it’s time to get down to business. Real Estate , Landlord Tenant, Estate Planning , Power of Attorney, Affidavits and More! All Major Categories Covered.