Find A Financial Advisor to Help Unlock Opportunities for Future Generations. Estate Planning Strategies and Wealth Transfer Plans Customized to Your Needs. Private Wealth Advisor Near You. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! By creating your estate plans early, and talking to your personal representatives about their roles, you can give yourself, and your family, the benefit of peace of mind.

Most estate planning advisors will recommend an individual start with their medical requests. This will involve completing the following forms: 1. Living Will – Allows a person to make their end of life decisions such as the option to no longer receive food or fluids if they should become incapacitated. The form is specific to each State.

Medical Power of Attorney – Allows a person to choose a health care agent who will have the authority to make medical decisions on their behalf. See full list on eforms. Although, it’s highly advised the financial agent be someone that can be trusted. The financial agent will have the following powers (if selected): 1. Operating Business Entit.

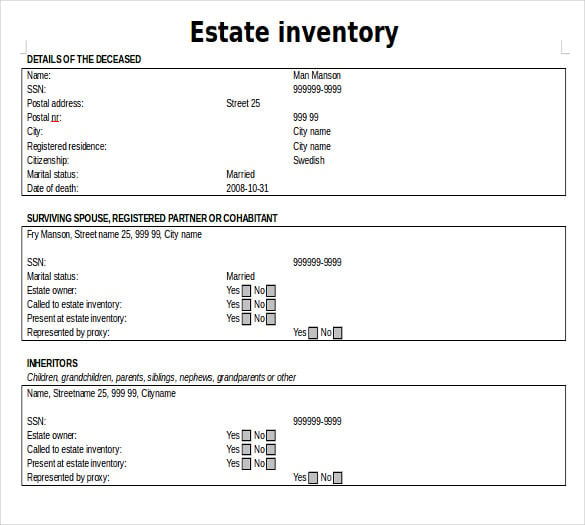

In order to begin managing the assets of the individual, a list of assets will need to be made to have an idea of its value. This list should also include any life insurance policies the person may have. Current Assets List – For personal use to better organize and list all personal property and real estate.

The beneficiaries are the individuals that will be given the estate assets after the person dies. This is most commonly the spouse (if married) and the children (if any). The person can choose to give their assets to whomever they choose and is not only limited to individuals but also companies or organizations, such as non-profit institution. To transfer the estate to the beneficiaries, one (1) of the following forms will need to be completed: 1. Last Will and Testament – Referred to simply as a ‘Will’, states who will get what after a person’s death. Living Trust – Avoids the probate process and allows the creator of the living trust to be the trustee and to remain collecting money being generated from the living trust’s ass.

It’s not so easy to sign these forms. They must be done in accordance with their State’s execution laws which usually involve two (2) witnesses and a notary public. It is important that the witnesses are not mentioned in the estate documents, meaning that they cannot be the financial agent or a beneficiary. Places to Notarize Documents 1. Charges $and the process is completed online. Financial Institution – Such as Bank of America, TD Bank, and Chase Bank will notarize doc.

After the documents are complete it’s important to have in a safe and secure place that family members are aware of for reference. The ideal location is with the individual’s attorney along with providing copies to trusted family members and friends. To learn more about the basics of estate planning , check out this estate planning checklist. Step 1: Cover the Basics A well-laid plan should consider the circumstances of both death and disability of the plan’s author.

ESTATE PLANNING CHECKLIST Things You Can Do to Get Your Estate in Order One of the greatest gifts you can leave your surv ivors is an organized estate. The tim e you spend now will help your loved ones to cope later, and also will ensure your wishes will be carried out. What are the steps of estate planning? What information is needed for estate planning?

What is the will and estate planning process? Why It’s Important Your estate consists of the property (assets) you own when you die. You probably have done some estate planning already, even if you didn’t realize it. All Major Categories Covered. So it is best to seek legal advice.

Estate executor checklist There are a number of steps to take to manage a departed loved one’s finances. Knowing what to expect and what you can do will make the transition easier for you. The Florida estate planning checklist provides helpful information for those wishing to ensure the security of their well-being and prepare their assets for distribution after death.

The owner of the estate , referred to in this checklist as the “principal,” can appoint surrogates to handle their affairs and make decisions on their behalf. ESTATE PLANNING WORKSHEET Please complete this worksheet as fully as possible and bring it with you to your conference. If you’ve been dragging your feet when it comes to estate planning , you aren’t alone. American adults lack even basic estate – planning documents. There’s not a thing you wouldn’t do to help them.

But I also know that what’s in your heart is not enough. At this stage of your life, preparing these must-have documents is one of the most profound acts of love you can bestow. Estate planning is daunting because it requires you to plan for your own death.

And while it’s very easy to ignore, a solid plan can really make things easier for you and your loved ones both before and after your death. When you create an estate plan, there are some essential things to consider.