The difference in the multiple is generally the result of a variety of characteristics specific to your business. To calculate , take their market cap (shares outstanding times stock price) and add in their net debt (total LT debt minus cash). Valuation Multiples by Industry.

EBITDA measures profitability. See full list on eval.

If you’re a seller, the calculator is a reality check. Similar to bond or real estate valuations , the value of a business can be expressed as the present value of expected future earnings. Use this calculator to determine the value of your business today based on discounted future cash flows with consideration to excess compensation paid to owners, level of risk, and possible adjustments for. Determine the value of your company by entering in financials.

Common revenues are product sales, service revenue, rent revenue and interest revenues. When figuring company expenses, include both operating and nonoperating expenses. After arriving at the company’s enterprise value using the formula described above, subtract the net debt of a company to determine the value of the equity claim on the firm’s total cash flow.

We calculate the multiple for the business in question based on profit, using SDE — seller’s discretionary earnings for business. For a more personalized and in depth business valuation , we provide a free business evaluation and consultation for local business owners who are thinking about selling their business. This is the total value of the company, including both equity and debt. ABC Ltd is engaged in the business of soft drinks manufacturing in the city of Lumberton, North Carolina (USA).

As per the annual report published recently, the company has clocked a turnover of $25000. With Equidam, you can seamlessly compute your valuation using methods, of which are properly using these multiples, start now! Before sitting down with prospective buyers or investors, small business owners should understand how this valuation metric will be used to calculate the worth of their company. X, for example, it means that the amount paid for the business is a value of 2. For example, a business that is doing $300in profit per year sold for at 2. Used to more easily compare cash flows and calculate post transaction debt structure.

A “Quality of Earnings” analysis by a CPA firm is a deeper dive into the current and predicted future cash flows of the business. Used by private equity and alternative lenders. Dear Entrepreneur, CONGRATULATIONS on building your business ! We hope this hustle was worth it.

ENJOY our tool and value your business. This business calculator is based on market multiples averages for your company’s business sector and country of operations.

It will estimate the value of your business based on your industry, current sales, and current profit. The three steps to determine the value of a business are: 1. Remember, they can do so using one of two methods. The enterprise multiple is dictated by the business’ industry, the cost of capital, and the overall health of business. Market multiples are updated on a weekly basis and are also adjusted by private market transactions. How is a company valued?

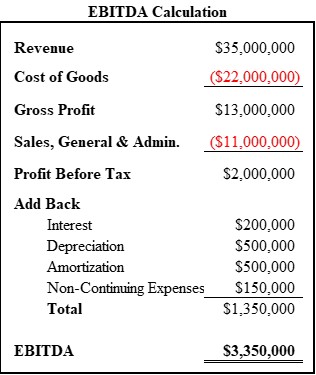

In profit multiplier, the value of the business is calculated by multiplying its profit. What does “add back” mean? An “add back” is an expense that you add back to a profits measure in order to get a more nuanced understanding of a company’s profits and cash flows. Depreciation can be seen from the Cash flow statement as is $2million, while amortization is $8million. The specific figure used and type of ratio vary depending on many factors, such as industry and size of the company, market conditions and multiples.

Business value to total assets and owners’ equity. Since the business valuation multiples are derived from similar employment agency sales, your business value estimates can be calculated as a range, from low to high, or a single value such as the median or average. Needless to say, these numbers are extremely generic, and plenty of industries have a multiple above or below that average. Start with the net income number, found on the Income Statement, and add to it interest expenses, taxes (federal and state income taxes only), depreciation, and amortization.

Earnings less than $0000 use SDE for company valuation. This simplified process will give you an overview of what your company is worth, but should not be considered a replacement for a detaile professional valuation. The present value of your business takes into account current and future cash flows to figure out what your business is worth now as well as later on.

This determines whether or not your company is a going concern—a business with stable future earnings, that can keep operating indefinitely without being liquidated.