Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! Financial Information A. Annual and quarterly financial information for the past three years 1. Income statements, balance sheets, cash flows, and footnotes 2. Planned versus actual 3. Management financial reports 4. Breakdown of sales and gross profits by: a. The three categories are: PHYSICAL, FINANCIAL, and LEGAL. A checklist for each category has been developed.

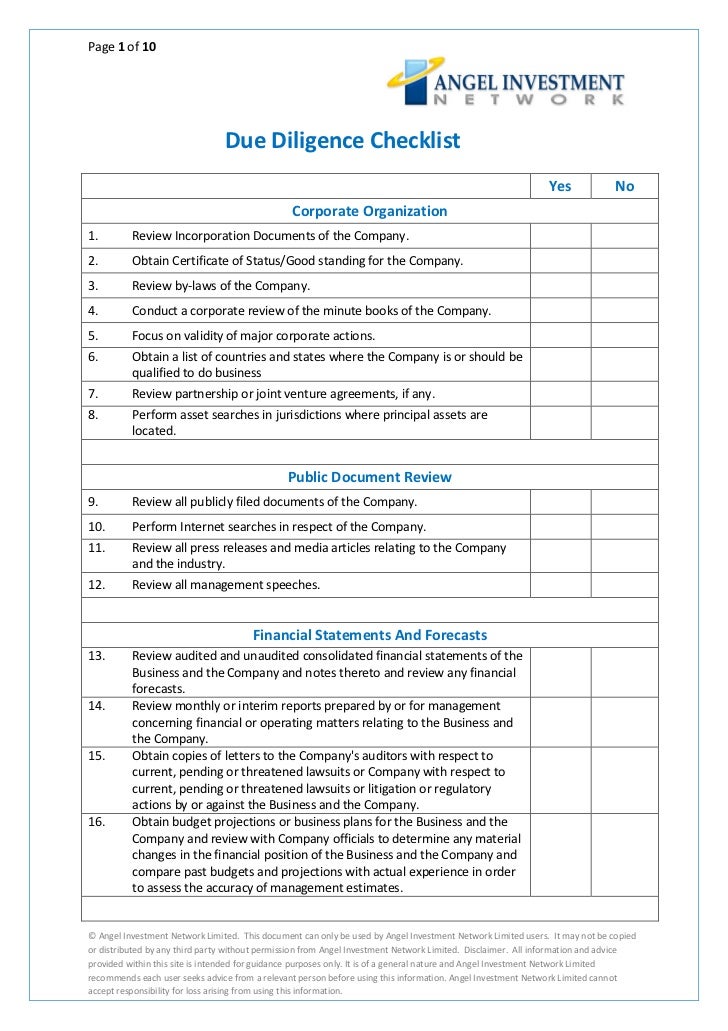

A due diligence checklist helps ensure that the final decision is based on a thorough investigation of all aspects of the business. Project Documentation (a) Have the following documents been provided? What should I review in due diligence? What do I need to know about due diligence? When is due diligence complete?

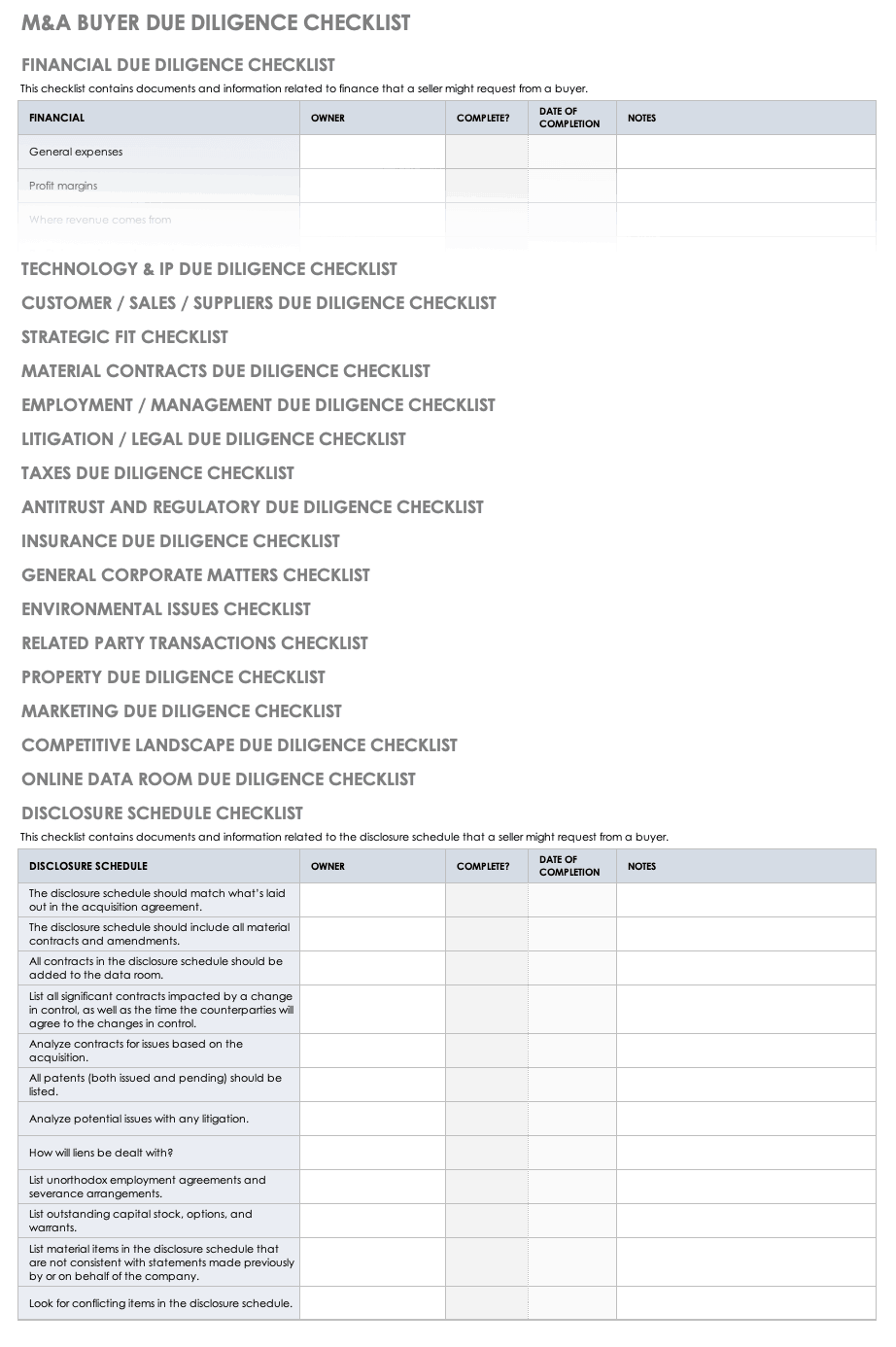

Additional issues may be appropriate under the circumstances of a particular deal. Due diligence is a process during which a potential buyer of a company investigates that company to gain information to allow it to decide whether to go through with the acquisition. Information concerning finances must also be added to the buyer due diligence checklist. Due Diligence is the act of gathering and evaluating information about a target business.

This aspect of due diligence gives potential buyers a clear vision of a company’s market value. Zoning Reports for your commercial real estate due diligence needs. DUE DILIGENCE CHECKLIST Thank you for your interest in learning more about the Promanas vetting process for new deals. Splitting it up into three categories will make it a lot easier to follow and keep track of. Throughout our years of syndicating millions of dollars’ worth of deals we’ve learned that kicking “bad” deals to the curb is even MORE important than picking “good” deals to invest in.

Other due diligence checklists take a more extensive approach, yet turn out not to cover all you need at the end of the day. Rather than focusing on either a narrow or broad scope, our due diligence checklist includes questions aligned to situational risks to help you determine the level of third-party due diligence investigation required to. Contact insurance to arrange for coverage 18. Current market reports and vacancy data B. PROPERTY OPERATIONS 1. Professionals on the due diligence team. You don’t want to leave any stone uncovere and you want the most time available to review all documents and look for any and all possible red flags with the property, title, tenant relationships, and numerous other considerations.

Title Commitment (a) Exception documents (b) Amount of insurance (c) Endorsement list 8. Due diligence makes all the difference between landing great deals and being burdened with duds. Use this checklist to cover your bases. While these are the most common items to focus on during due diligence , depending upon the particular deal, you will want to look into other elements outside of what is listed here.

Some questions may need to be added for an industry-specific acquisition, while far fewer will be needed for an asset acquisition. Basic Corporate Documents: a. This due diligence checklist is an in-depth look at the extensive documentation, research, and planning that is necessary to prepare a business for sale. Both buyers and sellers are encouraged to follow this template. Fill, sign and download Landlord Inspection Checklist Template online on Handypdf.

First and foremost on the due diligence checklist , you need to review the title, which should be, unless you are buying a distressed property, clear of any liens or other claims against it. The title is the transferable legal right to the property, which you must ensure the seller actually has. An IP due diligence checklist also helps investigators to not miss information.