Preserve Your Working Capital In This Financial Climate. Book An Appointment Or Call Us Today. Need investors for your start up funding? Free Trial Available.

What are the requirements for a business loan?

What do you need for a small business loan? How to apply for a small business loan? Does your small business qualify?

The following documents are required: 1. Bank statements covering the last 3-months. Last years’ tax returns and financial statements. Appropriate trade and business licenses as also other certificates required for conducting business.

Business history and overview, including vision and mission statements, challenges, goals and intended deployment of borrowed funds. Franchise agreements, if any. Ownership structure and affiliations, if any. See full list on smallbusinessloans.

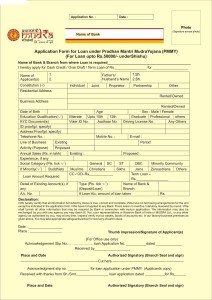

The business loan application (Form 4). Application of lender for participation or guaranty (Form 4i): To be filled in by lender or lending institution. Personal history statement (Form 912). Full details of one-year projection of finances and income, with a written explanation on how the applicant expects to achieve the disclosed numbers.

Certificate of Business. If it’s a corporation, the corporate seal is required on the SBA Form Section 12. The Application Form:Most prominent lenders are tech savvy now and encourage online applications for small loans. It saves them unnecessary paperwork and time. However, a good many still go by the conventional route and make it compulsory for a prospective borrower to personally visit their offices or branches and fill out proper paper application forms to get their required funding.

However, applying to multiple institutions may be detrimental because prospective lender will go through your business’s credit history with a fine comb. Thus, your creditworthiness becomes questionable.

Business Plan:For small business owners seeking loans, submitting a business plan is a must because this document will provide a detailed explanation of what the business is all about and where its owner desires to take it. The aforesaid business plan should manda. Be ready with following documents while applying for this loan. Original for verification and self-attested copies for submission) Mandatory Documents.

Most banks require an in depth business plan and some sort of collateral and documented positive credit history before. Getting a business loan is NOT easy – especially with the tough economic climate. Banks look at other factors not just your credit score when applying for a. All loan programs require a sound business plan to be submitted with the loan application.

Your lender will obtain your personal credit report as part of the application process. The Business Growth Loan Documentation process from HDFC Bank varies from individual to individual. The requirements are based on your profession, income and loan requirement. To support a small business owner’s application and demonstrate ability to repay the a loan, the following statements must be prepared: F Year End Profit and Loss (PL) Statement for the last three years.

F Year End Balance Sheetfor the last three years, including a detailed debt schedule. Requirements may differ from bank to bank and even the loan features will vary. More Information: Business Loan Interest Rate of Popular Banks Check your Business Loan Eligibility Business Loan EMI Calculator Step by Step Guide to Start a. Get A Decision As Soon As Today! Find Loan For Business.

Here, it is crucial to understand that this requirement varies slightly from one lender to another. Lenders need to review specific documents to assess risk and before approving any organization for a loan. Gathering the following documents ahead of time will prepare you for the loan application process and save time in the long run. Depending on a loan ’s specific requirements , your lender may require you to submit one or more legal documents.

Make sure you have the following items in order, if applicable: Business licenses and registrations required for you to conduct business. Articles of Incorporation. New Account and Loan Document Checklist- Business (Customer Use) When opening a business account or applying for a business loan , certain documentation and information is required.

Copies of contracts you have with any third. Documents Required for Business Loan We provide finance to Sole Proprietorship Firms, Partnership Firms and Private Limited Companies engaged in business of Manufacturing, Trading and Services. The documents required for these government schemes may vary from one scheme to another. No-paperwork lenders typically require you to submit an online application and possibly scan a few key documents.

You might also need to give them access to certain business accounts for verification. Because the loan amounts for a PPP loan and the requirements around using the funds to primarily support payroll, for many small. Instant Download and Complete your Loan Agreements Forms, Start Now!

All Major Categories Covered. Transparent terms, no hidden fees, no surprises. Credit Line Up To $300K. Min Months in Business.