Payments, Get Quotes – Start Today! Compare Rates and Get Your Quote. Find Your Best Mortgage Option Now. How to get pre-approved for a mortgage home loan?

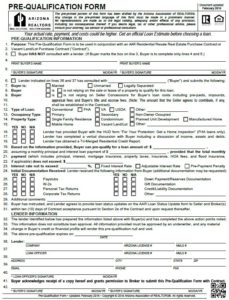

With a pre-qualification , you’ll fill out a basic online form and provide income , debt , and credit information. In most cases, you’ll conveniently upload them online.

As mentione very few loans these days require you to take mortgage pre-approval documents to a physical office space. More Veterans Than Ever are Buying with $Down. Friendly Customer Service! Apply For An Installment Loan Now! Here are the Most Common Documents You Need For a Mortgage Pre Approval : Social security number for anyone who is on the mortgage loan.

The lender needs this to verify your identity, and also to pull your credit. The loan officer requires you to complete a mortgage application that discloses. Present the Pay Stubs.

If you are employe the lender requires recent pay stubs and sometimes W-2s for the most recent.

These will determine if you are approved and how much you are approved for. Since so much depends on income verification, several types will be required. Pre -approvals can usually be made off of verbal information and credit pulls. Like with any borrower, the lender wants to verify you reasonably expect to receive income.

Depending on your unique situation, there are several documents you might need when you apply for a home loan, including your tax returns, pay stubs, bank statements and credit history. What information do I need ? Editorial Note: Credit Karma receives compensation from third-party advertisers, but that doesn’t affect our editors’ opinions. Income and employment. The documents required to verify income depend on how you get paid.

This step is easiest for. A prequalification or preapproval letter is a document from a lender stating that the lender is tentatively willing to lend to you, up to a certain loan amount. Most lenders will allow you to get an extension, but you may need to resubmit some documents.

Most lenders offer mortgage preapproval for free, in the hope of earning your business. For mortgage preapproval, you’ll need to supply more information so the application is likely to take more time. You should receive your preapproval letter within business days after you’ve provided all requested information.

Investment account statements. Your W-2s from the last two years. Pay stubs that show your year-to-date income.

Child Support Documentation. Bankruptcy Discharge. It’s important to know what documents are required for a mortgage pre – approval. Social Security card or number.

Driver’s license or U. Recent pay stubs covering the last days. W-forms from the last two years. Don’t Borrow Money From A Payday Lender. Proof of any additional income.