A loan agreement is an agreement between two parties whereby one party (the lender) agrees to provide a loan to the other party (the borrower). This agreement includes documents regarding borrowing money from a private company which can have serious pitfalls if not done correctly. Directors and shareholders often borrow money from their companies. Care must be taken so that the Australian Taxation Office does not deem these loans to be dividends.

He then has to pay back the loan in years (not 7). Division 7A Loan Agreement Template. Create A Loan Agreement In Your Browser. Comprehensive, Print 1 Free!

Hundreds Of Fillable Forms At Your Fingertips. Secure Cloud Storage. Fill Out Your Form In Minutes With Our Template Builder. Sample Loan Agreements – Start Now.

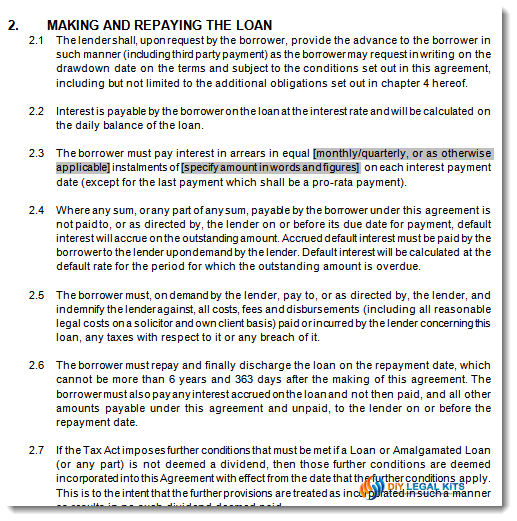

Download To Word And PDF Instantly. ORDERING A DIVISION 7A LOAN AGREEMENT. It also enables a number of loans over time to be governed by the one loan agreement. It covers certain loans that are made by a private company to people within the company, as well as people who seek loans through a company.

Combo Packages Best value. A Drawdown Loan Agreement happens when the loan is taken up by the borrower. Commercial’ loan agreements have acceleration clauses. If you don’t have an Acceleration clause then it is not a ‘commercial’ loan and can fall foul of the ATO. An acceleration clauses is a particular term in a loan agreement, usually associated with mortgages.

Note: You cannot use the calculator if the private company uses a substituted accounting period. Whole Agreement between the parties. Customer comments for this document: Thanks – was just what I. Business Loan Agreement Template Free – Besttemplates Source: bestcoolgame123.

Write A Loan Agreement With Our Easy Online Questionnaire. Get Started On Any Device. For Business Or Personal Use. Where a loan agreement is in place between the company and affiliated entity, deemed dividend provisions will not apply. Div 7A Loan Agreement.

It is an anti-avoidance provision which aims to prevent tax free distributions of company profits as loans which either remain outstanding or are forgiven altogether. Developed by our in-house legal experts, our loan agreement caters for a large range of lender and borrower types, loan conditions, further advances and security options. There are ways around it. A loan from a private company to a shareholder or associate is treated as a dividend , unless repaid in time or subject to an exclusion. Section 109C deals with payments section 109F is concerned with debt forgiveness.

Payments include transfers of property for less than the amount that would have been paid in an arm’s length dealing. Amounts lent by the company to a shareholder or shareholder’s associate. It’s pretty straightforward to repay the amounts by the lodgement time of the company’s tax return—but how do you implement a loan agreement ? High quality, low cost tax, legal and super documentation that is simply, Light-Years ahead.

You would then apply the distributable surplus. Servicing Assumption Agreements. Submit documents electronically to an SBA.

On the other han a secured loan is a loan that has collateral attached to it. With a secured loan , if the borrower defaults the lender can collect the collateral as a form of repayment.