There is nothing worse than realizing that your estate may be placed into the hands of your irresponsible child’s creditors. The benefits of discretionary trusts in protecting assets for future generations, and potentially minimising inheritance tax (IHT), have long been recognised by families and their advisors. Some of the main advantages of a discretionary trust include: Protecting the assets of a family.

This can mean protection from the beneficiary’s poor money-management skills, extravagant spending habits, personal or professional judgment creditors, or divorcing spouse. What does a discretionary trust mean? What are fixed and discretionary trusts? What is non discretionary trustee?

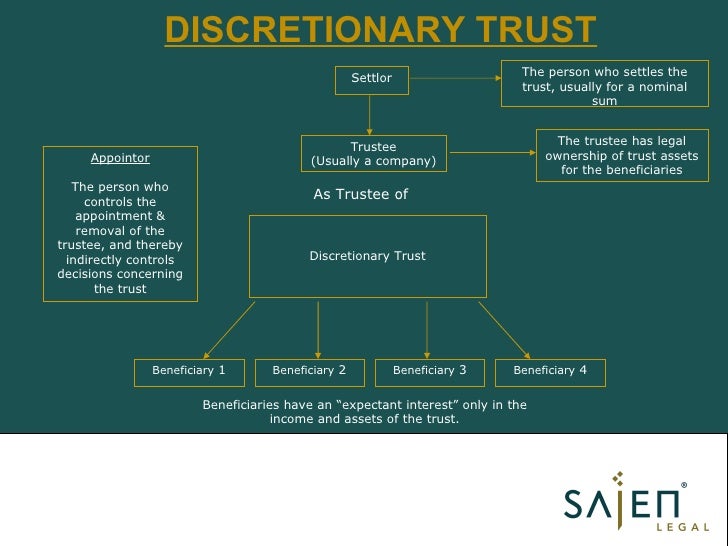

An arrangement whereby property is set aside with directions that it be used for the benefit of another, the beneficiary, and which provides that the trustee (one appointed or required by law to administer the property) has the right to accumulate, rather than pay out to the beneficiary, the annual income generated by the property or a portion of the property itself. An introduction to discretionary trusts A trust is a legal arrangement used to protect assets , such as land , buildings or money for the benefit of the “beneficiaries” to the trust. Such assets are known as “trust property”. When a trust is created “trustees” are appointed. Creditors that may come calling for one beneficiary can’t touch the trust’s assets if they don’t legally belong to the individual.

They have control over how much to distribute at any given time, when to make distributions and who to make them to. That gives a trustee the power to decide which beneficiary receives the funds and up to what amount. A key trait of a discretionary trust is that the beneficiary does not have any legal power to compel the trustee to release any trust assets to him or her. As well as being flexible, they have proved a popular method of estate planning because assets remain outside the beneficiaries’ estates for Inheritance Tax purposes, and are not included in any calculation for means-tested benefits. In many cases, however, these powers are open to interpretation.

The trust assets are controlled very differently. With a spendthrift trust, the trustee might be required to make disbursements in compliance with a trust document. Under a discretionary trust, however, the trustee has more control over who gets the funds. With this type of trust, the trustee makes the decisions as to who the beneficiaries will be and how much they will get.

A In this particular type of trust, however, the trustee is given full discretionary authority to decide when and what funds – such as principal or income – are given to which beneficiaries. With either trust, though, once the money is disburse it’s fair game. To prevent seizure of trust disbursements, the trustee of a discretionary trust can pay expenses, like tuition or a mortgage, bypassing the beneficiary completely.

A discretionary trust typically offers greater asset protection to its beneficiaries. The first £0is taxed at the standard rate. It means that: Your relative does not get their inheritance paid directly to them when you die, Your money and assets will pass to other people, called ‘trustees’, and. Capital gains above the trust’s annual exemption are charged at ( for residential property) 2. For example, the trust may set aside money for education, but the final decision is in the trustee’s discretion. The other party involved is called the trustee.

In spite of becoming the owner of the assets, the trustee must keep the assets on trust for the benefit of the. Many times, more than one. Where there is a discretionary discounted gift trust, the value to be used will be the surrender value of the bond at the ten year anniversary, minus the recalculated discount for inheritance tax based upon current age, plus any medical rating applied at outset. The surrender value of the trust fund at the tenth anniversary For a discretionary loan trust, this is the surrender value of the offshore bond at the ten year anniversary. However, there will only be a tax charge if the value minus any outstanding loan balance, exceeds the IHT NRB (currently £32000).

Trusted Will Writers. The following DTT charges apply to trust assets: An initial once-off charge. An annual charge on December in each year that the trust is in place. This can be useful for estate planning, and save assets from being depleted unnecessarily. Our solicitors are experienced at setting up and administering discretionary trusts.

Discretionary trusts give greater power to trustees to decide how and when to give funds to beneficiaries. Here we’ve answered some common questions about them. The value of any other CLTs made by the client in the seven years prior to the start date of the discretionary trust.

If the settlor died within years of making a ‘potentially exempt transfer’ (PET), this should also be included in the calculation.