What is example of notes payable? The difference between the greater face value and the lesser carrying value is considered the discount. It represents the added interest that must be paid over the life of the note.

The financial accounting term discounts on notes payable is used to describe a contra liability account that holds future interest charges that are included on the face value of a promissory note. This difference is gradually amortized over the remaining life of the note, so that the difference is eliminated as of the maturity date. The purpose of issuing a note payable is to obtain loan form a lender (i.e., banks or other financial institution) or buy something on credit.

The companies usually issue notes payable when they: 1. See full list on accountingformanagement. In this note, the Western Products Inc. Southern Company an amount of fifty thousand dollars plus interest after six month of the date of preparation of the note. Smith who is the treasurer of the company.

The note has been signed by A. The National Company prepares its financial statements on December 3 each year. Required:For National Company, prepare: 1.

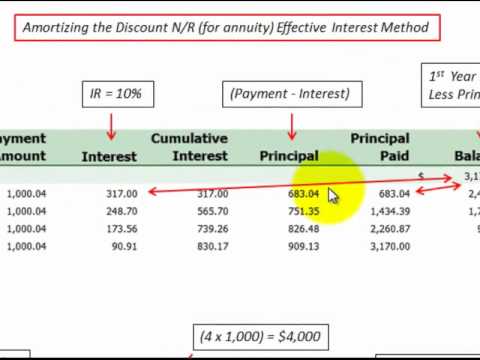

Therefore, it should be charged to expense over the life of the note rather than at the time of ob. A contra liability account arising when the proceeds of a note payable is less than the face amount of the note. The debit balance in this account will be amortized to interest expense over the life of the note. Each month a portion of the discount on the note payable is charged as an interest expense.

Discount notes are similar to zero-coupon bonds and Treasury bills (T-Bills) and are typically issued by. The $ 0discount would be offset against the $10note payable, resulting in a $0net liability. Discount amortization transfers the discount to interest expense over the life of the loan. Obtain the amount paid for the promissory note.

For instance, if you gave the issuer $ 8, this is the amount you paid for the promissory note. Determine the redemption value of the note. Notes Payable Issued at a Discount General Journal Entry.

A discount on notes payable arises when the amount paid for a note by investors is less than its face value. To get this transaction on the books, debit cash for $50and discount on notes payable for $250. Over the term of the note, the discount balance is charged to (amortized) interest expense such that at maturity of the note, the balance in the discount account is zero.

The discount on a zero-interest note payable shows the cost to the debtor of borrowing the money. Discounting Notes Receivable Just as accounts receivable can be factore notes can be converted into cash by selling them to a financial institution at a discount. Notes are usually sold (discounted) with recourse, which means the company discounting the note agrees to pay the financial institution if the maker dishonors the note.

Alternatively put, a note payable is a loan between two parties.

See required elements of a note and examples. When a taxpayer purchases a note at a discount , the gain to the purchaser on repayment of the note in full is interest income because the transaction does not involve a sale or exchange. The rules regarding dispositions of market discount bonds are outlined in Sec.

The amount used as a reduction on a note is considered to offset as a debit and a credit entry. One account receives less whereas the other account receives more. This is done by giving a discount on notes receivable to a bank or other lender prior to their maturity date. Subtract $14from the face value of the note receivable to get the discount of $5($20– $1403). A $5invoice would be discounted to $490.

Firstly, the company puts notes payable as a short-term liability. As we see from the above example, CBRE has a current portion of notes of 133. Interest expense for Year is.