It is first due the calendar year after your LLC is formed. This $3fee is standard protocol for every LLC, regardless of its age, gross sales, activity or periods of inactivity. If payment is by credit card click submit only once, clicking multiple times may result in duplication of charges to your credit card. Electronic Payment (ACH Debit)Required for all transactions over $000. Checking AccountCredit Card 1. See full list on corp.

Failure to file the report and pay the required franchise taxes will result in a penalty of $200. Exempt Domestic Corporations. The annual taxes for the prior year are due on or before June 1st.

Failure to pay the required annual taxes will result in a penalty of $200. The Division of Corporations recommends that consumers be alert to deceptive solicitations. Examples of deceptive solicitationsThe Secretary of State’s Office works closely with law enforcement to investigate deceptive solicitations. Annual taxes are assesse.

However, if you want your certificate of formation processed within hours, you must pay an additional $fee. Same-day service is available for $100. The cost of annual LLC fees by state varies greatly from one state to another depending on specific state requirements.

Learn more about annual fees here. This fee ranges between $and $50 depending on your state. Incorporation filing fees : $78. What is a single-member Limited Liability Company ( LLC )? A single-member LLC can be either a corporation or a single-member “disregarded entity.

The basic package fees: $filing fee (the minimum required fee) plus registered agent and $processing fees charged by the formation service. The current tax fee is $3per year. This cost is calculated using a minimum tax of $1plus the minimum filing fee of $50.

Filing costs for forming an LLC or corporation can vary from state to state. Use this filing fees tool to easily research and compare state fees before you start your business. The Franchise Tax for a corporation is a little more complicated. It is based on your corporation type and the number of authorized shares your company has.

Delaware LLC annual fees are due June every year. You can file online on the DE Division of Corporations website. Fees for such service typically start at about $1per year. By comparison, the state’s personal income tax rate varies zero for nominal personal income to a highest rate of 6. Taxes for these entities are due on or before June 1st of each year.

Penalty for non-payment or late payment is $200. A limited liability company may have more than manager. Unless otherwise provided in a limited liability company agreement, each member and manager has the authority to bind the limited liability company. FILING FEE on or before March 1st each year. Penalties start immediately after the due date.

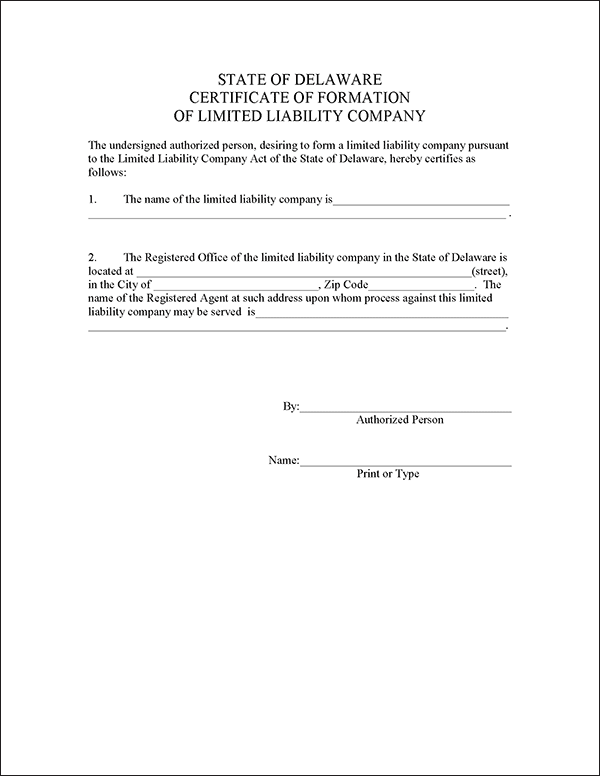

The total cost of the Franchise Tax is comprised of an annual report fee and the actual tax due. This type of company does not pay the annual tax but must file and pay the annual report fee. All one must do is file a Certificate of Formation with the State and include the $filing fee. Please note that no annual report is required to be filed and the annual fee can be paid online.

If the annual LLC tax is not submitted by June 1st, there is a $2penalty and interest of 1. The tax starts at $7 plus a $filing fee, and can be as high as $18000. The franchise tax for corporations is calculated based on the type of corporation , the. Print Business Tax Forms.