Can a deceased person transfer property to a trustee? What is the estate trustee? How to decease an estate? Who can provide information to the executor of an estate? See full list on sro.

Our Evidentiary Requirements Manualexplains what documents you need to lodge. Life estates and estates in remainder are dutiable property under the Duties Act. A life estate is one type of freehold estate. It arises by grant or operation of law for the benefit of a person for the rest of his or her life.

Our rulingprovides more information on how to distinguish between a right to reside and a life estate for the purposes of sof the Duties Act. A testamentary trust is a trust which is specified in the will of the deceased and arises upon their death. Where the creation or transfer of. The deceased intends that a trustee(s) holds the property in accordance with the terms of the testamentary trust for specified beneficiaries. At some future time, the trustee will distribute the property to those beneficiaries.

From the deceased estate, that is from the executor of the will to the trustee of the testamentary trust (the first transfer), and 2. From the trust at a future date, that is from the trustee of the testamentary trust to the beneficiaries of that trust (the second transfer). As such, it will be exempt fr. Use the Deceased Estate vessel transfer of registration form to transfer registration of each vessel registered to the deceased person.

To transfer car ownership to a beneficiary, you need to give copies of the death certificate, the will and proof of the executor’s identity to VicRoads. You will also need to fill out a Transfer of registration from a deceased estate form. Real estate is generally the most considerable asset to be transferred from a deceased estate.

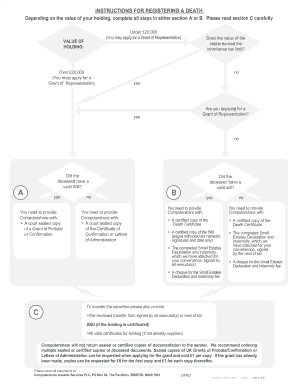

A grant of probate or letters of administration is required to transfer property owned outright by the deceased or a share in real estate held in his or her sole name. A person may die testate (with a valid will) or intestate (without a valid will). In either case, before an estate can be administered the personal representative for the estate will generally have to apply to the Supreme Court of Victoriaor other relevant authority for a grant of representation.

Once a grant of representation has been provide the estate moves into an administration period. During this time, the personal representative is the legal owner of all the land and property of the estate. It is their role to settle the liabilities of the deceased and collect the assets of the deceased so they can be distributed in accordance wit.

While the deceased estate is being administere land is held by the personal representative on trust for the benefit of the beneficiaries of the will or trustee of the testamentary trust. Generally, this regime imposes a surcharge rate of land tax, higher than the general rate of land tax, on trustees that hold taxable land unless certain notifications or nominations are lodged within prescribed timeframes. The Act, however, provides that land tax is not assessed at the surcharge rate for a specific period of time (the concessionary period) to allow the personal representative to complete administration of the deceased estate.

If administration of the deceased estate is not completed within the concessionar. For land tax purposes, the relationship existing between the personal representative and beneficiaries of the will during the concessionary period is known as an administration trust. The personal representative of the deceased estate is trustee of an administration trust. If the administration trust provisions apply, land tax will be assessed at the general rate for land tax during the concessionary period.

The concessionary period generally starts when the grant of representation is made (that is, when the assets of a deceased person are held by the personal representative) and ends at the earlier of the: 1. Third anniversary of the date of death of the deceased or further period approved by the Com. If the deceased owned and occupied land as a PPR at the time of their death, the PPR exemption applying to that land continues from the date of the person’s death until the end of a period known as the PPR concessionary period. This is the earlier of the: 1. Day on which the deceased’s interest in the land vests in the trustee of the testamentary trust or the beneficiary of the will.

In exceptional circumstances, we can extend the PPR concessionary period so that the PPR exemption continues beyond the third anniversary of the deceased’s death. If you believe such an extension should be grante you can write to us, stating your reasons and providing relevant supporting evidence. Note: The PPR concessionary period is not applicable if the property is rented out. The third anniversary of the testator’s death or further period approved by the Commissioner, or 2. If at the testator’s death, all the potential beneficiaries are minors, the 18thbirthday of the first beneficiary to turn 18. During that perio a trustee of an excluded trust will be assessed at the general land tax rates and will not be subject to the surcharge rate on the trust land.

Also, beneficiaries of excluded trusts will not pay land tax on land held on trust for them. Once the personal representative completes administration of the estate and distributes the relevant lan the new legal owner of the land is liable for any land tax. If the personal representative completes administration but retains legal ownership of the lan they no longer own the land in the capacity of personal representative. Accordingly, if the land is: 1. In this instance, the personal representative becomes the legal owner and will be liable to pay land tax if the land is subject to land tax.

If the land is still held by the personal representative in a trustee capacity after administration of the estate is complete the land tax trust regime rules apply and land tax may be payable at the surcharge rates. Under the land tax trust regime, a personal representative must notify us at the commencement and completion of administration of a deceased estate. Probate is a document given by a Supreme Court (usually it would be the Supreme Court of Victoria where there is property in Victoria) that confirms the validity of the will and the appointment of the executor to look after the estate of the deceased will maker. If you have inherited shares or are managing shares for a deceased estate , Deceased Estate Assistant guides you through the process of transfer , sale or finalising the estate.

The cost base may be the value of the dwelling when the deceased acquired it or the value when they die depending on the circumstances above. An instrument where the rights or interest of any person under a Will or Intestacy, where the estate of the deceased person includes lan are surrendere disclaime transferre assigned or agreed to be surrendere disclaime transferred or assigne will be chargeable as a transfer of land in respect of that right or interest. Unless the title has been transferred from the deceased to the joint tenant, executor, or personal representative, the property can’t be sold – or transferred to the purchased.

Selling a loved one’s deceased estate can be stressful. Properties which the deceased owned as a joint tenant with others do not form part of the estate and cannot be disposed of by Will. Ownership of this property passes to the surviving joint tenant (s), if more than one in equal shares. It is sensible to remove the deceased’s name from the title.

Mr Bezbradica said in Victoria there were limited circumstances where stamp duty exemptions applie such as “between de facto or married couples for their family home, as part of divorce, a court order, or in circumstances around a deceased estates’. In the Australian Capital Territory, stamp duty is called “conveyance duty”. First, find the deed that transferred the property to the deceased owner. The dee which may be titled a quitclaim, grant, joint tenancy, or warranty dee should state how the deceased person, and any co-owners, held title to the property. That will determine how the property can be transferred.

File a petition in probate court. The first step to transferring the property to the rightful new owners is to open up a case in probate court. When a person dies, generally the person responsible for administering the deceased estate is the legal personal representative. There are no inheritance or estate taxes in Australia.

Documents you need to send.