Do I have to pay estate taxes? What is deceased taxpayer? Is Joan estate taxable income? Is there an estate tax?

If the deceased estate taxable income exceeds $67 the entire amount from $will be taxed at the rate of.

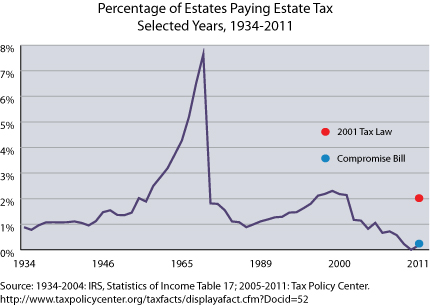

Estate tax is a tax on the transfer of property after death. For instance, the chart above would suggest that a $ 10estate would have tentative tax of $ 800. Above those thresholds, tax is usually assessed on a sliding basis.

Rates typically begin in. The Estate Tax is a tax on your right to transfer property at your death. It consists of an accounting of everything you own or have certain interests in at the date of death (Refer to Form 7(PDF)). The fair market value of these items is use not necessarily what you paid for them or what their values were when you acquired them.

Deceased Taxpayers – Probate, Filing Estate and Individual Returns, Paying Taxes Due Information to help you resolve the final tax issues of a deceased taxpayer and their estate.

Doing trust tax returns for a deceased estate. The inheritance tax exemption amount for people in this category is $1000. For amounts above that, the tax rate is.

Include all persons not included in Class A or Class B. Class C beneficiaries receive a $5exemption and the tax rate is percent to percent. There shall be an imposed rate of six percent () based on the value of such NET ESTATE determined as of the time of death of decedent composed of all properties, real or personal, tangible or intangible less allowable deductions. Property owned jointly between spouses is exempt from inheritance tax. A trust tax return of a deceased estate is a separate tax return from the date of death return of the deceased person. High call volumes may result in long wait times.

Before calling us, visit COVID-, Tax time essentials , or find to our Top call centre questions. They are taxed at the applicable capital gains tax rates. No states tax bequests to surviving spouses. Top tax rates range from 4. Pennsylvania on lineal heirs) to percent (Nebraska on collateral heirs).

See where your state shows up on the board. Executor must file a federal estate tax return within months and pay percent of any assets over that threshold.

For example: If an estate is worth $million, $3. Inheritance tax is due if any of these people inherits more than $4000. The tax rate is one percent of the clear market value of the property over the exempt amount.

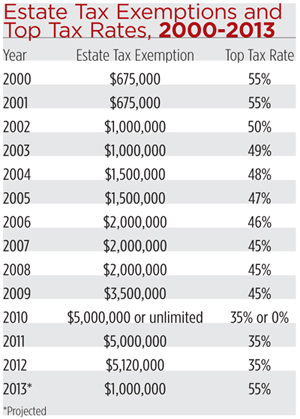

Income Tax Return for Estates and Trusts for any year either of these applies: The estate had $6or more gross income (without subtracting expenses). You may have read that the federal estate tax rate is. That rate is the top tax rate, and it only applies to families leaving behind more than $million—after accounting for the lifetime gift tax exclusion. For estates that exceed this amount, the top tax rate is. A full chart of federal estate tax rates is below.

Preparing and Filing Tax Returns. Any taxes due are also paid from estate funds. Massachusetts estate tax returns are required if the gross estate , plus adjusted taxable gifts, computed using the Internal Revenue Code in effect.