Unlock Financial Peace: The Ultimate Guide to Choosing Your Perfect Credit Card Keeper

In today’s fast-paced world, managing multiple credit cards has become the norm for many. Whether you’re a savvy rewards optimizer, a frequent traveler, or simply looking for convenient payment options, keeping track of your various cards can quickly become overwhelming. This comprehensive guide delves deep into the realm of the credit card keeper, exploring the diverse solutions available to help you streamline your finances, protect your valuable assets, and ultimately achieve greater financial peace of mind. We’ll navigate the landscape of physical organizers, digital management tools, and best practices, empowering you to make informed decisions and find the perfect system that aligns with your unique needs and lifestyle.

The Growing Need for an Effective Credit Card Keeper

The proliferation of credit cards, each offering unique benefits and rewards programs, has created both opportunities and challenges. While these cards can unlock significant value, they also introduce the complexity of tracking balances, due dates, and specific perks. Without a robust system in place – a reliable credit card keeper – individuals risk missed payments, forgotten rewards, and even the potential for loss or theft. Recognizing this need is the first step towards regaining control over your financial portfolio.

Organization is Key: A dedicated credit card keeper helps you maintain a clear overview of all your cards, preventing the chaos of misplaced or forgotten plastics.

Security Matters: Protecting your credit cards from physical theft and digital skimming is paramount. The right credit card keeper can offer enhanced security features.

Efficiency and Convenience: Accessing the right card at the right time becomes effortless with a well-organized system, saving you time and frustration at the point of sale.

Optimizing Rewards: Knowing which card to use for specific purchases to maximize rewards becomes simpler when your cards are neatly organized and easily accessible.

Exploring the Spectrum of Credit Card Keeper Solutions

The term “credit card keeper” encompasses a wide array of solutions, each designed to address different needs and preferences. Let’s explore the primary categories:

Physical Credit Card Keeper Options: Tangible Solutions for Card Organization

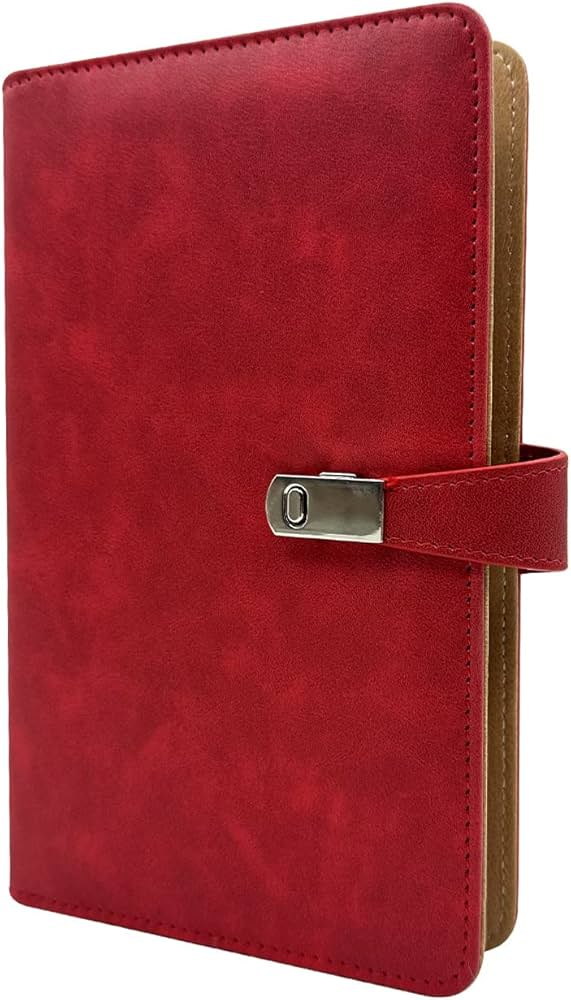

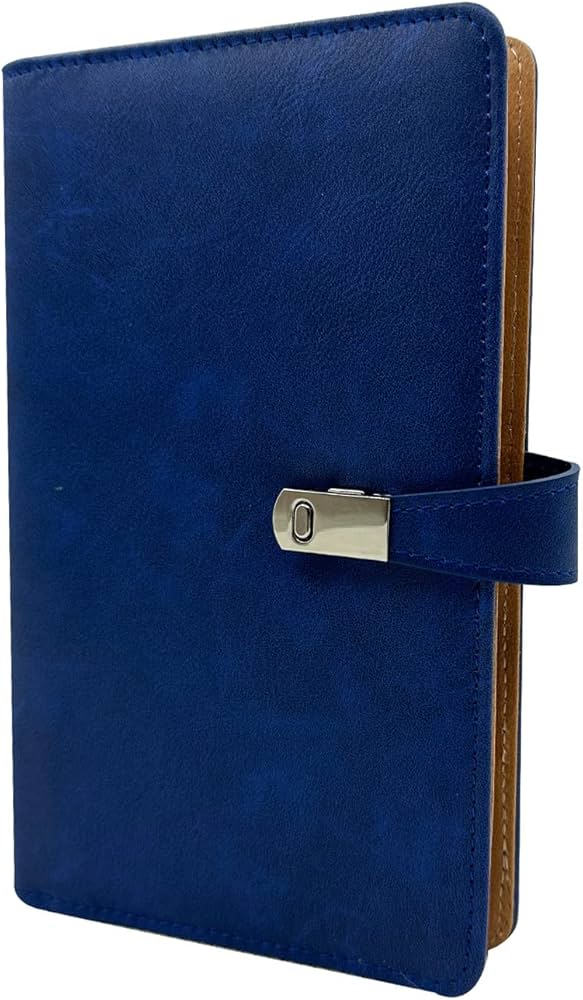

Traditional Wallets: While a standard wallet can certainly hold credit cards, those specifically designed as a credit card keeper often feature dedicated slots and compartments for better organization and security. Look for wallets with multiple card slots, secure closures, and even RFID-blocking technology.

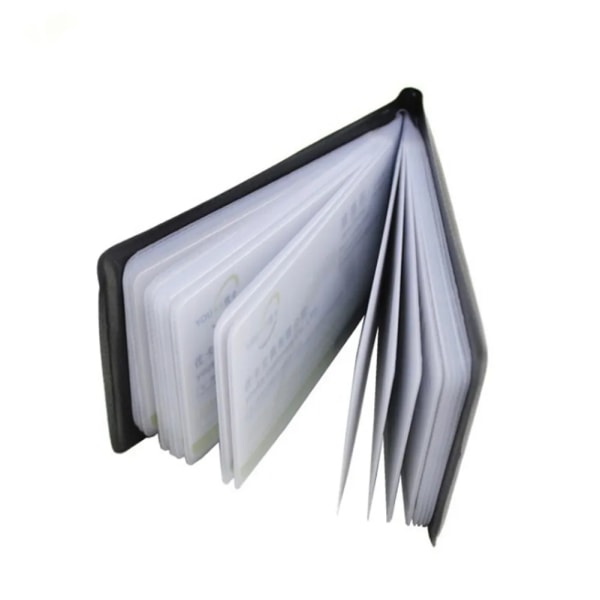

Card Holders and Cases: These slim and compact options are designed solely for holding cards, minimizing bulk and maximizing organization. Metal or hard-shell cases can offer added protection against bending and scratching.

RFID Blocking Wallets and Sleeves: In an age of increasing digital threats, RFID (Radio-Frequency Identification) blocking technology is crucial. These wallets and sleeves are designed to protect your contactless credit cards from unauthorized scanning, adding a significant layer of security to your credit card keeper strategy.

Travel Organizers: For frequent travelers, dedicated travel wallets or organizers offer compartments for credit cards, identification, boarding passes, and even cash, ensuring all your essentials are securely and conveniently stored in one place.

Digital Credit Card Keeper Solutions: Leveraging Technology for Management

Mobile Wallet Apps: Platforms like Apple Wallet, Google Pay, and Samsung Wallet allow you to digitize your credit cards, enabling contactless payments and often providing features like transaction history and balance tracking. While convenient for payments, they don’t physically “keep” your cards but rather store their information securely.

Personal Finance Management Apps: Many budgeting and personal finance apps offer features to track your credit card balances, spending, and payment due dates. Some even allow you to link your accounts for a holistic view of your financial situation. These act as a virtual credit card keeper, providing valuable insights.

Secure Note-Taking Apps: While not specifically designed for credit cards, encrypted note-taking apps can be used to securely store essential credit card information (card numbers, expiry dates, security codes) as a backup, although this requires careful security practices.

Key Considerations When Choosing Your Ideal Credit Card Keeper

Selecting the right credit card keeper depends on several factors unique to your individual needs and preferences. Consider the following:

Number of Cards: How many credit cards do you typically carry and need to manage? This will determine the capacity required of your chosen solution.

Security Needs: Are you concerned about physical theft or digital skimming? If so, prioritize options with robust security features like RFID blocking and secure closures.

Lifestyle and Usage: Do you travel frequently? Do you prefer the convenience of digital payments? Your lifestyle will influence the type of credit card keeper that best suits you.

Material and Durability: Consider the material and construction quality of physical wallets and card holders to ensure they can withstand daily wear and tear.

Size and Bulk: If you prefer a minimalist approach, opt for slim card holders or explore digital solutions to reduce bulk in your pockets or bags.

Features and Functionality: Do you need additional features like cash storage, ID windows, or the ability to track spending within the keeper itself (as with some digital apps)?

Budget: Credit card keeper solutions range from simple and affordable to high-end and feature-rich. Determine your budget before exploring options.

Best Practices for Effective Credit Card Keeper Management

Simply having a credit card keeper isn’t enough; effective management is crucial to maximize its benefits. Here are some best practices to follow:

Regularly Review Your Cards: Periodically assess which credit cards you actively use and whether they still align with your financial goals. Consider closing accounts you no longer need to simplify your management.

Keep Your Physical Keeper Secure: Treat your physical credit card keeper with care. Avoid leaving it unattended in public places and be mindful of your surroundings to prevent theft.

Update Digital Information: If you use digital wallets or finance apps, ensure your credit card information is always up-to-date, especially after receiving a new card or if any details change.

Be Mindful of Skimming Risks: Even with RFID-blocking technology, be cautious when using your contactless cards in public places. Be aware of potential skimming devices.

Maintain a Record of Your Cards: Keep a separate, secure record of your credit card numbers, expiry dates, and customer service contact information in case your physical credit card keeper is lost or stolen.

The Future of the Credit Card Keeper: Innovation and Integration

The landscape of the credit card keeper is constantly evolving. We can expect to see further integration of physical and digital solutions, with smart wallets that offer enhanced security features, track spending patterns, and even provide personalized financial insights. Biometric authentication and more seamless integration with other financial platforms are also likely to become increasingly common, further blurring the lines between the physical and digital management of our credit cards.

Conclusion: Empowering Your Financial Journey with the Right Credit Card Keeper

Choosing the right credit card keeper is an essential step towards achieving better financial organization, enhanced security, and greater peace of mind. Whether you opt for a sophisticated RFID-blocking wallet, the convenience of a mobile payment app, or a combination of both, the key is to find a system that aligns with your individual needs and habits. By carefully considering your options and implementing effective management practices, you can transform the often-daunting task of handling multiple credit cards into a streamlined and controlled aspect of your financial life. Embrace the power of a well-chosen credit card keeper and embark on a journey towards greater financial clarity and confidence.