What is the process to become a CPA? Age requirements to become a CPA. The only exception is if you are in a special program. Let us guide you towards landing an influential job in virtually any industry.

Who does the FBI recruit to investigate criminalfraud? What profession is often a stepping-stone to top-echelon positions like CFO and CEO? Who helps Hollywood moguls and actors manage their money?

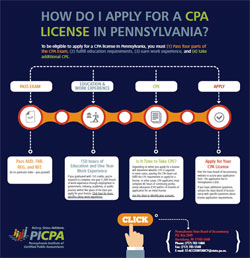

See full list on cpaexam. First, the big picture: each U. Many jurisdictions are similar in their requirements, but because the Certified Public Accountant licensure is regulated by individual state boards of accountancy, the requirements can and do differ between jurisdictions. All state boards of accountancy – with the exception of the U. Virgin Islands – require a minimum of 1hours of post-secondary education from a regionally accredited institution. Most bachelor degrees typically only give students 120-semester hours-meaning they have to obtain an extra semester hours to meet the requirement. Please feel free to fill out the form below with any question you might have.

We are happy to assist. CPA Examrequirements. It also protects the public interest by ensuring that only qualified individuals become licensed as CPAs.

While the specific steps are similar across the country, each individual state may have small differences. Mitula has a full range of Jobs listed. You might be thinking that just taking the exam is a huge process.

After you pass the exam , there are a few administrative things you must do before you can truly call yourself a Certified Public Accountant. Here is the basic process. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo. Accounting and Business classes must be completed with a grade of “C” or above.

View the most recent information here. District of Columbia, Puerto Rico, US Virgin. Typically, a minimum of a bachelor’s degree in Accounting is required and if your degree isn’t in accounting, most states require an additional credit hours or less to sit for the Exam. You must work under a licensed CPA. Each state has its own set of fees and educational requirements.

Every business needs a professional accountant to do its taxes, and individuals rely on accountants to help with small ventures, taxation, compliance and wealth management. The exam consists of four parts. All requirements are also explained in the VBOA Education Handbook. The board may permit a candidate to take the examination if the board is satisfied that the candidate will complete the educational requirements of this section within six months after the candidate’s application to take the examination. Board Approved Accounting Curriculum.

Those hours need to meet certain requirements for coursework. Discuss these requirements with your college or university advisor to make sure that you plan your courses accordingly. Age Candidates must be eighteen (18) years of age or older. Meet the experience requirements. Good Moral Character Each applicant must sign the Idaho Department of Law Enforcement Criminal History Records Check form and return it with their application.

Learn about how the CBA continues to serve the public during the COVID-pandemic. Read a statement from CBA President Nancy J.