Why use a corporate trustee? Who can be a corporate trustee? How is a corporate trustee different? An SMSF is a private superannuation fund regulated by the Australian Taxation Office (ATO).

It operates as it’s own tax structure under the ATO.

Similar to superannuation generally, SMSFs exist so that you will have money to live on when you retire. However, SMSFs are different to industry super funds. This is because you can choose where your super payments go.

These members can be a group of individuals or a company. To establish your SMSF, you need to appoint trustees to oversee your fund. The trustees you choose can be individuals or it can be a company.

See full list on lawpath.

A corporate trustee means that rather than a person being a trustee, a company is a trustee. Generally, your employees cannot also be members, except for if you’re related. Assets of the fund must be registered in the name of the company that is the trustee.

You may opt for this type of structure if: 1. Want to be the sole director and sole member of the fund 2. If you are seeking reduced liability 3. There are many advantages and disadvantages to a corporate trustee structure. Whatever decision you make can impact how your fund is managed and maintained. Overall, having an SMSF is a great way to control where your superannuation payments go. Some of the advantages of a corporate trustee structure include: Longevity: a corporate trustee does not end if a director dies. This makes succession and control of the trust easier.

Assets are less likely to be mixed , personal assets are held separately Reduced liability: the company is a. Every SMSF must appoint a trustee. That trustee can either be a company (known as a “corporate trustee”) or a group of individuals. That company will be the registered owner of all the assets of your SMSF and will hold and manage those assets on behalf of all members of your SMSF.

They can take on many different roles during the life of the trust, such as co-trustee, investment agent, and successor trustee. They typically take on these responsibilities for a percentage of the value of the assets that they manage. One option you should not overlook is the bedrock of asset management and personal service—the corporate trustee.

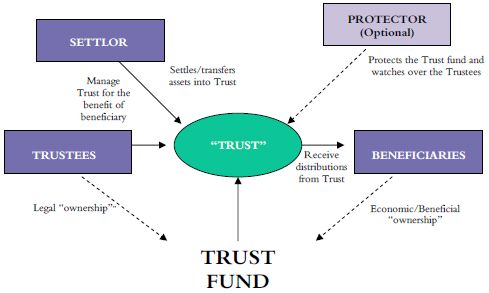

Its employees can help you buil manage and protect your wealth when you put your assets in a trust. What is a corporate trustee? In the most usual circumstances, the creation of a corporate trust allows the corporation to turn over management of financial resources to another corporation that is charged with specific tasks in handling the assets. Whilst trusts with individual trustees are certainly possible, the intergenerational nature of employing a company for this purpose means it is the popular entity for acting as a trustee.

In any event, a client considering using a PTC should ensure he or she has carefully assessed not only the costs of the options available but also the tax consequences. Why do I need a corporate trustee ? Another option is to have a corporate trustee serve as a co- trustee , working alongside the person chosen on the family side. With banks and other financial institutions that act as corporate trustees, you can ask them to explain their fees upfront so you know what you’ll pay before deciding to give them the trustee role.

The individuals employed by the Corporate Trustee must have advanced knowledge and experience. Naturally, their fees are higher than what a person, especially a family member, might charge. A trust is not a separate legal entity. The company is a registered company, much like any other company, but it is often incorporated with the sole purpose of acting as trustee.

This means that the company will not conduct business. Like any other company, the corporate trustee has shareholders and directors. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now!