Other articles from investopedia. The amount of short-term corporate IOUs fell to $996. Commercial paper is typically issued for the financing of payroll, accounts payable, inventories, and. B for the week ended Sept. Commercial Paper is defined as a money market instrument that is used for obtaining short-term funding and is usually in the form of a promissory note issued by investment-grade banks and corporations.

What does commercial paper mean?

The maturities in this paper do not last longer than 2days. The UCC identifies four basic kinds of commercial paper : promissory notes, drafts, checks, and certificates of deposit. The most fundamental type of commercial paper is a promissory note, a written pledge to pay money. A promissory note is a two-party paper.

The maker is the individual who promises to pay while the payee or holder is the person to whom payment is promised. The payee can be either a specifically named individual or merely the bearer of the instrument who has it in his or her physical possession when he or she seeks to be paid according to its terms. A note payable to bearer can be paid to the person who presents it for remuneration.

Such an instrument is said to be bearer paper. There is no obligation to pay a time note until.

See full list on legal-dictionary. There are basic requirements for the negotiability of commercial paper. The instrument must be in writing and signed by either its maker or its drawer.

In addition, it must be either an unconditional promise, as in the case of a promissory note, or an order to pay a specific amount of money, such as a draft. The requirement that the instrument must be in writing can be met in various ways. The paper can be printe type engrave or written in longhan either in ink, pencil, or both. Ordinarily, specimens of commercial paper can be obtained from banks or stationery stores.

Similarly, there are a number of ways to comply with the signature requirement. The signature may legally be either handwritten, type printe or stamped by a machine. Individuals who are unable to write their names can sign with a simple mark, such as an X. Also permissible are initials, a symbol, a business or Trade Name, or an as. An endorsement is the process of signing the back of a paper , thereby imparting the rights that the signer had in the paper to another person.

The number of times an instrument may be endorsed is unlimited. Four principal kinds of endorsements exist: special, blank, restrictive, and qualified. An endorsement that clearly indicates the individual to whom the instrument is payable is a special endorsement.

A paper containing a blank endorsement is one that has the signature of the payee but no specific endorsee is designated. Once endorse it becomes bearer paper and is negotiable by anyone who physically holds it. A qualified endorsement is one wherein liability is disc.

An individual who signs an instrument is either primarily or secondarily liable for payment. The maker of a promissory note is primarily liable, since that person is the individual who has originally promised to pay. He or she must meet this obligation when payment becomes due unless he or she has a valid defense or has been discharged of the debt. The drawer of a check or draft is secondarily liable, since that individual does not make an unconditional promise to pay the instrument. He or she expects the bank to pay and promises to pay the amount of the instrument only upon notification of dishonor, a refusal by the drawee to accept the paper when properly presented for payment.

The commercial paper must first be given to the person who is primarily liable for payment. In the event that the instrument clearly notes the date of payment, the instrument must be presented on the date indicated. If payment is unjustifiably refused by the individual who has primary liability, the secondary party must be given notice of the dishonor and the presentation of the instrument for payment must be made within a reasonable period of time. If the paper is a check, the drawer has primary liability for thirty days following the date on the check or the day it was given or sent to the payee, with the later date prevailing.

An endorser is secondarily liable for seven days following his or her endorsement. When presentation does not occur within. A holder is an individual who is in possession of an instrument that is either payable to him or her as the payee, endorsed to him or her, or payable to the bearer.

Those who obtain instruments after the payee are holders if such instrument is either payable to the bearer or endorsed properly to their order. The party in possession is not considered to be the holder in a case in which a necessary endorsement has been forged. According to law, a holder may either be an ordinary holder or a holder in due course, who has preemptive rights to payment. An ordinary holder becomes a holder in due course upon taking an instrument subject to the reasonable belief that it will be paid and that there are no legal reasons why payment will not occur. In more technical terms, to be a holder in due course, the party must take the paper for value, in Good Faith, and absent the notice that it is overdue, has been dishonore or is subject to an adverse claim.

Such notice of problems affecting the va. A holder of a negotiable instrument who has been refused payment when payment was due has a Cause of Action against the party or parties liable for payment. Ordinarily, when an individual is sued on a negotiable paper , he or she will try to defend his or her right to refuse payment. Certain defenses, known as real defenses, are valid against ordinary holders as well as holders in due course, whereas personal defenses are only valid against ordinary holders. Normally, any defense that can be asserted in an action concerning a contract may also be used in an action brought to enforce payment of a negotiable instrument.

The legal incapacity of the maker, drawer, or endorser, a signature effected by duress, illegality, or frau and alteration of the instrument qualify as real defenses. One of the most prevalent legal incapacity defenses asserted is infancy. The law affords protection to Infants by permitting them to evade their contractual obligations, even when, in some instances, the. The most common way to be discharged from liability on a commercial paper is through payment. The intentional Cancellation of an Instrument by the holder by either marking the instrument paid or by destroying it discharges all liability.

The holder may also discharge an individual from liability for payment through renunciation. This can be accomplished when a document is signed and delivered by the holder or when a paper is relinquished to the party who is being discharged. A stop-payment order put on a check by its drawer has the effect of discharging the bank from liability for refusing to honor the check when presented for payment.

It cannot, however, discharge the drawer from liability in cases where the drawer was contractually or otherwise obligated to pay the payee. Maturities range up to 2days but average about days. These days, commercial paper has low rates,” says Bob Williams, senior vice president of Delta Trust Investments in Little Rock, Ark.

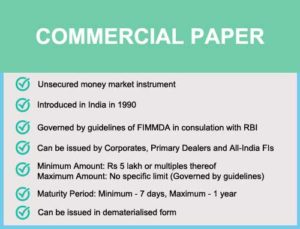

For example, UBS’ 30-day commercial paper paid 0. A commercial paper refers to a short-term, unsecured debt obligation that is issued by financial institutions and large corporations as an alternative to costlier methods of funding. They are issued by large corporations to meet short-term obligations. In terms of dollar volume, commercial paper occupies the second position in the money market after Treasury bills.

When you invest in commercial paper, you are paid a fixed interest rate plus the note’s principal balance upon its maturity. Rate bought, sol and traded like other negotiable instruments, commercial paper is a popular means of raising cash, and is offered generally at a discount instead of on interest bearing basis. Banks, corporations and foreign governments commonly use this type of funding. How Does Commercial Paper Work? Although Louisiana has not enacted all the articles of the UCC, it has adopted article 3. Shop for Commercial Paper Towels in Janitorial Disposables.

Fellowes Powershred 125Ci 1 Jam Proof 20-Sheet Cross-Cut Commercial Grade Paper Shredder,Black. Get it as soon as Fri. DYCacrlic Commercial Paper Towels Holder, Clear Acrylic Paper Towel Dispenser Holder fit for C-foltri-fold and Multi-fold Commercial Paper Towels 4.