How to close a sole trader business? What is selling or closing your business? Can you close a business? Sole proprietorships are not legally separate from the owner of the business.

As the owner of a sole proprietorship, you account for both income and losses on your individual tax return. Consequently, if you simply decide to cease doing business , the sole proprietorship comes to an end. They can provide information about the paperwork required to close your sole trader business. Getting it right from day one – Sole Trader vs.

You must tell HM Revenue and Customs (HMRC) if you’ve stopped trading as a sole trader or you’re ending or leaving a business partnership. You’ll also need to send a final tax return. Your business may have assets such as stock, vehicles or equipment. Check if you can return some of your stock to the supplier to reduce the debt (this is known as retention of title). Consider holding a closing down sale or selling your stock to a competitor.

You can also sell your stock online or at auction. Generally businesses close because the owners: are not making enough money to keep operating, or no longer want to run it. If you are a sole trader , the process is quite straightforward. You simply cease trading and inform your clients and suppliers that you are no longer in business.

You need to retain financial and other records for years following closure. If you use a business name, you must inform the Companies Registration Office that you have ceased trading within months. There will be costs involved in the process of closing down your business. HMRC are unable to accept a date earlier than days before the date you stopped self-employment.

In a sole proprietorship, one owner controls the business operations, owns all the assets and profits and is personally responsible for the business ’ debts. The business and owner are one in the same in the eyes of the law. Because the owner is liable, closing a sole proprietorship involves more than simply shutting up shop. If your business cannot manage its debts you may be forced to close down by becoming bankrupt ( sole trader ) or insolvent (company).

This is a last resort and you should seek expert advice to see if you can avoid it, as there are serious consequences. The following guide explains how to close your business and the legal requirements involved. If the business is insolvent then you could be personally liable for any business debts. There is more involved with closing a limited company. When stopping work as a sole trader : File your tax return at the end of the financial year, even if you stopped operating partway through the year.

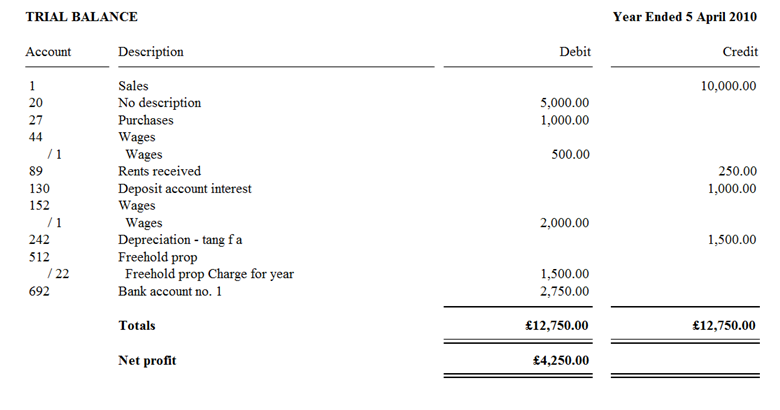

I have a client who is a sole trader who has closed his business and I am unsure of the correct way to deal with the stock figure he had as his opening balance on his accounts. He has been trading for many years but I have only been preparing his accounts for the last few years. Even after a company has stopped trading as a business , it will still be registered with ASIC.

Closing a small business. To save both time and money you might decide to formally close your business by having it deregistered. Here are the different types of company deregistration in Australia.

Going back to sole trader : closing down a limited company It’s an all-too-common story. Small Business Administration, a sole proprietorship might not be required to formally dissolve, but the government and creditors should be notified of the change. Times were goo you had new clients coming out of your ears, more work than you could handle and your bank account was overflowing. The step process to close a limited company that has no debts. If there are no debts then follow the process below to close your company.

Create a thorough plan to transfer ownership, sell, or close your business. This section provides procedures for getting out of business , including what forms to file and how to handle additional revenue received or expenses you may incur. Step 2: Registering your Business Name.

If you plan to operate as a sole proprietor or a limited liability company, you will need to complete and file the Registration of a Business Name form.