How to inform IRS of business closure? How do you close a company? Make final federal tax deposits.

Electronic Federal Tax Payment System (EFTPS) File final quarterly or annual employment tax form. There are many reasons why business owners decide to permanently close their doors. Perhaps the owners launched a company as friends and the relationship has soured over time. This section provides procedures for getting out of business , including what forms to file and how to handle additional revenue received or expenses you may incur.

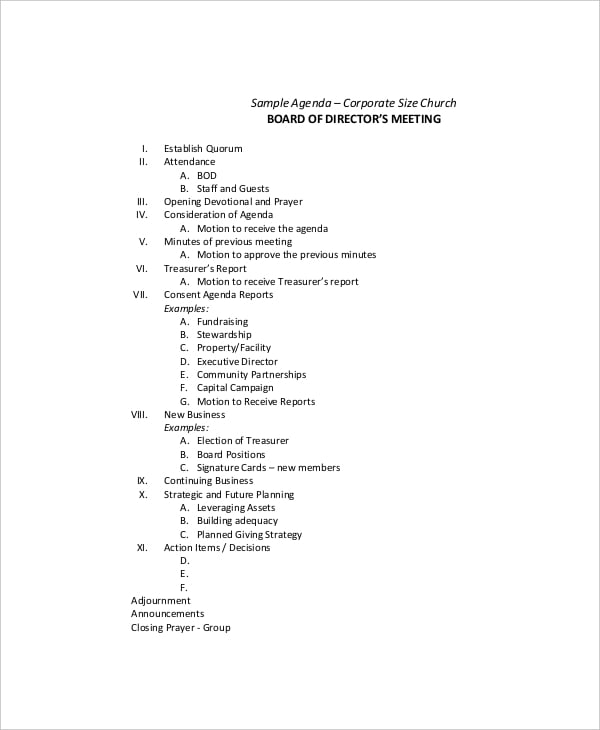

Following these steps can ensure you close down your business the right way, allowing you to carve a new path forward. Step 1: Create an exit strategy. The decision to close a business is not one you have to make on your own. Ten Steps to Closing Down a Business 1. Evaluate Your Decision.

Take some time and get distance and perspective. What’s really going on? If you’re closing down a business, you could also well be in financial distress. Be sure to carefully craft an announcement for your employees.

Advise your customers. Just as you don’t want your employees to find out secondhand about your business closing, you. You must file an annual return for the year you go out of business. If you have employees, you must file the final employment tax returns, in addition to making final federal tax deposits of these taxes. If your small business is a viable, ongoing concern but you’re leaving for personal reasons, consider selling your company instead of closing it.

You can use this step-by-guide checklist for selling your business as a guide. Notify Your City and County: Notify your city and county of your dissolution. Create a thorough plan to transfer ownership, sell, or close your business. If customers are still in the store and it is almost close to begin the retail closing checklist,.

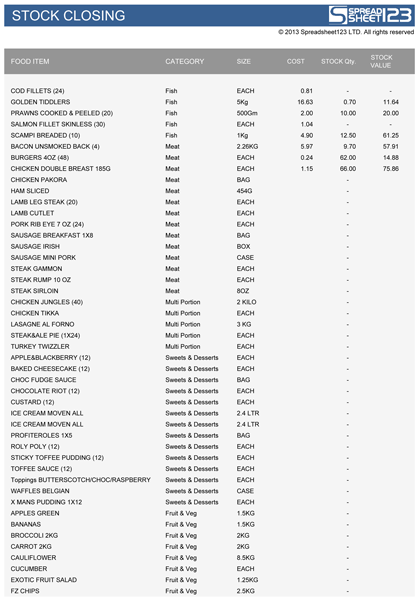

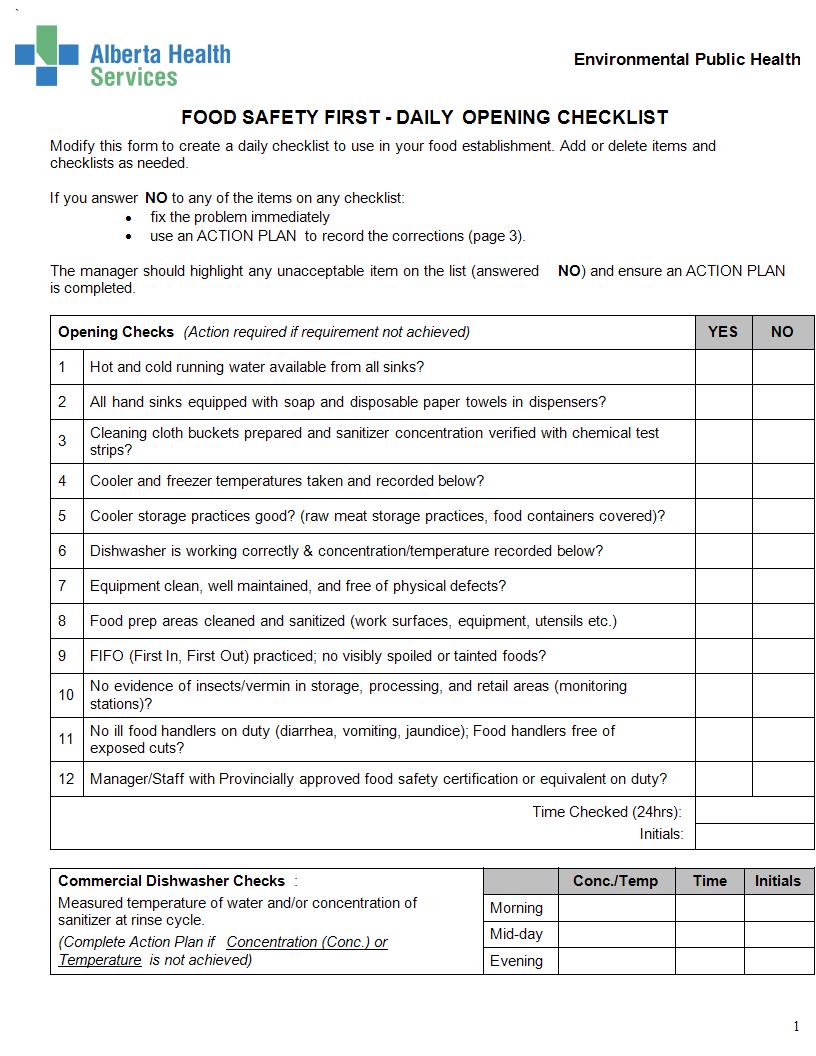

Closing a Business Checklist Template Clear the store. Complete a run-through of the floor. Just because the store appears empty, doesn’t mean that it is. A closing checklist defines a list of tasks that need to be completed or payments and items which need to be settled before the closing of a term or transaction.

A closing checklist templates will help you in organizing the responsibilities and actions which need to be taken at the end of a term. The Checklist for Closing Your Company 1) Choose the best way to close your business. The way you choose to close your business will depend on whether the.

Inform anyone affected by the closure. Before applying for liquidation or to strike off your company, you must first. For any first-time business owner, this read may demystify the. Conditions Precedent to Closing. Due Diligence Matters: 1. Gather and review due diligence items identified on separate due diligence checklist.

Do all required follow-up from due diligence checklist before closing. Just as your opening checklist sets the tone for your business day, your closing checklist will greatly influence how the next morning will go. Details overlooked at closing time create more work for your opening crew and can influence how the first customers of the day are served.

Small Business Administration recommends that you assemble a team of experts and professionals. Contact your local county clerk’s office to cancel the business name if your business name is a.