Unit Trust – non-fixed $ 159. GST Hybrid Trust $ 170. Can a corporate trustee own units in a unit trust? How does a cleardoc trust form? What documents do I need to set up an unit trust?

Who is the trustee of a trust? However, in certain circumstances, the trustee can make distributions that are not in proportion to the number of units the unit holder owns, see the next paragraph. Any change to a trust requires careful consideration to make sure the change will not involve any ending of the trust or creation of a new trust out of the existing trust. In a Discretionary Trust , the trustee has discretion to pay beneficiaries any amount of the trust income or capital that the trustee believes is appropriate.

Avoid getting side tracked with compliance administration tasks with a solution that simplifies preparing compliant legal documents. The question and answer design makes it easier for non-legally trained professionals to use. This product also includes an option to deal with NSW Land Tax requirements.

The system asks a series of questions and gives detailed instructions on how to answer. It will verify whether details you enter, such as a postcode, are valid. When they’ve done that, the interface then asks if the shares are to be held by the trustee(s) on trust. If you need advice, we will arrange for you to speak with a lawyer at Maddocks. Guess you get what you pay for.

Often they want to change the trustee (s) of a discretionary trust, but sometimes the change is more complicated. We currently offer over 1compliant Company, SMSF, Family Trust , HR and Estate Planning legal documents. Cleardocs , Melbourne, Victoria, Australia. Trusts cleardocs Aug The range of legal services and legal documents offered online for. It explains each section of your.

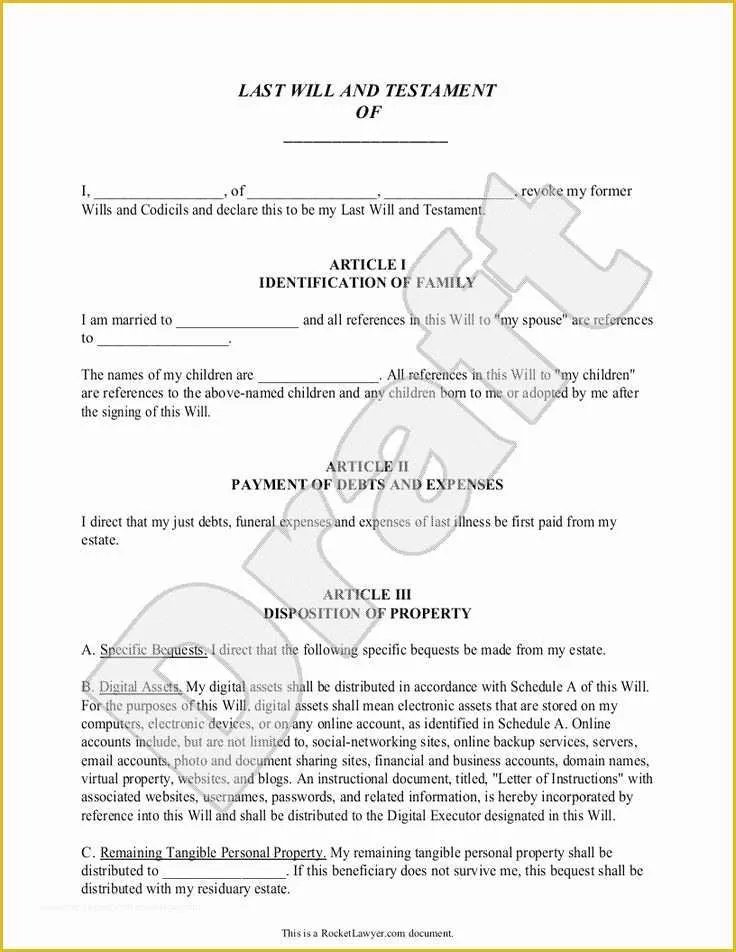

A will is a legal document stating what you. You may be able to set up a hybrid trust or SMSF trust online, however many people prefer to use an accountant. Should there be a controller for the trust ? Some asset protection and estate planning benefits from having a controller. Is it better to have a unit trust over a discretionary trust ? DT in NSW also subject to higher land tax rates. When creating a trust there must be a record of all unit holders of the fixed trust as the trustee is responsible for keeping track of all these details.

For example, it will describe whether the trust allows you to change the trustee and the procedure for doing so. For making any change to a trust , the golden rule is to always follow the trust deed’s instructions. The Topdocs non-fixed unit trust provides for a large range of unit classes, ensuring you have the ultimate flexibility in determining the rights and responsibilities of each unit holder. Units can be issued as income or capital units and the trustees have maximum flexibility in relation to income distribution (Bamford case provisions). The Trustee for Y Family Trust would be Company Y, who would be in charge of distributing to Y Beneficieries (other family members and myself).

My question is, given this setup, are there any pitfalls in simply registering all the Trustee Company, The. Only available to accounting firms registered in the last months. You answer simple questions to personalise the documents with the relevant details and to order the documents required.

Trusts that are used in a business rather than an investment context may also be entitled to additional tax concessions under the small business CGT concessions. If any of those vehicles get down to a zero balance sheet take advantage of just getting rid of them. You may think you know what your own trusts have been up to over the years, but that is often not the case. LRBA loan, as per new Section (1) (f) of the SIS Act. ASIC INTEGRATION To avoid any unnecessary duplication of data entry, our server’s link to ASIC to provide a single application process to register a special purpose corporate trustee as part of the SMSF set up.

Fully online, legally compliant trust deed instantly delivered to your inbox. One stop solution for your trust structure needs.