Book An Appointment Or Call Us Today. Place An Order Today. What banks offer free business checking? What do I need to open a chase business checking account?

Business checking includes mobile and online banking with access to 10ATMs and nearly 0branches. In addition, you can view canceled checks on your online statements.

Your business checking account is the lifeblood of your business. It is how you receive and send the money your company needs to keep going each day, growing stronger for the next. There are many banks that offer business checking accounts, but so very few offer low or no fees for having your account. Learn more and apply online today.

Your qualifying mortgage must be linked and enrolled in automatic payments on the business day before the end of your statement period. Affordable Quality Business Checks. Deposit limits may change at any time.

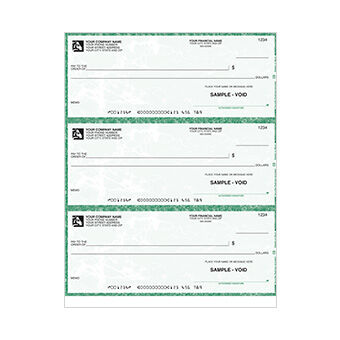

Our Checks are Guaranteed Compatible with Any Bank.

However, if you enroll in paperless statements, it’s reduced to $12. Easy Online Ordering. Normally this fee is $per month or $1per year. Complimentary ATM Access and Debit Cards. Chase checking accounts.

Go directly to chase. Otherwise a $Monthly Service Fee will apply ($Monthly Service Fee when enrolled in Paperless Statements). This is the easiest account to keep fee free. It’s probably best to. Earn cash back with the Freedom Flex or Freedom Unlimited Credit Card.

All Personal Checks Ship Free. All Business Checks Can Be Used With Your Laser Or Inkjet Printer. If you don’t plan on having any major growth in the coming months, this could be a great starter checking account. Customers receive 1monthly transactions for.

Find an ATM or branch near you, please enter ZIP code, or address, city and state. You can receive only one new business checking account opening related bonus every two years from the last enrollment date and only one bonus per account. It operates nearly 0branches and 10ATMs nationwide.

The account needs to be opened in a branch.

I recommend making an appointment since a business specialist needs to open the account and you may have to wait or come back if they are busy. This account is free as long as you avoid going over 2transactions and making deposits greater than $5each month. Maintain a Minimum Balance. Each level of account has its own monthly charge that is waived if you earn enough in one month and maintain a certain balance.

You can still open business checking account online no chexsystems using the remaining of the banks. Even if you qualify for an online business checking account with banks that don’t use ChexSystem, a good rule of thumb is to clear your name and have your accounts in good standing. With Spark Business Basic Checking , you get unlimited transactions each month, plus online and mobile banking.

And of course, you can make as many transactions as you want with no unexpected. Flexible Checking You Can Count On Each month you’ll get unlimited transactions include along with free Overdraft Protection with a linked Capital One small business deposit account. Also, you’ll get a business debit car online bill pay and online and mobile checking at no additional cost.

Free Savings Transfer: Automatically transfer funds from your 3savings account to take care of what you owe.