What is the best advice for cancelling a contract? Can I cancel my business license? How do I cancel my business license in Chicago?

Once an EIN has been assigned to a business entity , it becomes the permanent Federal taxpayer identification number for that entity. Regardless of whether the EIN is ever used to file Federal tax returns, the EIN is never reused or reassigned to another business entity. File an abandonment form for a DBA. You should contact the state agency and ask for the form (if any). Publish notice of the abandonment.

You may also have to publish notice in a newspaper that you are abandoning the. Cancel your resale license. You probably need to contact the same department from which you got permission to use the name. Fill out any required form and publish a notice of abandonment in a newspaper, if necessary.

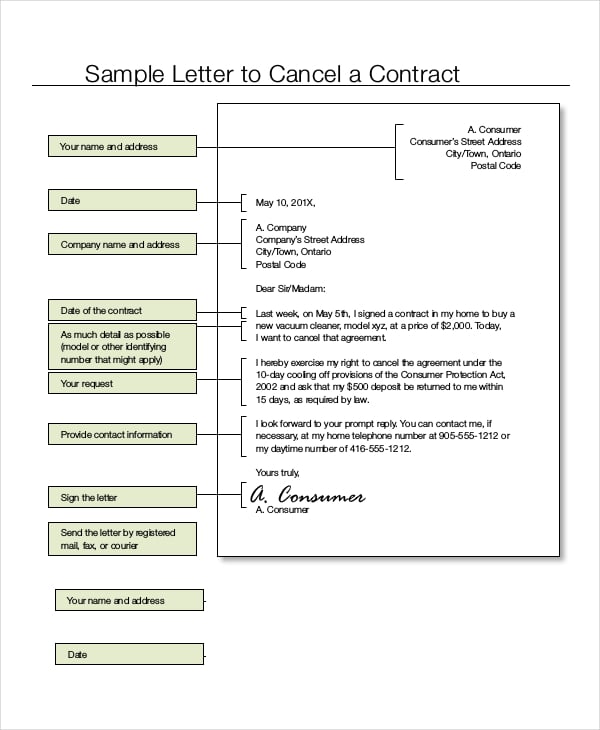

Write this type of letter for any situation in which you are communicating business-related cancellation information. You will likely need to modify this letter sample at least somewhat so that it most closely matches what you want to communicate. Include in your letter any pertinent details. There are some additional steps that may need to be taken while closing a business entity.

Close out business checking account and credit cards. Give an example of why you are canceling the contract specifically. Always state when you would like the service to end as well as not to automatically renew any annual contracts.

It is recommended you wait to cancel your ABN until all processes are completed. You need to indicate where the event was supposed to take place, write the date, time and location. Also, you have to include details about the cancellation and due to what unavoidable circumstances it was closed. To close your USDOT number record you MUST mail, fax or upload via our web form an updated and signed MCS-1(Motor Carriers) or MCS-150B (Hazmat Carriers) form, and check the box “out of business” (out of “motor carrier” operations, even if the company is still in business ) in the “reason for filing” section.

Dissolve or Withdraw a Business. A letter to cancel a business contract is similar to a letter of request, but what you are requesting is to end to an agreement. An we appreciate any feedback you have so that we can improve our service. Before you cancel the subscription, have them save their OneDrive for Business or SharePoint Online files to another location. Any customer data that you leave behind might be deleted after days, and is deleted no later than 1days after cancellation.

Instructions, and the related form, are not intended to provide legal, business , or tax advice, and are offered as a public service without representation or warranty. While the related form is believed to satisfy minimum legal requirements as of its revision date, compliance with applicable law, as the same may be amended from time to time. Mention the reason behind this action. Attach all the necessary documents along. When the cancellation becomes effective, your users lose access to their data.

Identify your business type for applicable documents and links in that category. By letting us know when you close your business , or a business location, we will mark your account inactive and not expect future tax return filings for you. To report a change in ownership of an existing business , the current owner must close the business , and the new owner must register as a new business. This will display all business names linked to your account. Select the radio button to the left of the business name to select it.

If you need help, call 804. The Entity Department at the IRS doesn’t have a fax number. Selling or Closing Your Business There are several steps you must take when you sell or close a business.

You must notify the Registration Section of the Michigan Department of Treasury by completing a Form 1Notice of Change or Discontinuance. Your cancellation date is the day your business ends.