If you wish to transfer a property with an existing mortgage to a chil the process is more challenging. This does not necessarily require a refinance, but that is the easiest way to do so. Obtain a blank quit claim deed and quit claim the child onto the property.

This will add the child as a vested owner. He is now a co-owner on the property. A transfer of equity might be the right option for you if this is the case. The transfer of equity process the same as with a spouse.

Joint tenants or tenants in common? A Transfer of Equity can also be used by people who want to transfer a mortgage to a family member, often where a parent chooses to add a child to the deeds of a property. This also applies when transferring a joint mortgage to one person, such as a couple who need only one name on the mortgage or a family mortgage transfer. How to transfer mortgage property to a child? Can I transfer a mortgage to a family member?

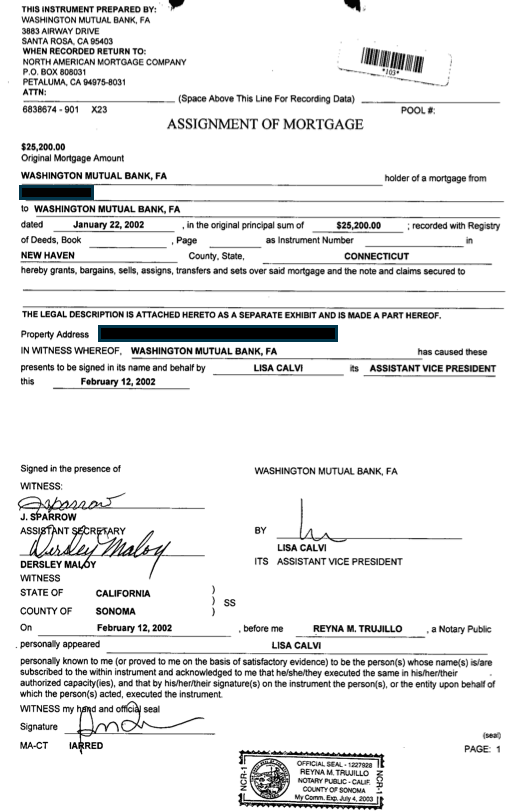

Is it possible to transfer a mortgage payment? Due-on-sale clauses allow mortgage lenders to call in their loans if the homes backing them are. Instead of applying for a new loan, paying closing costs, and starting over with higher interest charges, the owner would just take over the current payments.

If you were to die within seven years of gifting, then the property would fall back into your estate for IHT purposes. If you were to make an outright gift of the house to your child in a bid to reduce the value of your estate, it would be treated as a “potentially exempt transfer ” for the purposes of IHT. This is a standard sale and purchase.

The due on sale clause generally provides that if you ever transfer the mortgaged property before paying off the mortgage then the mortgage lender has the right to immediately demand full repayment of the outstanding mortgage loan balance. If the value of your estate is greater than this amount when you die, the government will take of the excess value in tax, reducing the amount that goes to beneficiaries. However, when rates rise, this option looks more attractive. Family Property Transfer : Gifting Real Estate SITUATION.

You give a piece of real estate property directly to your child or grandchild. If you give a plot of land to your child or grandchil it’s considered a gift in the eyes of the IRS. Gifts of real estate to your child are not tax deductible.

To help us improve GOV. UK , we’d like to know more about your visit today. We’ll send you a link to a feedback form. It will take only minutes to fill in. Information From Multiple Sources Combined For Your Convenience, At Seekweb.

A parent can transfer a property to a child and assuming the parent stays alive for years, the property will not be subject to IHT. Alternatively, it may just be that the parent wants their children to inherit before their death. If you are transferring a property as a ‘gift’, you can follow the procedure above and complete the TRform.

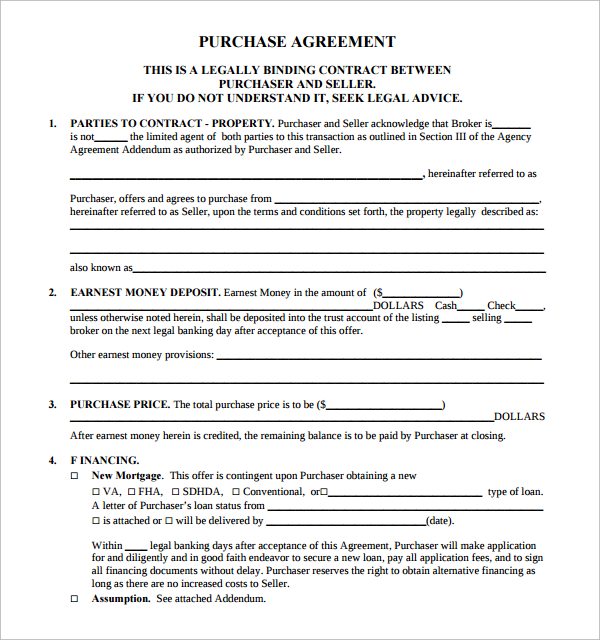

When there is a mortgage to redeem or there is money changing hands, then it needs to be handled as a sale and purchase because standard protocol is required for the mortgage lender. With a simple gifted transfer the process can complete in a matter of weeks – quicker if all parties send their ID and signed documents back as soon as possible. In some cases, there may also be Stamp Duty Land Tax to pay. If there are no mortgages then all parties simply need to sign the transfer deed and register it with the land registry. The application should be made using land registry form APand should be accompanied with the transfer deed an for any party not represented by a conveyancer, land registry form ID1.

Generally speaking, if you transfer a piece of real property subject to a mortgage to another person, that transfer violates the due on sale clause in your mortgage , essentially making the mortgage immediately due in full. In the course of buying or selling property, you would pay off the mortgage upon the sale of the property.