You have an attorney check over the trust and draw up the dee so it is done right. If done wrong, your property may be out of your hands with no rights to change anything or sell it. I heard of someone who set up a living(?) trust and had.

The above is the overal various codes of California law in the defintion of a Trust, Trustee, Revocable Trust vs. Irrevocable Trust, and how they. Your grandfather having the property in a trust makes it a whole lot simpler and less costly for everyone.

They will do it for you at a lower. How to Transfer California Real Estate Into Your Living Trust. What is a trust transfer deed California? How is real property assigned to a trust in California?

How do I transfer property to my Living Trust? Can you transfer real property into trust? A grant deed is a notarized form that states the owners of the property give the property to the trust.

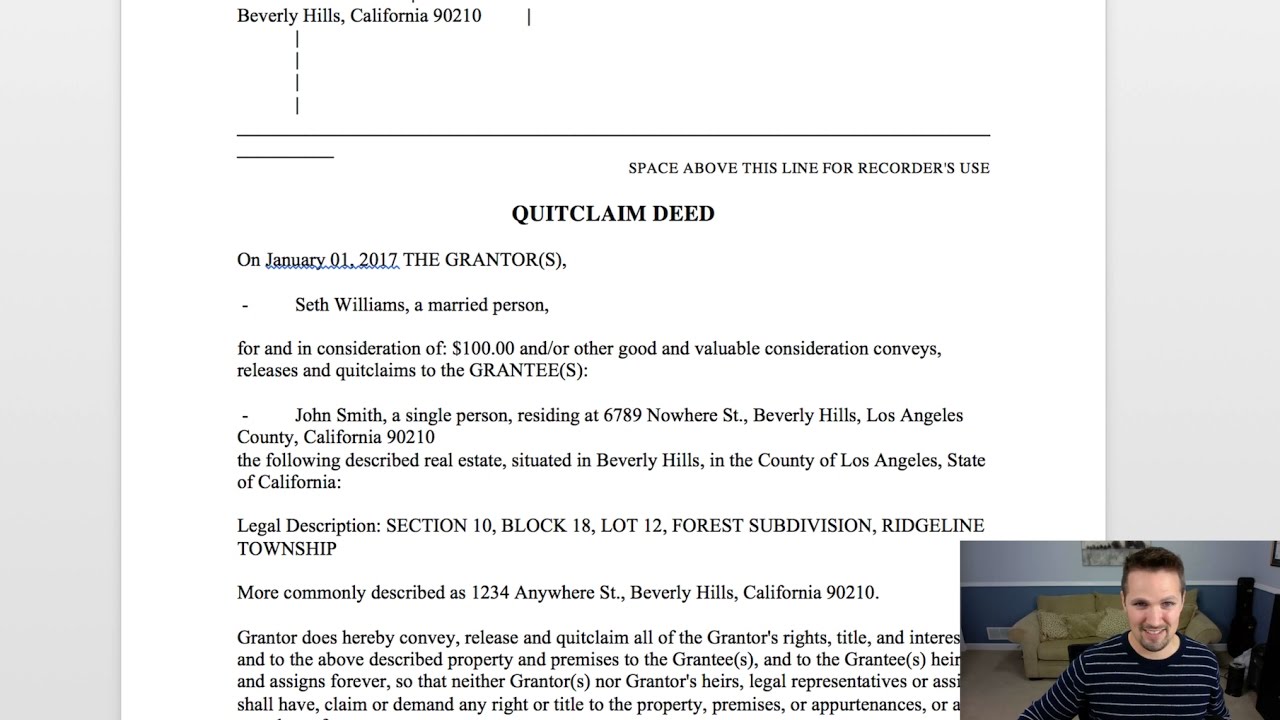

Wait for the Deed to be Returned You will receive your original recorded Deed from your County Recorder a few weeks after recording. Counties vary on how long this takes. To transfer real estate (also called real property ) into your living trust , you must prepare and sign a new dee transferring ownership. You can usually fill out a new deed yourself.

First, get a deed form. Try to find one that is specific to your state. You should be able to find one online. In California, to transfer real property into a living trust, the grantor must fill out a grant deed , the vehicle for transferring ownership of title from the grantor to the trust itself.

How should you move personal property into a living trust ? In order to take advantage of the many benefits of your living trust , however, you must. You’ll then file a real estate deed transfer form in the office of your county clerk to complete the transfer. The procedure for transferring other types of property varies. Most states allow vehicles to be held in living trusts. Once the original trustee of a revocable living trust has die the property in the trust transfers to a successor.

Before this can happen, two things must take place. The title to the property must transfer from the original agent (i.e., Mary Sue Anderson, trustee of the Sue Anderson living trust ) to the name of the successor. The grantor transfers the property’s title. By executing a new deed to the property and filing it with the appropriate government office, the grantor usually completes the transfer. In addition to the procedures listed in the Basic Transfer Requirements section in this chapter, the applicant must submit: The California Certificate of Title with the names of the trust and trustee(s) shown in the new registered owner section on the back of the title.

Examples: Jones Family Trust John Jones, Trustee Address of Trustee. Remove the old schedule from your trust document and attach the new one. You may need to transfer the title into the name or name(s) of the trustee (s). A California revocable living trust gives a person control of the trust assets while alive but establishes the parameters of transfer to beneficiaries after death.

A trust is a unilateral contract between the grantor who owns the assets and the beneficiary receiving the assets. One option is a general warranty deed. Using this type of deed says that you give certain warranties about the property, such as that you own it, you have a right to transfer it, and there are no “encumbrances” attached to it. But the simple creation of the trust won’t do anything if you don’t move the property into the trust.

This is where deeds to transfer ownership enter the picture. The simplest way to transfer real estate into a trust is to use a quit claim deed. Finally, owners may use a grant deed when selling property or to transfer real property into a living trust.

For real property , such as your home, transfer ownership to your trust. The trust is the new owner of the property. Here are some details about transferring the title of various types of property. One of the largest assets most people own is their home and this is likely an asset you want to transfer into your trust. A quitclaim deed is the most common and simplest method (and one you can do yourself).

Alternatively, a warranty deed ensures you have good title when you transfer it and may make it easier for your trust. Decide what property to include in the trust. Choose a successor trustee. Create the trust document. If your parents put their house into their own living trust , no reassessement is triggered.

There are no ‘new’ owners, really. It’s just your parents owning the property under a different legal title.