Should power of attorney gift money to themselves or someone else? Can a power of attorney open a bank account? While power of attorney documents can allow for such transfers, generally speaking, a person with power of attorney is restricted from giving money to themselves. No — at least that is not sufficient.

The Office of the Public Guardian has also issued guidance on gifts and payments made by an attorney to family members in respect of care provided to a Protected Party. Should a power of attorney gift money to themselves or someone connected with them from the funds of a Protected Party, the attorney should apply to Court for approval of the gift.

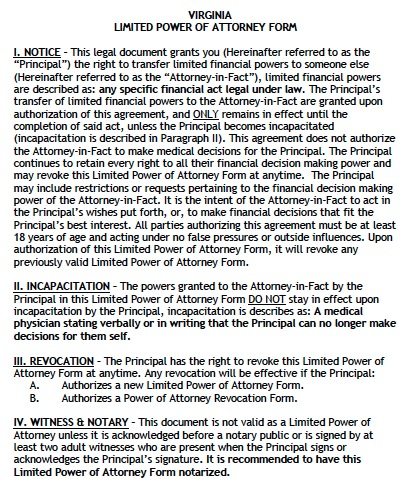

Power of attorney is a legal document giving rights of choice to another individual. There are two separate forms of power of attorney. One is for financial authority and the other is medical power of attorney. The medical power of attorney cannot legally transact his financial affairs. It is to make medical decisions on.

Even in states which have passed a uniform act, unless the power to gift to oneself is specifically set out in the power of attorney, the agent may be cautioned as in Alabama Code Section 26-1A-11 Item b(2) against creating a “conflict of interest that impairs the agent’s ability to act impartially. It sounds like what you propose is not permitted under the provisions of the power of attorney. However, if everyone is in agreement, as a practical matter it may be possible and not be challenged.

What you describe is not uncommon as a Medicaid-planning device and can have some tax benefits since you can deduct some of your parents’ medical expenses on your tax return.

However, as with all other payments they must be in the best interests of the donor. Attorneys can even make payments to themselves. Whether a power of attorney can make themselves a joint owner of your bank account depends on the powers you grant them. However, official bank policy determines what restrictions, fees and conditions apply. An individual who has been given authority via a power of attorney, also known as an agent , may sometimes change beneficiaries on bank accounts.

Although state law varies, this type of authority may only be granted in specific circumstances. Yes , however, as one might expect, there are a number of rules which must be complied with and strict limits to observe if you have appointed either an attorney or a deputy. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now!

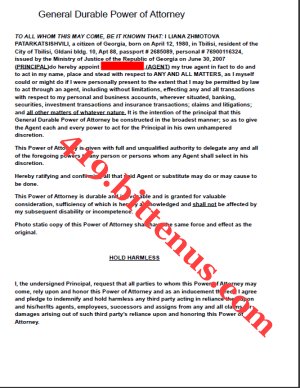

Edit PDF Files on the Go. Unfortunately, this led to several incidences of criminal fraud. At the very least, it led to behavior and decisions that were unethical. If there is language in the POA which allows the transfer of real property, the power of attorney is able to transfer the property to himself. If father is still able to sign documents, it may be wiser for him to sign the quit claim deed.

Each power of attorney can be unique. I need to examine your actual document to answer the question, can your son use that particular document to legally make gifts to himself, but here are some facts. After all, a Florida power of attorney is not supposed to steal money, get rich, or take advantage of a senior citizen.

In that instance the agent (“attorney-in-fact”) benefits to the detriment of the principal an often the principal’s family and heirs. The reason you need the power of attorney to sell a car for someone else is that the title isn’t technically in your name without it.

Without the title in your name, you can ’t legally sign the title over to someone else. The power of attorney is also a great tool to protect both you and the other person that you’re helping. Yet, these essential tools can help aging adults and their families create a solid plan to address future care needs and gain peace of mind. A recent Mississippi court case examined the legality of an attempted transfer of jointly-owned bank CDs by use of a power of attorney and how transactions done through the use of such powers of attorney may be overturned where the law finds them to be improper. Dorothy Johnson gave her daughter, Sheila West, a durable power of attorney.

The power gives your agent control over any assets held in your name alone. Your should consult an attorney to take appropriate action. Whether or not you have the power to gift under the power of attorney depends on what the power of attorney says.

Often powers of attorney limit gifts to the annual gift tax exclusion (currently $10per individual per year). A power of attorney cannot use their document to legally benefit themselves. Powers of attorney are incredibly useful documents, which allow an individual to delegate decision-making to another. Durable powers of attorney are a common component to a Florida estate plan. However, a POA can also be the most “dangerous” document in the world.

Because sometimes bad people do bad things with a durable power of attorney in Florida and take money. If you know of anyone doing this then this should be. Generally speaking, a Principal (the person conferring the power granted in a power of attorney , or POA) may grant an Agent as much, or as little, power as the Principal wishes.

A durable power of attorney doesn’t expire if the principal becomes incapacitated.