Secured or unsecured. Do you want to offer an asset as security for your loan or not? The lower the interest rate , the less you’ll have to pay in interest charges on the amount you spend. Make sure to look at the fees and charges.

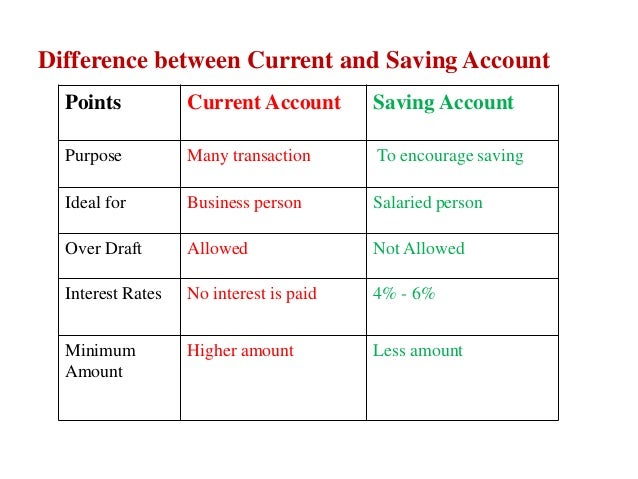

As with any loan, any amount you spend using the overdraft is a debt you must repay, and interest is charged daily on the overdraft balance until it is fully repaid. Compare business current accounts. Use our table below to compare business bank accounts from a number of providers. You can compare features – such as free business banking, interest on in-credit balances, overdraft facilities, and free account transactions – in an easy-to-view table to find the best account for your business.

So, if you have a $30overdraft account but only use $00 interest will only be applied to the $0outstanding balance. How many overdrafts can I have? An overdraft facility can be linked to any eligible business account, but only one overdraft per business. What rate will I pay?

The best way to work out the actual cost of a business overdraft from a bank is to use our business overdraft calculator which is here. You can find the total actual rate your bank charges you on your latest bank statement. The resources in this story may also be helpful. Lenders typically charge their clients a rate made up of three parts. See full list on interest.

The debit interest rate margin you pay will be re-assessed each time we review your overdraft facility and may change at this time. A bank overdraft is when someone or a business is able to spend more than what is actually in their bank account. If there is a prior agreement with the account provider for an overdraft , and the amount overdrawn is within the authorized overdraft limit, then interest is normally charged at the agreed rate. The average interest rate for a secured overdraft will be between 14. Before you do, be aware that the type of finance you choose will greatly affect how much you repay.

To avoid paying more than you should for your business finance, make sure that you match the term and type of your loan with your business need. Debit interest is calculated on the daily outstanding balance and is charged to the account on the last banking day of the month. Interest is a variable rate and available on application. Please refer to the overdraft reference rates and fees within our business banking rates and fees, as these are subject to change. It has been prepared without considering your objectives, financial situation or needs.

Your business will benefit from any interest rate decrease. Alternatively, if rates increase, you may need to speak to your lender about increasing your monthly repayment. You won’t pay fees or interest for using your overdraft , or if you exceed your agreed overdraft. You can borrow money over and above your account’s credit balance.

An EAR (Equivalent Annual Rate ) is a common way of showing interest rates on overdrafts which you can use to compare different banks’ interest rates. This does not include fees (such as set up or annual renewal fees). Notably, the interest rates of an overdraft are higher than those of the loans.

The overdraft facility is used for short-term borrowing, where repayment is made between a few days to six months. Flexible credit Manage your short-term cash flow, unexpected expenses, or simply have access to extra credit if the business need arises. EAR (variable) thereafter, giving a representative rate of 5. If your balance was already £0and you were charged £2 your new balance would be -£020.

After months, available at fixed price of £5. K cash per month fee-free, then pay 50p per £1cash deposited). Overdraft charges are taken from your bank account.