Loans from traditional lenders, such as banks or credit unions, can have annual percentage rates (APRs) ranging from to , while alternative or online loans can have APRs ranging from to over 1. Other articles from valuepenguin. Take the business loan and interest rate calculator for a test drive today. Get with Bankrate. Particularly with small business loans , interest rates should be reasonable to help the.

BlueVine offers a variety of business loans, including business lines of credit , term loans and invoice financing.

Businesses that have. The lender offers term loans and lines of credit with. The prime rate is an interest rate US commercial banks offer their top clients. The 30-year fixed-rate average has never been this low since Freddie Mac began tracking mortgage.

With so many different types of business loans available for borrowers across a broad credit spectrum, the answer isn’t entirely clear. The interest rate is fixed for the life of the loan. Platinum tier , and 0. The rate benefit is non-transferable.

Fixed rates start at 6. No specific collateral required. Currently , the maximum rate for Express loans of $50or less is 9. Most business loans come with an annual interest rate (AIR ), which means that that percentage applies to the loan balance over a year. However, some short-term loans come with a monthly percentage rate that applies to the balance once a month. Consult your loan agreement for details.

This business loan calculator is intended for demonstration purposes only. This is not a guarantee of your actual term, fees or. Loans that fall under Non-Priority Sector have a higher rate of interest, as compared to the priority sector loans. Short-term financing options that don’t typically come with interest like merchant cash advances and invoice factoring tend to be more expensive than the competition. The government-guaranteed SBA loan program works with banks to offer low interest rates and long-term repayment.

But the process is time-consuming, and the requirements are strict. SBA Express loans fall under the SBA 7(a) umbrella. They are faster and easier to apply for.

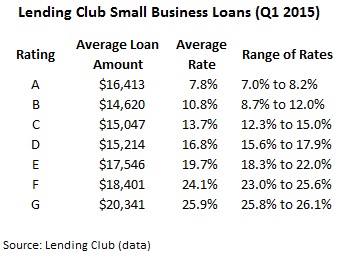

Prime rate on loans over $50up to $350($500for Export Express) making the current rate for these loans up to 7. Lenders may charge up to: 4. Knowing the average small- business loan rates is one thing. Average rates for small business loans.

You might have known that your revenue, credit score and time in business are all important factors in which rate you end up with on a business loan. But the type of loan and lender can also impact the rate you get. The right business loan product depends on your needs, and terms, rates and qualifications vary by lender. Here is a breakdown of the types of business loans , plus lenders that provide financing.

With that sai most businesses are better off using business loans rather than personal loans , since business loans generally have lower rates and longer terms. Luckily, Fundera lets you apply for regular business financing too (more types than listed in the table above). The personal loans are just an added bonus. Revolving lines of credit have variable rates , and the loan amounts typically range from $10and up. You repay the amount borrowed through monthly payments that can usually be deducted directly from your business checking account.

These loans are easier to qualify for than traditional commercial mortgages, while still carrying competitive interest rates. While unsecured business loans don’t require collateral and have a quick approval process, an unsecured business loan also is typically costlier for the borrower, with higher interest rates and personal guarantees.