Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! Business Use this two-page credit application form template to consider extending a line of credit to your customers. The form has sections for application information, employment information, debts, and assets.

These free business credit application forms will help you collect and organize the appropriate information so both the lender and borrower can stay on the same page and make informed decisions. Download them now as free Word and PDF documents you can modify and print for official use. This template helps you gather important information in order to evaluate whether the borrower is reliable and will pay back their debts to you.

This business credit application template works by collecting the following details from your applicants – Their contact details, business details, credit info, and business references. The form also sports some terms and agreements that you can modify, along with a signature field. If your business extends credit to customers, you should become very familiar with consumer credit laws and privacy laws.

Do not ask any questions that could be leading or ask questions about race, gender, etc. Credit Application Form. There are many laws in place that prohibit discrimination based on these attributes.

Why does a business need to use a credit application? What terms should be included in a credit application form? What is commercial credit application? Some of these small business forms ( forms , agreements, contracts, etc) contain. Of course, you should provide all the required information to make the application process easy.

Is your company offering a credit application for a business account? Much has already been written about the benefits of creating an online credit application forhow such forms make it easier for your customers to place orders, get approve and do business with you in general, and how they decrease turnaround times and reduce errors for credit teams. Main objective of this template is to establish the credit system terms in between the company along with its customer. You can also see Application Form Template.

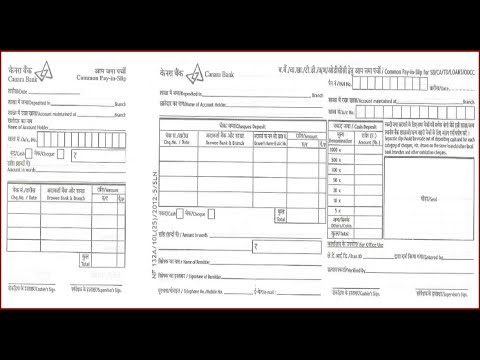

The credit Application Templates in Word and PDF format can also designed with the space for filling Type of business , legal operates, address and many other details about business. The appeal and appeal of credit are pulling in each one. The quantity of candidates going for credit is expanding step by step. The use of readymade credit application form template makes it easier for the business to obtain the required details from the customers.

Moreover, the risks associated with extending credits are also minimized. If you are running a big business , creating credit application forms and handing them can be a troublesome task. A commercial credit application is also known as the commercial line of credit or business credit , is an amount of money issued by a bank to a company which is pre-approved and that can be taken by the borrowing company at any time to help meet the various financial obligations of the business. And if your company operates in a high-volume industry, an. The business credit application form can be applied when an additional business these as a distributor or vendor needs to ascertain credit conditions or maybe a line of credit with the business.

Download it, fill it out and bring the completed form to dealer. Verification of corporate existence and corporate name. Examples: Copy of fictitious name filing, Articles of Incorporation, Partnership Agreement, Business License, etc. Fields for company information along with banking and trade references are provided. Customize terms within the agreement section to meet your own credit requirements.

A credit application form as the name implies is a form that is filled and completed by a business or an individual that seeks to apply for a line of credit with a lending institution or. The information supplied by the individual or business is then used to determine the credit history of the borrower, the employment status and his or her. Many business owners are reluctant to run credit applications for trade credit. The main reason behind the reluctance is an illogical fear of losing the sale.

While sales are important, getting paid is what matters and credit applications can help your business do more of both. Extending credit to a customer can be useful to your business cash flow by enabling steady orders from them. CREDIT APPLICATION FORM Please provide with your application , the following documents. Individuals a) Copy of ID Document 2.