Do stocks return more in the long run than bonds? What is the average rate of return for a bond? Why do bonds give lower returns than stocks? Risk and yield are closely related simply because investors demand greater compensation for taking bigger chances. Bond Yield and Return Yields That Matter More.

Coupon and current yield only take you so far down the path of estimating the return your bond.

Reading a Yield Curve. Figuring Bond Return. The simplest way to calculate a bond yield is to. The investor can either take this income in the form of a check or reinvest it back into the fund to buy new shares. There are various ways to calculate yiel which can be a source of confusion for many investors.

Rolling 10-year returns for each year represent the annualized return for the previous years. Notice the difference: Looking at 10-year , they are smoother than annual , and bonds look more attractive. Price is important when you intend to trade bonds with other investors.

In the online offering table and statements you receive, bond prices are provided in terms of percentage of face (par) value.

It has a face value of $2000. At points in time, its price—what investors are willing to pay for it—changes from 9 to 9 to 102. See full list on fidelity. The price investors are willing to pay for a bond can be significantly affected by prevailing interest rates.

If prevailing interest rates are higher than when the existing bonds were issue the prices on those existing bonds will generally fall. So, higher interest rates mean lower prices for existing bonds. If interest rates decline, however, bond prices of existing bonds usually increase, which means an investor can sometimes sell a bond for more than the purchase price, since other investors are willing to pay a premium for a bond with a higher interest payment, also known as a coupon. This relationship can also be expressed between price and yield. The yield on a bond is its return expressed as an annual percentage, affected in large part by the price the buyer pays for.

The financial health of the company or government entity issuing a bond affects the coupon that the bond is issued with—higher-rated bonds issued by creditworthy institutions generally offer lower interest rates, while those less financially secure companies or governments will have to offer higher rates to entice investors. If the issuer is financially strong, investors are willing to pay more. Inflationary conditions generally lead to a higher interest rate environment.

Therefore, inflation has the same effect as interest rates. When the inflation rate rises, the price of a bond tends to drop, because the bond may not be paying enough interest to stay ahead of inflation. Remember that a fixed-rate bond’s coupon rate is generally unchanged for the life of the bond. Bond pricing involves many factors, but determining the price of a bond can be even harder because of how bonds are traded.

But with bonds, the situation is often not so straightforward. For example, a yield means that the investment averages return each year.

Yield is the anticipated return on an investment, expressed as an annual percentage. There are several ways to calculate yiel but whichever way you calculate it, the relationship between price and yield remains constant: The higher the price you pay for a bond , the lower the yiel and vice versa. Current yieldis the simplest way to calculate yield: For example, if you buy a bond paying $2each year and you pay $20for it, its current yield is. While current yield is easy to calculate, it is not as accurate a measure as yield to maturity. A yield curve is a graph demonstrating the relationship between yield and maturity for a set of similar securities.

A number of yield curves are available. A common one that investors consider is the U. Treasury yield curve. The shape of a yield curve can help you decide whether to purchase a long-term or short-term bond. Investors generally expect to receive higher yields on long-term bonds.

Yield to maturity is the measurement most often use but it is important to understand several other yield measurements that are used in certain situations. Refund of rental bond (Form 4) START NOW Request or dispute a bond refund online. This form should be completed when the tenancy agreement has ended. The RTA cannot accept this form before the expiry date of the appropriate notice – Notice to leave (Form 12), Notice of intention to leave (Form 13) or Abandonment termination notice (Form 15).

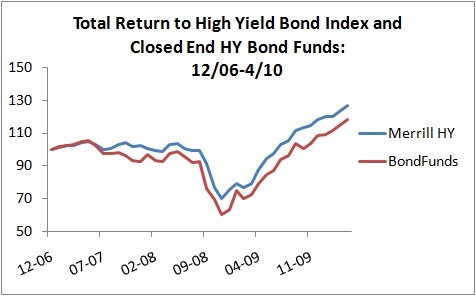

Total return is the entire pot of money you wind up with after the investment period has come and gone. In the case of bonds or bond funds, that amount involves not only your original principal and your interest, but also any changes in the value of your original principal. Assume that you buy the same bond and own the security for the same length of time.

In this instance, you buy the bond for $10and sell it for $1100. It is difficult to point out a bottom in yields. You generate a $1gain. Learn more about VFSTX at the Vanguard provider site.

Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Performance for periods less than one year are cumulative, not annualized. Total returns include changes in share price and reinvestment of dividends and capital gains, if any.

Years remaining until maturity—Yield to maturity factors in the compound interest you can earn on a bond if you reinvest your interest payments. A landlord can only submit a form that the tenant hasn’t signed within months of the tenancy ending.