How is a bond recorded on the balance sheet? How are the bonds payable classified on the balance sheet? What is the normal balance of bonds payable account? How do you check the balance of savings bond? It is also referred to as defease.

You, as the bond holder, are the creditor. When the bond matures, the issuer pays the holder back the original amount borrowe called the principal. Loans are a kind of debt in which a lender will lend the money, and a borrower will borrow the money. If you have an existing Bond Loan , you can check your outstanding balance with our online tool. All you need is your Bond Loan number and your date of birth.

You’ll need to provide your Bond Loan or Bond Loan Plus number and date of birth. The bonds must be qualified by the State Treasurer and the bond proceeds must be used for capital expenditure purposes. You can check your outstanding balance with our online tool.

Transferring bond to another property. Check your balance now. Get your Bond Loan repayment details Enter your details to get your repayment card barcode and BPay reference number. To be eligible for a Bond Loan , you must meet all these conditions: You don’t currently live in the property that you need bond for. You’re an Australian citizen or permanent resident, or have a temporary protection or bridging visa.

If you know your current payment, the interest rate and the term remaining, you can calculate your outstanding loan balance. Use this calculator to determine the loan balance along with an amortization schedule. Outstanding loan balance = 7140.

The same answer as given by the annuity formula applied to the remaining three installments. Suppose a business borrows 150from a lender at an interest rate of. It can also mean a private company’s owner or a deal’s chief participants. Steady Installments are Easy to Track Installment loans , for homes and cars, require the same payment each month, according to terms and conditions contained in loan agreements and. The remaining balance on a loan formula shown is only used for a loan that is amortize meaning that the portion of interest and principal applied to each payment is predetermined.

The term future value in the remaining balance formula may seem confusing, but the balance at any time after payments are being made is the future value in. Annual interest rate: Use the interest rate on your loan (you can either use APR or a stated interest rate, if available). The loan is interest free and repayable to DCJ Housing. Any payments you make will be returned to you at the end of the tenancy as long as there are no claims made by the real estate agent or landlord. Let us take you through the various ways you can manage your home loan , from getting a fixed interest rate to making your final bond repayment.

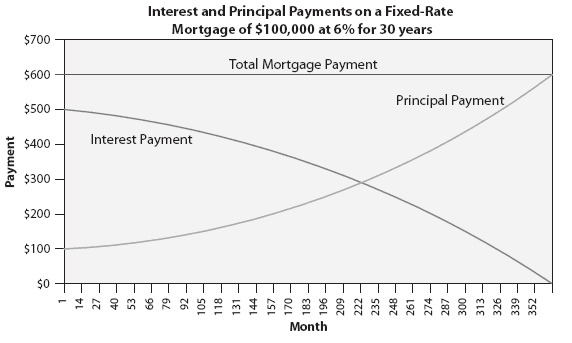

Manage your information Find out the quickest way to update your personal details, retrieve tax certificates or home loan documents you’ve misplace or switch to eStatements. In the early stages of the loan , much of each payment will go towards interest, and in late stages, a. Fully Amortized Loan. Imagine you wanted to take on a $000partially amortizing loan. You have a fixed interest rate of 8. The bank agrees to give you a 7-year maturity with a 30-year amortization schedule. The borrower gets a competitive interest rate on their home loan along with cash equal to of their loan amount.

The cash assistance will help reduce the total closing costs needed to buy the home. Borrowers cannot use Cash Advantage funds for the minimum investment required for an FHA Loan. Amortization refers to how loan payments are applied to certain types of loans.

Subordinated debt is also known as a junior security or subordinated. They typically have higher interest rates than primary loans. If you have more than one loan against a property, it can sometimes make it difficult to refinance your primary loan.