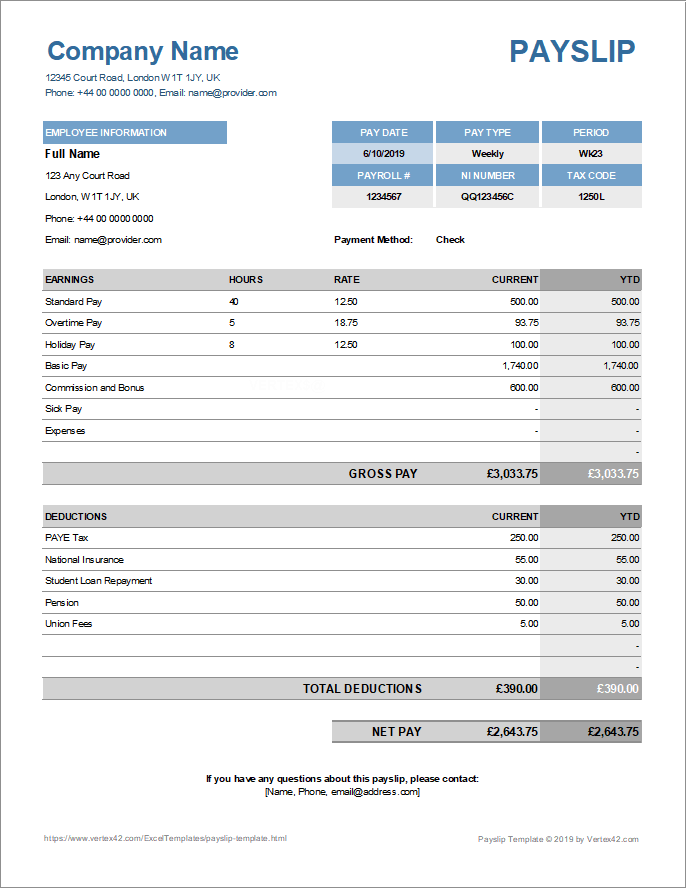

PAYG payment summaries: forms and guidelines. Under pay as you go ( PAYG ) withholding, you must give each of your employees, workers and other payees a payment summary showing the payments you have made to them and the amounts you withheld from those payments during a financial year. If you are reporting using ATO paper forms , the pay as you go ( PAYG ) payment summary statement, along with the originals of all payment summaries you issued for the financial year, make up your PAYG withholding annual report. This form provides an outline of all payment summaries you issued to your payees for the financial year. When do you pay workers a payment summary?

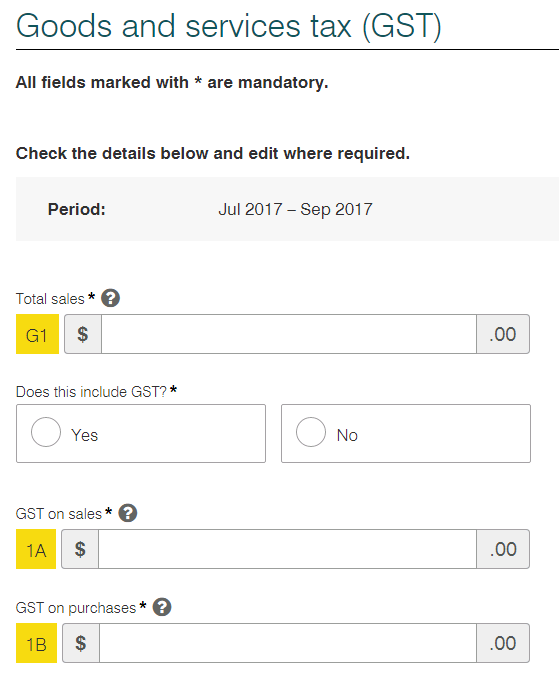

What is a financial year payment summary? Why is it important to provide a payment summary? Apply a check mark to indicate the choice where demanded. Double check all the fillable fields to ensure full precision.

Utilize the Sign Tool to create and add your electronic signature to certify the Payg summary form. Press Done after you complete the document. Now you may print, downloa or share the document. The advanced tools of the editor will guide you through the editable PDF template.

Enter your official identification and contact details. You need to provide this payment summary at the time you make the payment or as soon as practicable afterwards. EST Monday to Friday. See reverse of page for how to complete this form.

If you report your payment summary information to us electronically, do not complete this form. Payment summaries printed from payroll software should not accompany this form. It can also be used for prior financial years. For help completing this form visit. If the payee or payer information was incorrect, do not prepare a new payment summary – instea advise the payee as soon as possible.

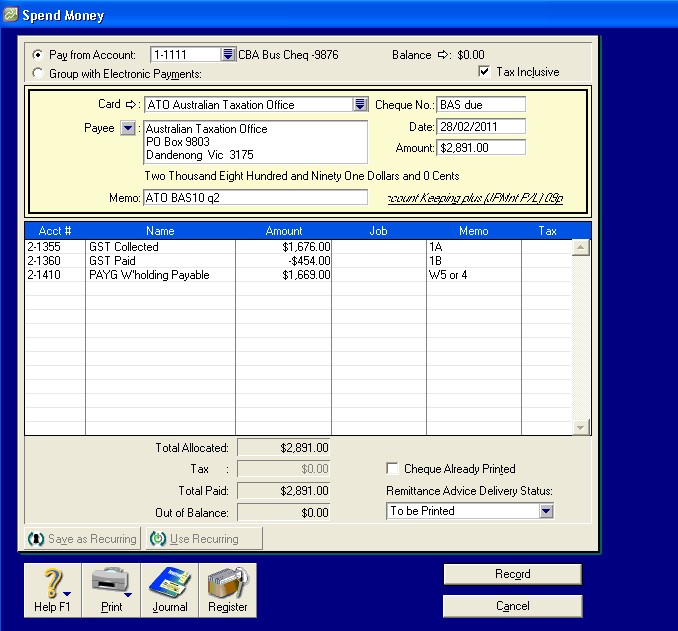

Your PAYG ( Pay as You Go ) annual reporting to the ATO (Australian Taxation Office) comprises two different forms : 1. You must show the payee and payer information as it was on the original payment summary. I have attached an example from the Clearwater sample file. On the payment summary form , for. If no tax was withhel you may still have to lodge a tax return.

For more information on whether you have to lodge, or about this payment. Infoware prints PAYG Payment Summary reports for Individual non-business, ETP Payment Summary and a Business and Personal Services Payment Summary. If you print your Payment Summaries on Blank paper (i.e. not the preprinted documents supplied by the ATO) you will have to submit the Payment Summary data electronically.

Fringe Benefit Details. On Work With Payment Summary Extract, select a record in the detail area and then select Maintain FBT from the Row menu. Enter fringe benefit information by employee.

PAYG Payment Summary reports that replace the previously named group certificates. Review Payment Summary Details. It also does an ETP Payment Summary and a Business and Personal Services Payment Summary. Taxation regulations specify who is authorised to sign documents required under pay as you go ( PAYG ) withholding.

These documents include payment summaries, payment summary annual reports and annual reports for withholding where ABN not quoted. Adjusting or entering payment summary data manually. To meet PAYG ( Pay As You Go ) legislative requirements for Australia withholding, the PeopleSoft system provides several withholding report formats and the functionality to handle PAYG withholding as defined by the ATO. Use a separate declaration for each income year ( July to June).

Complete all the relevant sections. Ensure that all details in relation to your payments and the amounts withheld are included.